Exciting news! Sahm Research Center is launching a new Weekly Report section, and we want your input! Help us shape our content by taking a quick survey: Join the Survey

Your feedback is essential in creating a tailored experience just for you. Thank you for being part of our community!

Saudi Market

TASI Technical Analysis:

The 10-day SMA (blue line), 20-day SMA (purple line) and 30-day SMA (yellow line) are all trending upwards, and the 10-day SMA is currently trending upwards across the 20-day SMA, which indicates that market sentiment is positive in the short term.

The RSI value is 59.91, close to 60, which indicates that the market is currently in a relatively balanced state, with no obvious overbought or oversold signals. However, if the RSI continues to rise and exceeds 70, it may indicate that the market is overbought and prices may pull back.

TASI Index Weekly Market Summary (December 29, 2024 to January 2, 2025)

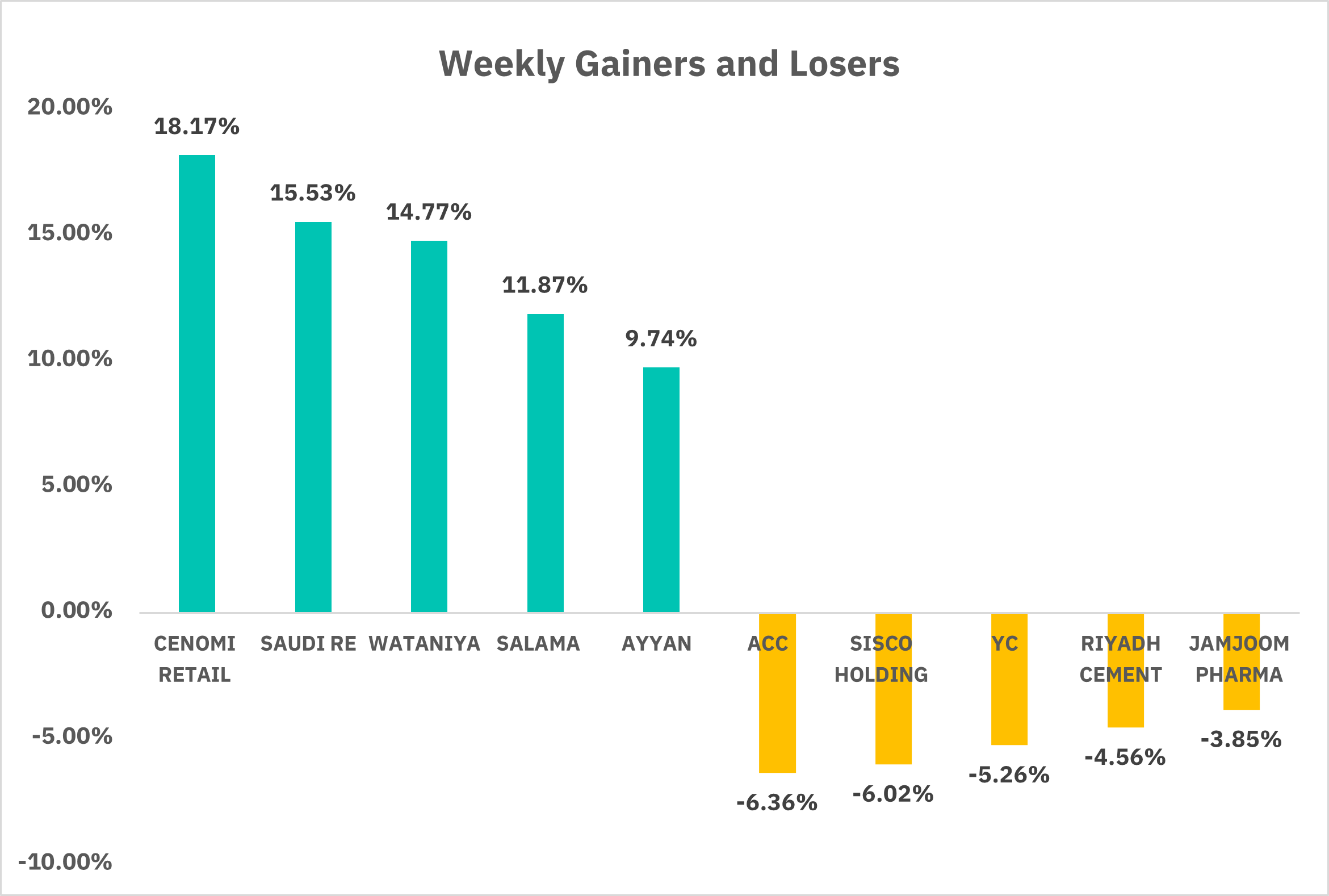

The TASI index closed up 1.76% last week, showing a steady upward trend, especially after the first trading day of 2025 (January 1), rising to 12,077. The average daily turnover is 4,668, million Saudi Riyals (SAR), Market liquidity remained stable last week. In terms of individual stock performance, 181 companies saw their share prices rise, while 70 companies experienced declines. CENOMI RETAIL and SAUDI RE were the top gainers, with gains of 18.17% and 15.53%. Conversely, ACC and SISCO HOLDING were the worst losers, with declines of 6.36% and 6.02%.

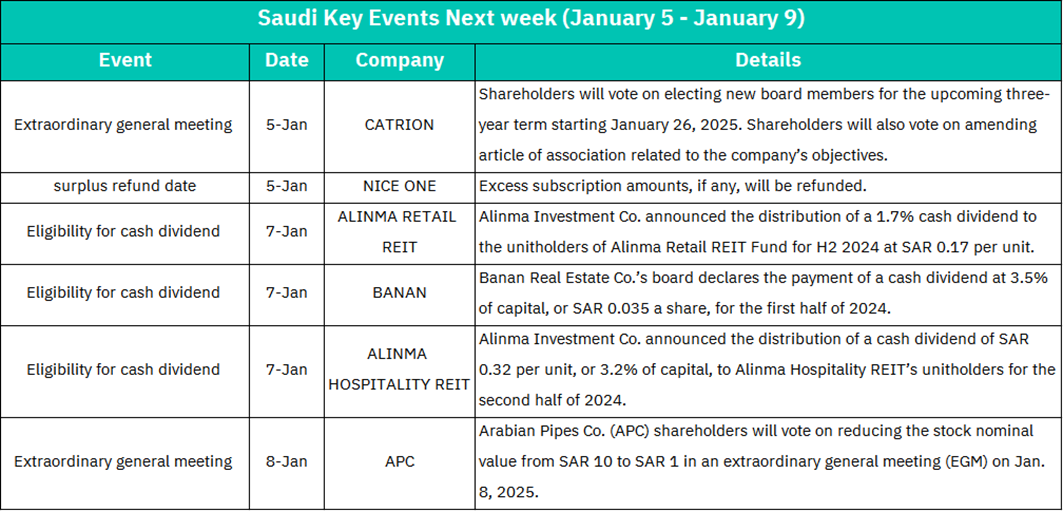

1. January 5: CATRION will hold an extraordinary general meeting of shareholders, where shareholders will vote to elect new board members for a three-year term starting on January 26, 2025. The holding of an extraordinary general meeting of shareholders means that the company's governance structure may change, and the election of new board members and the amendment of the company's articles of association may have an impact on the company's long-term strategy and performance. If NICE ONE has an oversubscription amount, a refund will be made on this day.

2. January 7: Alinma Investment Co. announced that it will distribute a cash dividend of 1.7% of capital for the second half of 2024, or SAR 0.17 per unit, to unitholders of Alinma Retail REIT Fund. The board of directors of Banan Real Estate Co. announced the payment of a cash dividend of 3.5% of capital for the first half of 2024, or SAR 0.035 per share. Alinma Investment Co. announced that it will distribute a cash dividend of SAR 0.32 per unit, or 3.2% of capital, to unitholders of Alinma Hospitality REIT for the second half of 2024. Eligibility for cash dividends today.

3. January 8: Shareholders of Arabian Pipes Co. (APC) will vote at an extraordinary general meeting on whether to reduce the par value of its shares from SAR 10 to SAR 1. Such a change could attract investors seeking a lower threshold for investment.

U.S. Market

S&P500 Technical Analysis:

The S&P 500 decreased by 1.71%, The S&P 500 index reaching the support level of $5,699 again. The SMA 10 started to cross over the SMA 20 and SMA 30 downwards, which could be a bearish sign indicating that the price might continue to fall in the short term.

The U.S. stock market is in a "sell" mood last week. The market is worried about the performance of technology stocks in 2025. As the profit growth of large technology stocks slows down, the market generally expects that technology giants may find it difficult to dominate the market in 2025. Bank of America pointed out in the report: Bank of America's "Sell-Side Indicator SSI" rose 33 basis points to 57% in December, the highest level since the beginning of 2022. The indicator is still in the "neutral" range, but it is only 1 percentage point away from triggering a "sell" signal.

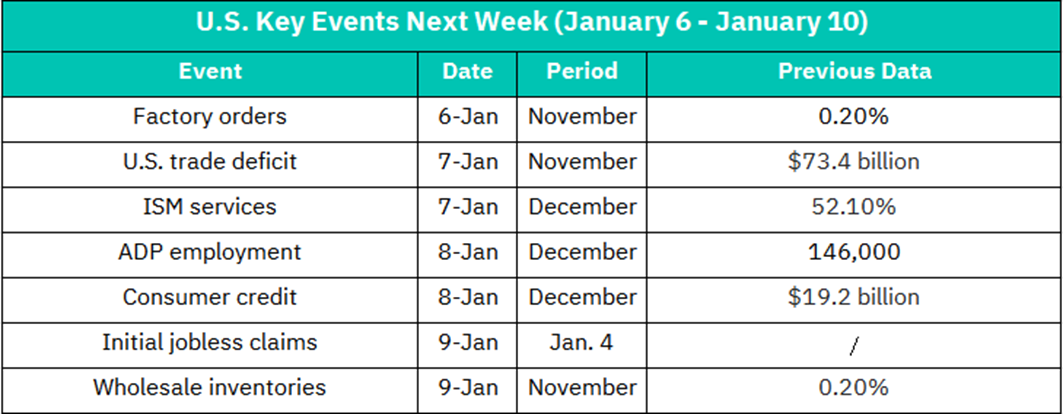

1. Factory orders - January 6: reflects November data, the previous value was 0.20%. An increase in factory orders is often seen as a signal of increased manufacturing activity and may have a positive impact on the stock market as it indicates an increase in economic activity.

2. U.S. trade deficit - January 7: November data will be released; the previous value was $73.4 billion. An increase in the trade deficit may have a negative impact on the US dollar because it means that the United States imports more than exports, which may lead to a depreciation of the US dollar.

3. ISM services - January 7: reflects December data, the previous value was 52.10%. A service index above 50% usually indicates expansion in the service industry, which may have a positive impact on market sentiment.

4. ADP employment - January 8: December data will be released; the previous value was 146,000. ADP employment data is an important indicator of private sector employment and has a certain reference value for predicting non-farm employment data.

5. Consumer credit - January 8: Will reflect December data, with the previous value of $19.2 billion. An increase in consumer credit may indicate that consumers are more confident and willing to take on more debt, which may have a positive impact on retail sales and overall economic activity.

6. Initial jobless claims - January 9: Will release data for January 4. A decrease in the number of unemployment claims is generally seen as a sign of a healthy job market.

7. Wholesale inventories - January 9: Will release November data, with the previous value of 0.20%. Changes in wholesale inventories can reflect companies' expectations for future sales.

Disclaimer:

Sahm is subject to the supervision and control of the CMA, pursuant to its license no. 22251-25 issued by CMA.

The Information presented above is for information purposes only, which shall not be intended as and does not constitute an offer to sell or solicitation for an offer to buy any securities or financial instrument or any advice or recommendation with respect to such securities or other financial instruments or investments. When making a decision about your investments, you should seek the advice of a professional financial adviser and carefully consider whether such investments are suitable for you in light of your own experience, financial position and investment objectives. The firm and its analysts do not have any material interests or conflicts of interest in any companies mentioned in this report.

Performance data provided is accurate and sourced from reliable platforms, including Argaam, TradingView, MarketWatch.

IN NO EVENT SHALL SAHM CAPITAL FINANCIAL COMPANY BE LIABLE FOR ANY DAMAGES, LOSSES OR LIABILITIES INCLUDING WITHOUT LIMITATION, DIRECT OR INDIRECT, SPECIAL, INCIDENTAL, CONSEQUENTIAL DAMAGES, LOSSES OR LIABILITIES, IN CONNECTION WITH YOUR RELIANCE ON OR USE OR INABILITY TO USE THE INFORMATION PRESENTED ABOVE, EVEN IF YOU ADVISE US OF THE POSSIBILITY OF SUCH DAMAGES, LOSSES OR EXPENSES.