Super Micro Computer, Inc.

Supermicro: Sailing Against the Wind in the AI Surge

Date: September 23, 2024

Financial Insights:

1. Q2 revenue was $5.31 billion, up 143.6% year-over-year, slightly above market expectations. Net income was $353 million. Non-GAAP adjusted diluted EPS was $6.25, falling far short of market expectations. Gross margin dropped significantly by 5.8 percentage points to 11.2%.

2. Regarding Q3 guidance, revenue is higher than market expectations, projected to be between $6.0 billion and $7.0 billion, compared to market expectations of $5.5 billion. Adjusted EPS is expected to be between $6.69 and $8.27, in line with market expectations.

Earnings Report Analysis:

1. This financial report has raised market concerns about Supermicro's declining profitability. Q2 EPS was not only significantly lower than analysts' expectations but also below the company's previously announced guidance range of $7.62 to $8.42. More importantly, the gross margin declined at an alarming rate, resulting in profit growth significantly lagging behind revenue growth.

2. Looking ahead, the delayed launch of NVIDIA's Blackwell chips has led to doubts about server demand. The overall logic is similar to the recent significant fluctuations in NVIDIA, Microsoft, and Google stock prices. The market's patience for profitability under large-scale capital expenditures in the AI sector is waning, which also affects AI infrastructure companies like SMCI(Supermicro).

3. On the positive side, the company stated that with the release of production capacity from its Malaysian factory, the gross margin is expected to recover to the 14%-17% range.

Key Events:

Recently, the well-known short-selling firm Hindenburg Research announced its intention to short SMCI. The report alleges that SMCI has significant issues including apparent accounting manipulation, undisclosed related party transactions, and export control failures.

Key Events Analysis:

Hindenburg's accusations have raised some market concerns about SMCI's corporate governance. More importantly, SMCI had previously been accused of financial issues by the U.S. Securities and Exchange Commission (SEC). Although it's currently unknown whether the allegations in this report are true, traders worry that the report may subject SMCI to stricter scrutiny and potentially lead to issues such as loss of orders.

Key Points:

1. The demand for AI servers remains high, with Super Micro Computer currently holding over 10% market share in AI servers. It's expected that AI data center infrastructure will continue to grow rapidly in the future.

2. The current valuation has noticeably decreased, with the current P/E ratio of 20 now lower than most IT hardware and semiconductor companies, partly reflecting the market's concerns about the aforementioned issues with Super Micro Computer.

3. The Hindenburg accusation remains an unresolved issue, and the struggle between buyers and sellers at this stage may cause significant fluctuations in the stock price.

Technical Analysis:

Since 2023, Super Micro Computer's stock price has increased by more than 10 times, driven by fundamentals under strong performance growth. Starting from Q2 2024, the stock price retreated by half from its peak and consolidated for a quarter to digest the valuation. From July, it entered a new downward channel with significantly increased trading volume. From the recent trend, it continues to make new lows, but fortunately, the trading volume has begun to narrow. If it can hold the previous low of $382 and rebound to stabilize above $487, it would mark the beginning of technical improvement. Additionally, attention should be paid to the subsequent developments of the short-selling report, which could cause significant stock price fluctuations at any time.

[1] Long-term upward channel: A pattern where the price moves between two parallel upward trendlines, with the lower line serving as support and the upper line as resistance.

[2] Neckline: In a head and shoulders bottom pattern, an important support or resistance level whose breakout is often viewed as a strong signal of trend reversal.

[3] Support level: A price area in a downtrend where the price decline tends to halt and a potential rebound may occur.

Research Report Appendix

Company Concept:

SMCI is a leading American technology company that designs, develops, and manufactures high-performance, energy-efficient server and storage solutions for data centers, cloud computing, artificial intelligence, and edge computing markets worldwide.

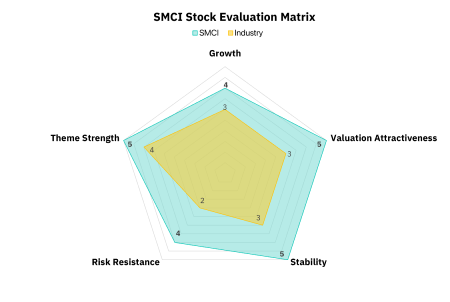

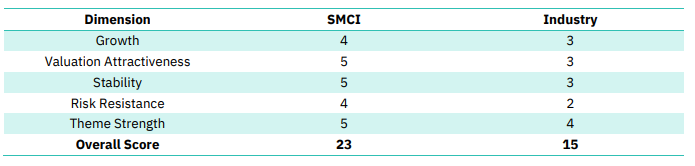

Model Explanation:

The model primarily evaluates companies and industries across five dimensions: growth ability, valuation attractiveness, stability, risk resistance ability, and theme strength. Each dimension is scored from 1-5, with 1 being the lowest and 5 the highest. Overall, higher scores indicate stronger fundamentals. For each dimension, a multi-factor model will be constructed based on industry and historical data of selected stocks, and a quantitative model will be used to automatically score each dimension.

Here are the dimensions explained:

- Growth Ability: Measures future performance potential; higher growth rates yield higher scores.

- Valuation Attractiveness: Assesses stock valuation; lower valuations earn higher scores.

- Stability: Evaluates the consistency of profit generation; greater stability means higher scores.

- Risk Resistance: Gauges the capacity to endure macroeconomic changes; better risk resistance leads to higher scores.

- Theme Strength: Rates market favor for the stock in the short term; increased favor results in higher scores.

Disclaimer:

The Information presented above is for information purposes only, which shall not be intended as and does not constitute an offer to sell or solicitation for an offer to buy any securities or financial instrument or any advice or recommendation with respect to such securities or other financial instruments or investments. When making a decision about your investments, you should seek the advice of a professional financial adviser and carefully consider whether such investments are suitable for you in light of your own experience, financial position and investment objectives. The firm and its analysts do not have any material interest or conflict of interest in Super Micro Computer, Inc.

IN NO EVENT SHALL SAHM CAPITAL FINANCIAL COMPANY BE LIABLE FOR ANY DAMAGES, LOSSES OR LIABILITIES INCLUDING WITHOUT LIMITATION, DIRECT OR INDIRECT, SPECIAL, INCIDENTAL, CONSEQUENTIAL DAMAGES, LOSSES OR LIABILITIES, IN CONNECTION WITH YOUR RELIANCE ON OR USE OR INABILITY TO USE THE INFORMATION PRESENTED ABOVE, EVEN IF YOU ADVISE US OF THE POSSIBILITY OF SUCH DAMAGES, LOSSES OR EXPENSES.