Please use a PC Browser to access Register-Tadawul

Stock Ratings | Another $25 Upside Expected! Wells Fargo maintains its Overweight rating on Advanced Micro Devices (AMD) and raises its price target from $120 to $185.

SELLAS Life Sciences Group Inc SLS | 2.20 | +7.84% |

PagSeguro Digital Ltd. PAGS | 9.71 | -3.09% |

Vinci Partners Investments Ltd. Class A VINP | 13.20 | -0.30% |

AngioDynamics, Inc. ANGO | 13.48 | +1.05% |

CommVault Systems, Inc. CVLT | 120.95 | +0.93% |

Major US investment bank ratings are used to track the latest valuations and target prices on Wall Street daily, and to explore potential stock investment opportunities.

Hazard Warning:

Investing in small-cap stocks can be risky. Be prepared for potential liquidity challenges, high volatility, limited information, and financial instability. Always diversify your investments.

Today's Key Ratings and Concerns

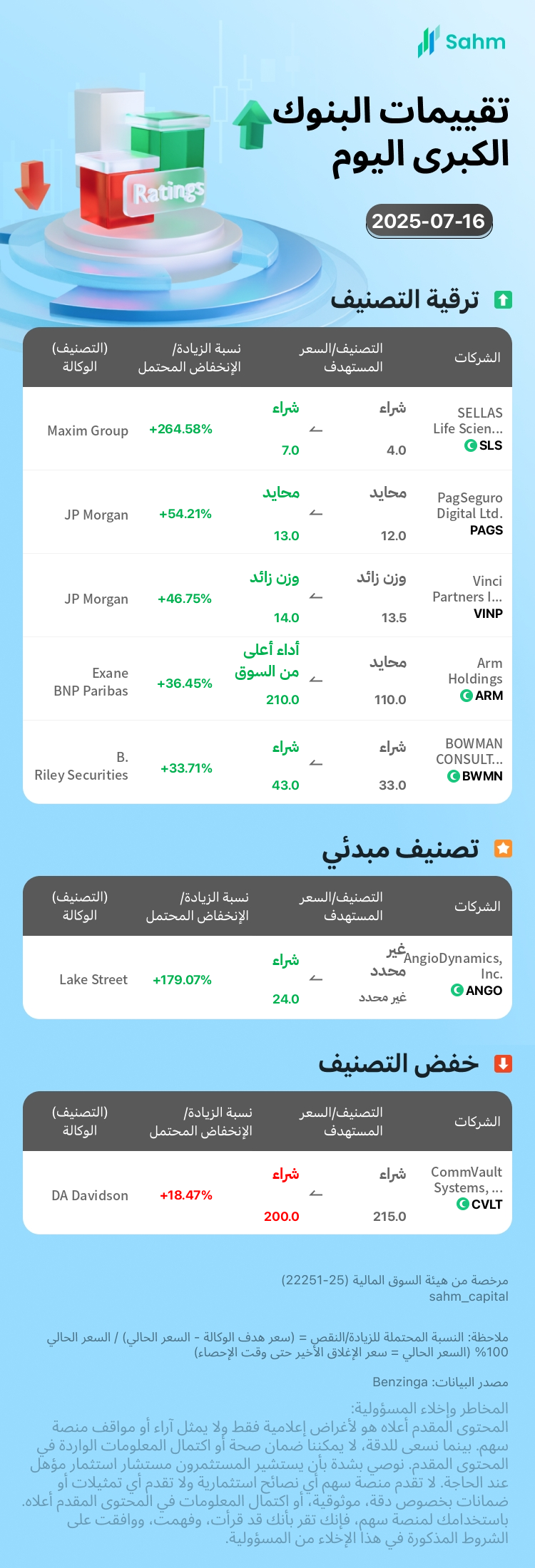

Maxim Group: Maintained a "Buy" rating on SELLAS Life Sciences Gr ( SELLAS Life Sciences Group Inc(SLS.US) ), raising the price target from $4 to $7.

JP Morgan: Maintained a "Neutral" rating on PagSeguro Digital Ltd.(PAGS.US) ), raising the price target from $12 to $13.

JP Morgan: Maintained an “Overweight” rating on Vinci Compass Investments ( Vinci Partners Investments Ltd. Class A(VINP.US) ), raising the price target from $13.5 to $14.

Lake Street: Initial rating for AngioDynamics AngioDynamics, Inc.(ANGO.US) ) with a "Buy" recommendation and a $24 price target.

DA Davidson: Maintains a "Buy" rating on CommVault Systems, Inc.(CVLT.US) ), lowering the price target from $215 to $200.

| The symbol | Classification | Target price | Current price | Potential increase/decrease rate | (Classification) Agency |

| SELLAS Life Sciences Group Inc(SLS.US) | to lift | $7.0 | $1.92 | 264.58% | Maxim Group |

| PagSeguro Digital Ltd.(PAGS.US) | to lift | $13.0 | $8.43 | 54.21% | JP Morgan |

| Vinci Partners Investments Ltd. Class A(VINP.US) | to lift | $14.0 | $9.54 | 46.75% | JP Morgan |

| Arm Holdings(ARM.US) | to lift | $210.0 | $153.9 | 36.45% | Exane BNP Paribas |

| BOWMAN CONSULTING GROUP LTD.(BWMN.US) | to lift | $43.0 | $32.16 | 33.71% | B. Riley Securities |

| AngioDynamics, Inc.(ANGO.US) | Initial classification | $24.0 | $8.6 | 179.07% | Lake Street |

| CommVault Systems, Inc.(CVLT.US) | cut | $200.0 | $168,825 | 18.47% | DA Davidson |

| BlackRock, Inc.(BLK.US) | cut | $1170.0 | $1082.24 | 8.11% | Wells Fargo |

| Omnicom Group Inc(OMC.US) | cut | $78.0 | $74.05 | 5.33% | Wells Fargo |

| Alpine Income Property Trust(PINE.US) | cut | $15.0 | $14.38 | 4.31% | UBS |

comments:

Target price unit and current price: US dollar;

Current Price: As of the latest closing price of US stocks;

Potential increase/decrease ratio = (Agency target price - current price) / current price 100% (Current price = last closing price up to the time of census)

Lifting

Wells Fargo: Maintained an “overweight” rating on Advanced Micro Advanced Micro Devices, Inc.(AMD.US) , raising the price target from $120 to $185.

Exane BNP Paribas: Upgraded Arm Holdings Arm Holdings(ARM.US) to “Outperform,” with a price target increase from $110 to $210.

Wells Fargo: Maintained a “market-matched weight” rating on Bank Bank of New York Mellon Corporation(BK.US) ), raising the price target from $96 to $100.

JP Morgan: Maintained a “Neutral” rating on BlackRock BlackRock, Inc.(BLK.US) ), raising the price target from $1,018 to $1,093.

B. Riley Securities: Maintained a "Buy" rating on Bowman Consulting Group ( BOWMAN CONSULTING GROUP LTD.(BWMN.US) ), raising the price target from $33 to $43.

Wells Fargo: Maintained an “Overweight” rating on Citigroup Inc.(C.US) , raising the price target to $115 from $110.

JP Morgan: Maintains a "Neutral" rating on Coursera Inc(COUR.US) ), raising the price target from $8 to $9.

Wells Fargo: Maintained an “Underweight” rating on CoStar Group, Inc.(CSGP.US) ), raising the price target from $65 to $70.

DA Davidson: Maintained a "Neutral" rating on Equity Bancshares, Inc. Class A(EQBK.US) ), raising the price target from $39 to $44.

JP Morgan: Maintained a "Neutral" rating on Halozyme Therapeutics, Inc.(HALO.US) ), raising the price target from $58 to $60.

DA Davidson: Maintains a "Buy" rating on Hancock Whitney Hancock Whitney Corporation(HWC.US) ), raising the price target from $65 to $67.

Wells Fargo: Maintained an "overweight" rating on JB Hunt J.B. Hunt Transport Services, Inc.(JBHT.US) ), raising the price target from $150 to $163.

JP Morgan: Maintained an “Overweight” rating on Janus Henderson Group ( Janus Henderson Group PLC(JHG.US) ), raising the price target from $44 to $47.

First coverage

Lake Street: Initial rating for AngioDynamics AngioDynamics, Inc.(ANGO.US) ) with a "Buy" recommendation and a $24 price target.

B. Riley Securities: Initial rating for Oncology Institute ( Targets Tr Xxiv Targets 7%Intc(TOI.US) ) with a "Buy" recommendation and a $6 price target.

reduction

Wells Fargo: Maintained an “overweight” rating on BlackRock BlackRock, Inc.(BLK.US) ), lowering the price target to $1,170 from $1,180.

DA Davidson: Maintains a "Buy" rating on CommVault Systems, Inc.(CVLT.US) ), lowering the price target from $215 to $200.

UBS: Maintains a "Neutral" rating on Getty Realty Corp.(GTY.US) ), lowers the price target from $29 to $28.

UBS: Maintains a "Neutral" rating on National National Retail Properties, Inc.(NNN.US) ), lowering the price target from $43 to $42.

Wells Fargo: Maintained a "market-weight" rating on Omnicom Group ( Omnicom Group Inc(OMC.US) ), lowering the price target from $84 to $78.

UBS: Maintains a "Neutral" rating on Alpine Income Property Trust Alpine Income Property Trust(PINE.US) ), lowers the price target from $16 to $15.

Editor's Note: This content was generated by Sahm's AI-powered SaaS tool and reviewed by our editorial team.

Risk Warning: Investing involves risks, and securities prices may rise, fall, or even become worthless. Investing does not guarantee profits and may result in losses. Past performance does not necessarily reflect future performance. Before making any investment decision, investors should evaluate their financial situation, investment objectives, experience, and risk tolerance, and understand the nature of the investment products and the risks associated with them. For further details on the nature and risks of each investment product, please read the relevant offering documents carefully. If you have any questions, you are advised to seek independent professional advice.