Saudi Market

TASI Technical Analysis:

TASI is currently at 12,025.05 points with significant volatility. The RSI of 54.57 indicates a neutral market, neither overbought nor oversold. The MACD shows recent bullish momentum but hints at a potential trend reversal. Support is around the 11,672 points area, with resistance at 12,229 points. Short - term bullish signals are emerging, and an upward move could follow if the price breaks above resistance with increased volume. The relatively stable volume suggests sustained market interest.

TASI Index Weekly Market Summary (March 23 to March 27)

Over the week of March 23 to March 27, 2025, the TASI (Tadawul All Share Index) rose by 2.82%, underpinned by an average daily turnover of SAR 4.92 billion and total transactions exceeding 24.2 billion.

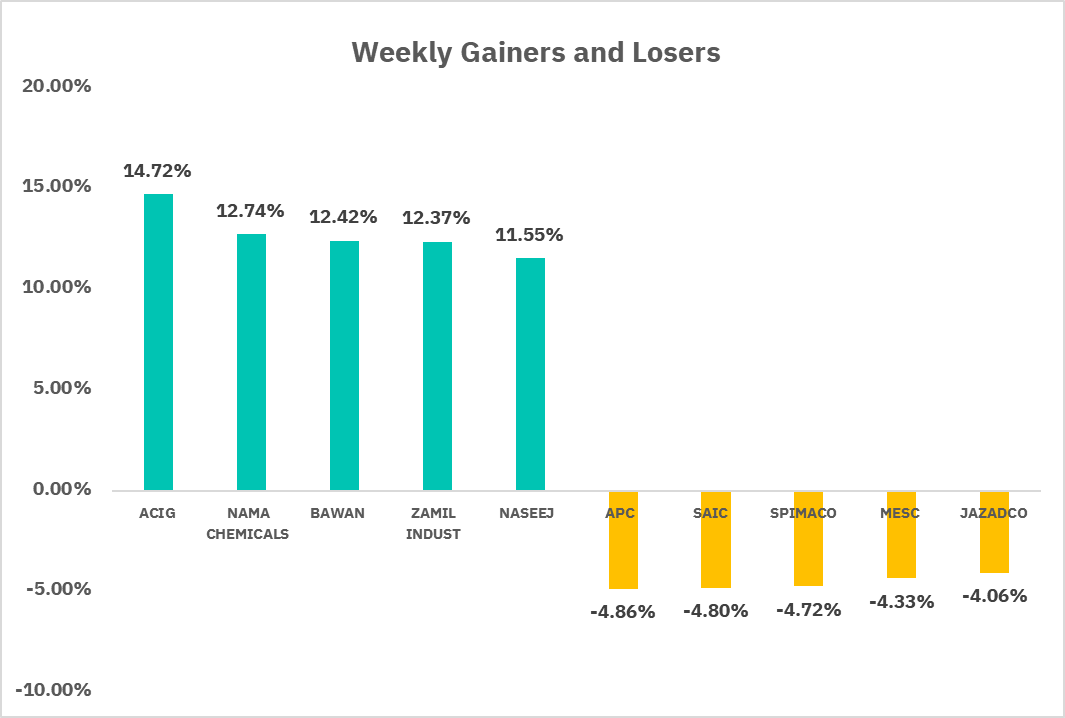

From the perspective of individual stock performance, 220 companies saw their stock prices rise this week, while 46 companies saw their stock prices fall. The companies with the highest increase included ACIG, NAMA CHEMICALS, BAWAN, with increases of 14.72%, 12.74%, and 12.42% respectively. The companies with the highest decline included APC, SAIC, SPIMACO, with declines of 4.86%, 4.80%, and 4.72% respectively.

U.S. Market

S&P500 Technical Analysis:

The market is currently at 5,693 points, showing a bearish trend but with potential signs of consolidation, having recently bounced off a significant support level around 5,494. Shorter - term SMAs are below longer - term ones, indicating bearishness but also potential trend reversal. The RSI is neutral at 44.26, suggesting neither overbought nor oversold conditions and possible trend change or sideways movement. The MACD shows recent bullish divergence and a potential short - term bullish momentum as its line crosses above the signal line, with the histogram indicating positive momentum.

Key support is at 5,507 points, with immediate resistance around 5,706-5,817. Trading volume is consistent, with recent spikes suggesting increased market interest and confirming price movement, indicating potential trend strength.

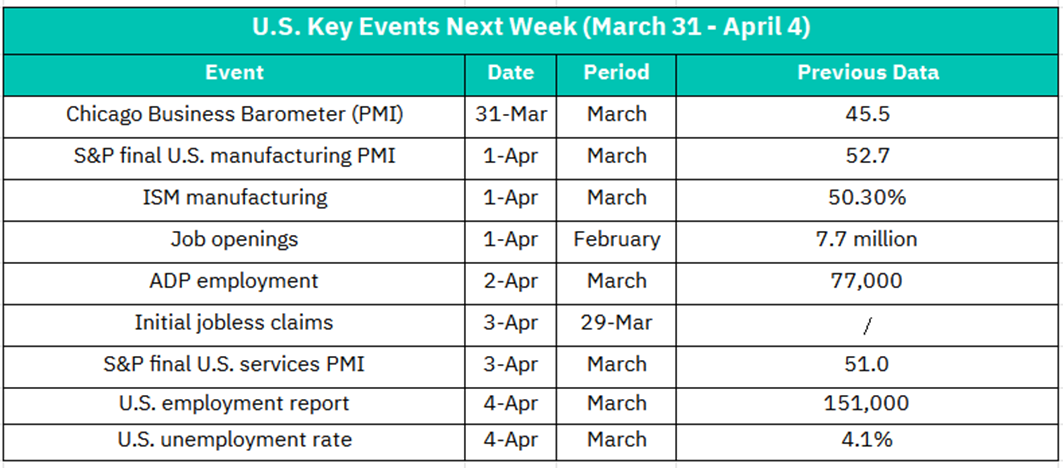

1. March 31– Chicago Business Barometer (PMI)

Previous Data: 45.5 (contractionary level below 50).

A reading above 50 could signal regional economic expansion, boosting sentiment in cyclical sectors (e.g., industrials). A weaker figure may weigh on market confidence, especially in manufacturing-exposed stocks.

2. April 1 – S&P Final U.S. Manufacturing PMI

Previous Data: 52.7

Confirmation of steady growth would support equities, particularly industrials and tech. A downward revision might trigger concerns about slowing factory activity.

– ISM Manufacturing Index

Previous Data: 50.3% (barely expansionary).

A rise above 51% could lift markets, signaling resilience in manufacturing. A drop below 50% (contraction) may spook investors, pressuring cyclical stocks.

– Job Openings (February)

Previous Data: 7.7 million.

Higher openings suggest labor market tightness, potentially stoking wage-inflation fears. This could dampen rate-cut hopes, weighing on growth stocks (e.g., tech) sensitive to borrowing costs.

3. April 2 – ADP Employment (March)

Previous Data: 77,000 (low due to seasonal factors).

A rebound to ~150K+ would align with Fed’s “soft landing” narrative, supporting equities. A weak print (<100K) might revive recession fears, hitting risk assets.

4. April 3 – Initial Jobless Claims (Week of March 29)

Persistent low claims (sub-220K) indicate labor strength, reinforcing confidence in consumer-driven sectors (e.g., retail). A spike could trigger volatility.

– S&P Final U.S. Services PMI

Previous Data: 51.0 (modest expansion).

Services dominate the U.S. economy; upward revisions could lift broad indices (S&P 500). A downgrade may raise growth concerns, hurting hospitality and financial stocks.

5. April 4 – U.S. Employment Report (Nonfarm Payrolls, March)

Previous Data: 151,000.

A strong print (>200K) could signal economic resilience but may delay Fed rate cuts, pressuring rate-sensitive sectors (real estate, utilities). A miss (<150K) might fuel rate-cut bets, boosting tech and small caps.

– Unemployment Rate (March)

Previous Data: 4.1%.

A stable or lower rate (≤4.1%) supports consumer confidence, benefiting discretionary stocks. A rise above 4.3% could spark recession worries, dragging down cyclicals.

Crypto ETF Technical Analysis:

The Invesco Galaxy Bitcoin ETF is in a complex consolidation within a descending channel at $86.85. The 10 - day, 20 - day, and 30 - day SMAs suggest a neutral to slightly bullish short - term momentum, with converging moving averages hinting at a potential trend shift. The RSI of 48.95 signals neutral momentum with a slight bearish inclination but not oversold. The MACD shows early bullish divergence and a possible trend change.

Price is in a descending channel, consolidating between $80 - $90, with recent action indicating a potential breakout. For short - term traders, watch for a breakout above the $87 - $88 resistance confirmed by increased volume.

Disclaimer:

Sahm is subject to the supervision and control of the CMA, pursuant to its license no. 22251-25 issued by CMA.

The Information presented above is for information purposes only, which shall not be intended as and does not constitute an offer to sell or solicitation for an offer to buy any securities or financial instrument or any advice or recommendation with respect to such securities or other financial instruments or investments. When making a decision about your investments, you should seek the advice of a professional financial adviser and carefully consider whether such investments are suitable for you in light of your own experience, financial position and investment objectives. The firm and its analysts do not have any material interests or conflicts of interest in any companies mentioned in this report.

Performance data provided is accurate and sourced from reliable platforms, including Argaam, TradingView, MarketWatch.

IN NO EVENT SHALL SAHM CAPITAL FINANCIAL COMPANY BE LIABLE FOR ANY DAMAGES, LOSSES OR LIABILITIES INCLUDING WITHOUT LIMITATION, DIRECT OR INDIRECT, SPECIAL, INCIDENTAL, CONSEQUENTIAL DAMAGES, LOSSES OR LIABILITIES, IN CONNECTION WITH YOUR RELIANCE ON OR USE OR INABILITY TO USE THE INFORMATION PRESENTED ABOVE, EVEN IF YOU ADVISE US OF THE POSSIBILITY OF SUCH DAMAGES, LOSSES OR EXPENSES.