Tesla Beyond Cars: A Strategic Analysis of the EV Giant's Transformation into a Multi-Vertical Tech Powerhouse

Company Overview:

Tesla, Inc. (TSLA) was founded in 2003 and has evolved from an electric vehicle startup into a global leader in clean energy and automotive technology. The company primarily engages in the design, development, manufacturing, and sales of electric vehicles, energy storage systems, and solar products. Tesla went public on NASDAQ in 2010 and has become one of the highest-valued automobile manufacturers in the world.

Currently, Tesla operates major production facilities in the United States, China, and Germany, with plans to further expand its global manufacturing network to support its ambitions in autonomous driving systems, robotics, and artificial intelligence.

Business Structure Analysis

Tesla's current main business segments include automotive operations, energy generation and storage, services, and other businesses.

1. Automotive Business (approximately 79% of total revenue in 2024):

The company's automotive business includes automotive sales, automotive regulatory credits, and automotive leasing, with automotive sales accounting for over 90% of this segment, representing Tesla's core business.

Automotive Sales Business:

• Model 3/Y Series: Positioned in the mid-market segment as sedan and crossover SUV, priced between $40,000-$60,000, these models are Tesla's main sales contributors, accounting for approximately 90% of total deliveries in 2024

• Model S/X Series: Positioned in the high-end market as luxury sedan and SUV, priced between $80,000-$120,000, with lower sales volume but maintaining higher profit margins

• Cybertruck: An electric pickup truck that began deliveries in late 2023, priced between $60,000-$100,000, featuring a stainless steel exterior and innovative design, with limited initial production capacity but strong demand

• Future Models: Including the highly anticipated Model 2 (tentative name), positioned in the $25,000-$30,000 price range, as well as the Robotaxi autonomous ride-hailing platform planned for launch in 2026

2. Energy Business (approximately 10% of total revenue in 2024):

• Powerwall: Residential battery storage system used for storing solar energy and mitigating grid outages

• Powerpack/Megapack: Commercial and utility-scale energy storage solutions deployed in numerous large-scale grid projects worldwide

• Solar Roof: Solar power generation system integrated into roof tiles, offering aesthetic advantages compared to traditional solar panels

3. Services and Other Business (approximately 10% of total revenue in 2024):

• After-sales Service and Maintenance: Provided through self-operated service center network

• Used Car Sales: Official certified pre-owned vehicle transactions and supporting services

• Charging Network: Global Supercharger network with over 50,000 charging stalls as of early 2025

• Insurance Services: Personalized auto insurance products based on vehicle data

• Full Self-Driving (FSD) Software: Available in subscription model and one-time purchase options, with one-time purchase priced at $8,000 in the US, currently in testing phase but with significant future revenue potential. Subscription model priced at $99/month in the US

• Insurance Business: Innovative insurance products priced according to real-time driving data, currently expanding across multiple states in the US

4. Humanoid Robot Business (not yet generating significant revenue)

Technological Progress:

• August 2021: First revealed Tesla Bot concept

• September 2022: Unveiled Optimus prototype (without exterior shell), adopting a pure vision approach, equipped with FSD chip

• March 2023: Released Optimus Gen 1, capable of assembly tasks and power tool operation

• December 2023: Released Optimus Gen 2, 10kg lighter, 30% faster walking speed, upgraded hand sensors

• May 2024: Demonstrated Optimus battery sorting capabilities, completely based on end-to-end neural networks, deployed for testing in factories

Commercialization Roadmap:

• Q2 2024 Earnings Call: Reported that Optimus robots are already performing tasks in Tesla factories

• Early 2025: Expected to begin production with limited supply

• End of 2025: Production volume to reach 5,000 units, primarily for internal use

• 2026: Significant production scale-up expected, with a projected 10-fold increase to 50,000 units, beginning external customer distribution

Although not yet generating revenue, humanoid robotics is currently in the early stages of industry explosion with strong growth potential. Tesla's early positioning gives it significant first-mover advantage in this field.

Financial Insights:

2025 Q1 Tesla Earnings Report Analysis:

Revenue: Tesla's first quarter operating revenue was $19.34 billion, down 9% year-over-year, below the expected $21.3 billion; Net Profit: First quarter adjusted net profit was $934 million, down 39% year-over-year; First quarter operating profit margin was 2.1%, with a gross margin of 16.3%; Among this, first quarter automotive revenue was $14.0 billion, down 20% year-over-year, while energy storage business increased by 67% year-over-year.

In Q4 2024, Tesla reported revenue of $25.707 billion (yoy +2.1%), below the expected $27.1 billion. Gross margin was 16.30%, lower than the expected 19%. Q4 net income attributable to common shareholders was $2.317 billion (yoy -71%), significantly below expectations.

Full-year revenue was $97.69 billion, a slight 1% year-over-year increase, while full-year net income attributable to common shareholders was $7.091 billion, down 53% year-over-year.

The main reason for this decline was the continued deterioration in the automotive business. Looking at the full year, Tesla's total deliveries reached 1.79 million vehicles, down 1% year-over-year, with Model 3/Y deliveries at 1.70 million units, falling short of expectations.

The primary factor was increasing competitive pressure in the global electric vehicle market. Price reductions to drive sales significantly impacted Tesla's profitability, with Q4 automotive gross margin at just 13.6%.

Although the energy business performed exceptionally well, with Q4 revenue reaching $3.061 billion (yoy +113%), its overall proportion of total revenue remains relatively small, making it difficult to sustain overall profit levels.

Investment Thesis:

1. Transforming from a Pure Electric Vehicle Manufacturer to a Technology Conglomerate

Redefining Company Positioning: Tesla is transitioning from a single electric vehicle manufacturer to a technology conglomerate encompassing transportation, energy, AI, and robotics. This strategic transformation aims to expand the company's addressable market and create diversified revenue streams. Elon Musk has explicitly stated that Tesla's long-term value will primarily come from autonomous driving, AI, and robotics technology, rather than traditional automobile manufacturing. Taking Tesla's current focus on intelligent driving and humanoid robot businesses as examples, the potential market size for both of these businesses is no less than electric vehicle sales. In particular, if humanoid robots are widely applied in both B2B and B2C scenarios, the potential market size could reach no less than $10 trillion. The larger the market size, the higher the valuation, which is why Tesla's valuation has consistently been the highest among the MAG7 companies.

Vertical Integration Advantage: Unlike traditional automakers, Tesla employs a highly vertically integrated business model, controlling everything from battery production to sales and service, reducing dependence on traditional supply chains while increasing the speed of technological innovation and cost efficiency. This integration capability is unique in the industry and creates a competitive barrier that is difficult to replicate.

Data-Driven Operating Model: Tesla has accumulated vast amounts of actual road driving data and user experience data, forming a powerful closed-loop optimization system.

Brand Premium and Consumer Loyalty: Despite intensifying competition, Tesla maintains strong brand premium and user loyalty. Taking the Chinese market as an example, Tesla's products have lower specifications and features compared to Chinese brands, yet command higher prices. For consumer product companies, brand is one of the most core barriers, even surpassing technological capabilities to some extent.

2. Energy Business Poised to Become the Second Growth Curve

Enormous Energy Market Size: The global energy storage market is experiencing explosive growth, with a projected compound annual growth rate of 30%-50% from 2025-2030. Tesla, with its technological advantages and scaled production capabilities, is poised to take a leading position in this market.

Improving Profitability of Energy Business: Tesla's energy business has achieved a gross margin of 26%, exceeding that of its automotive business, with strong growth momentum.

Synergies with Automotive Business: Significant synergies exist between the energy business and automotive business in terms of supply chain, technology development, and brand marketing, with shared infrastructure reducing overall operating costs. For example, improvements in battery technology benefit both automotive and energy storage products, enhancing overall competitiveness.

3. Leadership in Autonomous Driving Technology and Software Value Monetization

Pure Vision Approach Validation: Unlike competitors relying on expensive LiDAR and radar, Tesla has persisted with a pure vision solution, a strategy that received initial validation in 2024. The FSD beta version continues to improve in performance, with accident rates lower than human drivers, laying the foundation for large-scale commercialization.

Software-as-a-Service Business Model: Tesla's FSD subscription model will continue to generate cash flow, with monthly subscription fees reduced from $199 to $99, greatly increasing user acceptance. By the end of 2025, the penetration rate is expected to reach 15%, forming a stable revenue stream.

Data Flywheel Effect: As more vehicles enable FSD functionality, Tesla's data advantage will further expand, creating a virtuous cycle. This data is directly used to train neural network models, improving autonomous driving system performance, attracting more users, and generating more data.

4. Economies of Scale and Cost Leadership Advantages

Significant Scale Economies: As the world's largest electric vehicle manufacturer, Tesla enjoys significant economies of scale. Its enormous production volume puts it in an advantageous position for supply chain negotiations, R&D amortization, and fixed cost allocation.

Continuous Innovation in Advanced Manufacturing: Through large casting technology, structural battery packs, and simplified assembly processes, Tesla continues to revolutionize automobile manufacturing methods.

Localized Production Strategy: By establishing local production bases in key markets, Tesla has effectively reduced logistics costs and tariff impacts while increasing supply chain resilience.

5. Robotaxi and Humanoid Robots Expanding Growth Opportunities

Robotaxi Implementation Progress: Tesla plans to launch completely unsupervised FSD services in Austin in June 2025, with Robotaxi expected to launch in multiple cities subsequently and achieve scaled production in 2026. According to company estimates, the lifetime revenue per Robotaxi could reach $300,000, far exceeding traditional vehicle sales.

Humanoid Robot Commercialization Process: The Q4 2024 earnings report confirmed that Tesla plans to produce approximately 10,000 Optimus humanoid robots internally in 2025, with unit costs dropping below $20,000 when production capacity reaches 1 million units. Musk has stated that Optimus's ultimate annual production capacity could reach 100 million units, potentially generating $10 trillion in long-term revenue.

Key Technology Reuse: The visual AI technology and neural network models accumulated in Tesla's FSD development are being repurposed for humanoid robot development, creating significant technological synergies and accelerating product maturity.

Clear Industrialization Path: Tesla is adopting an internal application-first strategy, initially deploying Optimus robots in its own factories, then promoting them to external markets after improving product maturity. This gradual commercialization approach effectively reduces risk while accumulating practical application experience.

Main Challenges:

1. Musk's Political Rhetoric Impact on Tesla's Brand Power

Following the inauguration of the new U.S. President Trump, Musk's level of involvement in public affairs has increasingly intensified. Some of his statements, particularly his support for right-wing political forces, have significantly affected potential consumers' purchase intentions. Tesla's potential buyers largely value environmental protection and appreciate technology—political views directly opposite to what Musk advocates. This has led to a continued decline in Tesla's sales across European regions. In January this year, Tesla's sales in Europe plummeted: sales in the UK fell by 18% year-over-year, Portugal by 31%, and especially in Germany, where sales dropped by 59.5% and 76.3% in the first two months of 2025, while overall electric vehicle sales in Germany grew by 27% during the same period. Simultaneously, protests targeting Tesla are erupting across Europe and America. If Tesla's brand power continues to deteriorate, the impact on its valuation and long-term performance could be substantial.

2. FSD Commercialization Path Remains Uncertain

Currently, the one-time purchase price for FSD is around $8,000. However, with the development of AI large language models, numerous Chinese automakers have already implemented "autonomous driving democratization"—offering autonomous driving features to users free of charge, with no subscription or fees. Even among manufacturers that do charge, fees are significantly lower than Tesla's. From the current situation, many automakers' autonomous driving capabilities don't significantly lag behind FSD. If this trend spreads globally and the subscription-based business model for autonomous driving becomes unsustainable, it would significantly impact Tesla's valuation.

3. Commercial Viability of Humanoid Robots Remains Unclear

Although the potential market size for humanoid robots exceeds $10 trillion, many automakers are currently accelerating their development in this space. It's foreseeable that competition will intensify. Additionally, the technological maturity of humanoid robots still has a long way to go before reaching large-scale commercial viability.

Valuation Analysis:

Tesla's current PE-TTM (Price-to-Earnings ratio on a Trailing Twelve Months basis) is 109x, which is relatively high overall. Using the SOTP (Sum-of-the-Parts) valuation method:

For the automotive business, main competitor BYD is valued at 1.5x PS (Price-to-Sales). Considering Tesla's brand premium, we assign a 3x PS multiple, corresponding to a market value of $234 billion.

For the energy storage business, the median valuation of US-listed energy storage companies is approximately 3.5x price-to-sales ratio. Considering Tesla's growth potential and brand premium, we assign a 5x PS multiple, corresponding to a market value of $50 billion.

Tesla's current market capitalization is approximately $770 billion, which means the market is assigning a valuation of over $470 billion to Tesla's humanoid robot and FSD businesses. Although Tesla maintains strong competitiveness in these two business areas, progress must consistently exceed expectations to support this valuation.

Risk Factors:

1. Macroeconomic Risk: Global economic slowdown may impact demand for premium consumer products, and electric vehicle market growth may fall below expectations.

2. Intensifying Competition Risk: Traditional automakers and new entrants are accelerating their transition to electrification, intensifying market competition may lead to continued price wars.

3. AI Computing Power Shortage Risk: Global chip supply chain constraints and limited high-end GPU availability may impact autonomous driving technology iteration.

4. Production Capacity Underperformance: Production ramp-up for new products and new markets may fall short of expectations, affecting sales target achievement.

5. Regulatory Policy Risk: Regulatory policies for autonomous driving across various countries face uncertainties, potentially delaying the commercialization process of FSD and Robotaxi.

Research Report Appendix

Company Concept:

Tesla, Inc. (TSLA) was founded in 2003 and has evolved from an electric vehicle startup into a global leader in clean energy and automotive technology. The company primarily engages in the design, development, manufacturing, and sales of electric vehicles, energy storage systems, and solar products.

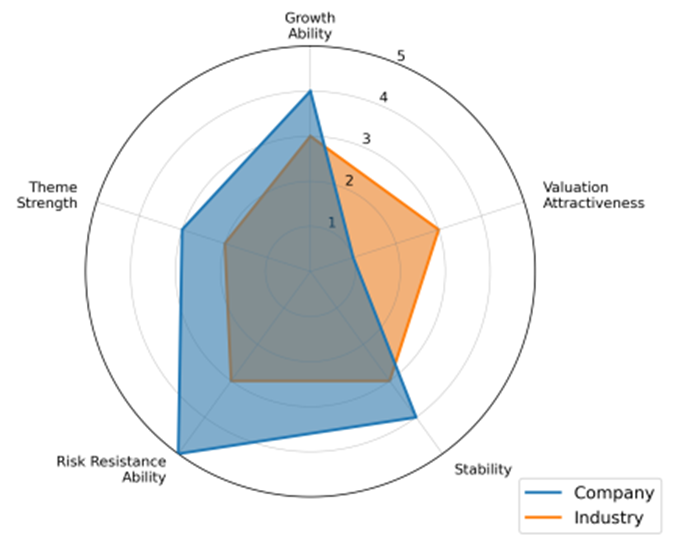

Dimension | TSLA | Industry |

Growth | 4 | 3 |

Valuation Attractiveness | 1 | 3 |

Stability | 4 | 3 |

Risk Resistance | 5 | 3 |

Theme Strength | 3 | 2 |

Overall Score | 17 | 14 |

Model Explanation:

The model primarily evaluates companies and industries across five dimensions: growth ability, valuation attractiveness, stability, risk resistance ability, and theme strength. Each dimension is scored from 1-5, with 1 being the lowest and 5 the highest. Overall, higher scores indicate stronger fundamentals. For each dimension, a multi-factor model will be constructed based on industry and historical data of selected stocks, and a quantitative model will be used to automatically score each dimension.

Here are the dimensions explained:

1. Growth Ability: Measures future performance potential; higher growth rates yield higher scores.

2. Valuation Attractiveness: Assesses stock valuation; lower valuations earn higher scores.

3. Stability: Evaluates the consistency of profit generation; greater stability means higher scores.

4. Risk Resistance: Gauges the capacity to endure macroeconomic changes; better risk resistance leads to higher scores.

5. Theme Strength: Rates market favor for the stock in the short term; increased favor results in higher scores.

Disclaimer:

The Information presented above is for information purposes only, which shall not be intended as and does not constitute an offer to sell or solicitation for an offer to buy any securities or financial instrument or any advice or recommendation with respect to such securities or other financial instruments or investments. When making a decision about your investments, you should seek the advice of a professional financial adviser and carefully consider whether such investments are suitable for you in light of your own experience, financial position and investment objectives. The firm and its analysts do not have any material interest or conflict of interest with any stocks mentioned in this report.

IN NO EVENT SHALL SAHM CAPITAL FINANCIAL COMPANY BE LIABLE FOR ANY DAMAGES, LOSSES OR LIABILITIES INCLUDING WITHOUT LIMITATION, DIRECT OR INDIRECT, SPECIAL, INCIDENTAL, CONSEQUENTIAL DAMAGES, LOSSES OR LIABILITIES, IN CONNECTION WITH YOUR RELIANCE ON OR USE OR INABILITY TO USE THE INFORMATION PRESENTED ABOVE, EVEN IF YOU ADVISE US OF THE POSSIBILITY OF SUCH DAMAGES, LOSSES OR EXPENSES.