Saudi Market

TASI Technical Analysis:

Tasi broke through the previous resistance of 12318 points last week and is now facing the new resistance (12390 points). Tasi is currently 12,354 points, above all moving averages, and the price fluctuates within an ascending channel, indicating that market sentiment is bullish in the short term. Investors should pay attention to whether the price can continue to stay above SMA 10.

The current value of RSI 14 is 70.63, which is close to the overbought area of 70, indicating that the market may be overbought and there may be a risk of a correction in the short term.

TASI Index Weekly Market Summary (January 19 to January 23)

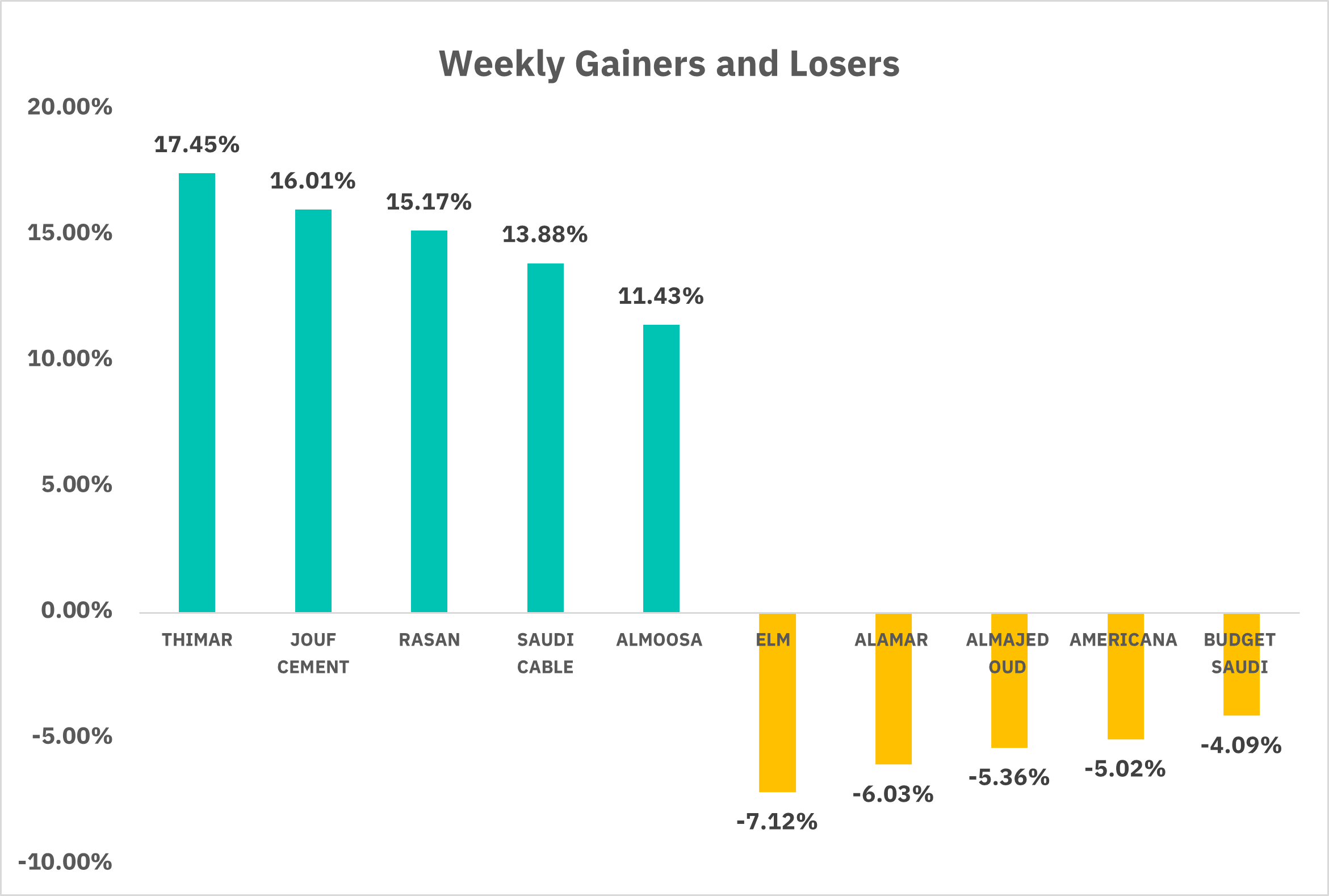

The TASI index closed up 0.18% last week, showing a slightly upward trend, especially on January 20, when it rose to the highest point of the week at 12,379 points. The average daily turnover is 6,604million Saudi Riyals (SAR), Market liquidity surged last week. In terms of individual stock performance, 150 companies saw their share prices rise, while 106 companies experienced declines. THIMAR and JOUF CEMENT were the top gainers, with gains of 17.45% and 16.01%. Conversely, ELM and ALAMAR, with loss of 7.12% and 6.03%.

1. January 26: SFICO shareholders will discuss the Board's proposal to reduce capital by 83.25%, from SAR 400 million to SAR 66.99 million, by cancelling 33.3 million shares, in order to restructure the company's capital to offset accumulated losses. Capital reductions may affect the company's share price and shareholders' equity, and investors need to assess the potential impact of this change on the company's long-term value. MULKIA REIT's 0.8% cash dividend for the fourth quarter of 2024 is SAR 0.08 per unit.

2. January 29: The board of directors of the National Gas and Industrialization Company (GASCO) approved a cash dividend of 11% or 1.1 SAR per share for the second half of 2024. A higher cash dividend rate may attract investors, indicating strong profitability and healthy cash flow.

3. January 30: Derayah Financial, the manager of the Derayah REIT fund, announced a cash distribution of SAR 0.084 per share to unitholders for the fourth quarter of 2024.

U.S. Market

S&P500 Technical Analysis:

The S&P 500 increased by 2.04% last week, the current price break above the resistance level (6,099 points). There is currently no resistance level for the S&P 500.

The current value of RSI 14 is 63.5, which is close to the neutral area, indicating that the market has no obvious overbought or oversold signals.

The interest rate meeting on January 29 was held just nine days after Trump took office. Data from the CME Fed interest rate monitoring tool showed that the probability of the Fed keeping interest rates unchanged in January was 95.2%, and the probability of a 25-basis point rate cut was 4.8%. Strong employment data and core CPI through December have provided little incentive for the Fed to be dovish, so the Fed is almost certain to keep interest rates at current levels.

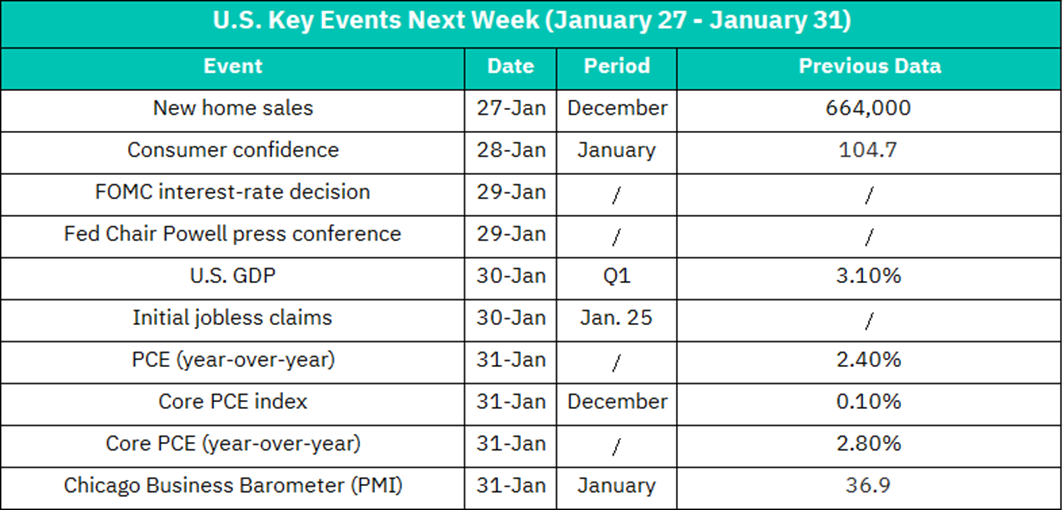

1. New Home Sales - January 27: New home sales data for December will be released, with the previous value of 664,000 units. New home sales are a key indicator of the health of the real estate market, and higher sales figures may indicate an active real estate market, which may have a positive impact on stocks in the real estate sector.

2. Consumer Confidence - January 28: The Consumer Confidence Index for January will be released, with the previous value of 104.7. The Consumer Confidence Index reflects consumers' views on economic conditions. A higher index may indicate an increase in consumer spending, which is a positive signal for the stock market and the economy.

3. FOMC interest rate decision - January 29: The interest rate decision will be announced, and the market will pay close attention to whether the Fed adjusts the interest rate.The interest rate decision will directly affect borrowing costs and financial markets, and any unexpected decisions may cause market volatility.

4. Federal Reserve Chairman Powell Press Conference - January 29: Powell will hold a press conference to discuss monetary policy and the economic outlook. Powell's remarks may affect market expectations of the future interest rate path, thereby affecting the stock and bond markets.

5. U.S. GDP - January 30: The GDP data for the first quarter will be released, with the previous value of 3.10%. GDP is a key indicator of economic activity. Growth that exceeds expectations may boost market sentiment, while data that is lower than expected may cause the market to fall.

6. Initial Jobless Claims - January 30: The number of initial jobless claims for the week ended January 25 will be released. The number of unemployment claims is an indicator of labor market conditions. An increase in the number of people may indicate a weak job market, which may be negative for the stock market.

7. Personal consumption expenditures (PCE) year-over-year - January 31: The PCE year-over-year data for December will be released, with the previous value being 2.40%. PCE is an indicator of changes in consumer prices, and higher inflation data may affect the Fed's monetary policy decisions.

8. Core PCE index and year-over-year - January 31: The core PCE index and year-over-year data for December will be released, with the previous values being 0.10% and 2.80%, respectively. Core PCE is the inflation indicator favored by the Federal Reserve, and higher inflation data may affect monetary policy expectations.

Crypto ETF Technical Analysis:

The current price of Invesco Galaxy Bitcoin ETF (BTCO) is $103.25, which is above the 10-day, 20-day and 30-day moving averages. Investors should watch if the price can sustain above SMA 10. If the price can break out of $105.31 and stabilize above it, further gains to $108.31 are possible. The relative strength index (RSI) is 55.07, which shows that the market has no obvious overbought or oversold signals. If the price can break through the $108.31 resistance level, it is likely to rise further.

On Thursday, January 23rd, Eastern Time, the White House announced that US President Trump signed an executive order titled "Strengthening America's Leadership in Digital Financial Technology." The order requires the establishment of a presidential "Working Group on Digital Asset Markets" within the National Economic Council, an agency that advises the president. The executive order also explicitly mentions that the possibility of establishing and maintaining a national digital asset reserve should be evaluated and criteria for establishing such a reserve should be proposed, which could come from cryptocurrencies lawfully seized by the federal government through law enforcement efforts.

Disclaimer:

Sahm is subject to the supervision and control of the CMA, pursuant to its license no. 22251-25 issued by CMA.

The Information presented above is for information purposes only, which shall not be intended as and does not constitute an offer to sell or solicitation for an offer to buy any securities or financial instrument or any advice or recommendation with respect to such securities or other financial instruments or investments. When making a decision about your investments, you should seek the advice of a professional financial adviser and carefully consider whether such investments are suitable for you in light of your own experience, financial position and investment objectives. The firm and its analysts do not have any material interests or conflicts of interest in any companies mentioned in this report.

Performance data provided is accurate and sourced from reliable platforms, including Argaam, TradingView, MarketWatch.

IN NO EVENT SHALL SAHM CAPITAL FINANCIAL COMPANY BE LIABLE FOR ANY DAMAGES, LOSSES OR LIABILITIES INCLUDING WITHOUT LIMITATION, DIRECT OR INDIRECT, SPECIAL, INCIDENTAL, CONSEQUENTIAL DAMAGES, LOSSES OR LIABILITIES, IN CONNECTION WITH YOUR RELIANCE ON OR USE OR INABILITY TO USE THE INFORMATION PRESENTED ABOVE, EVEN IF YOU ADVISE US OF THE POSSIBILITY OF SUCH DAMAGES, LOSSES OR EXPENSES.