Please use a PC Browser to access Register-Tadawul

Stock Ratings | Loop Capital maintained its Buy recommendation on NVIDIA (NVDA) and raised the price target from $175 to $250.

Nektar Therapeutics NKTR | 50.55 | -5.16% |

Indie Semiconductor Inc Ordinary Shares - Class A INDI | 3.92 | -4.74% |

NVIDIA Corporation NVDA | 176.23 | -0.03% |

The Real Brokerage Inc. Ordinary Shares REAX | 3.96 | -0.63% |

Capricor Therapeutics, Inc. CAPR | 26.20 | -1.32% |

Major US investment bank ratings are used to track the latest valuations and target prices on Wall Street daily, and to explore potential stock investment opportunities.

Hazard Warning:

Investing in small-cap stocks can be risky. Be prepared for potential liquidity challenges, high volatility, limited information, and financial instability. Always diversify your investments.

Today's Key Ratings and Concerns

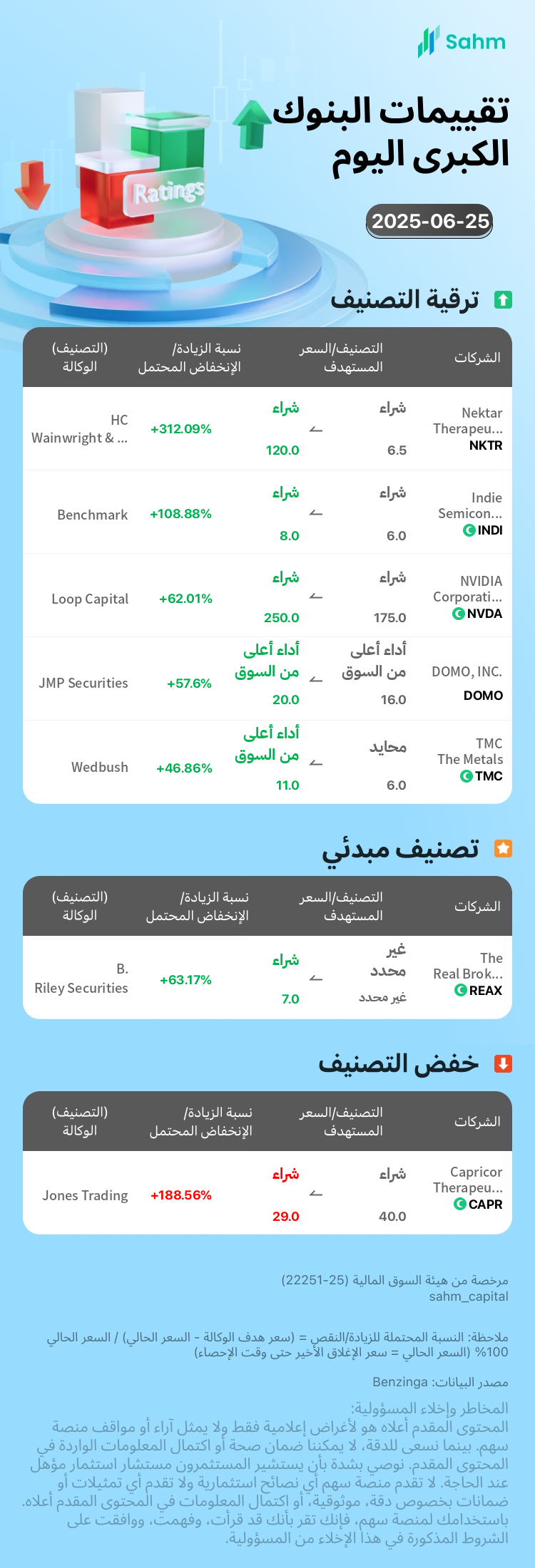

HC Wainwright & Co.: Maintained a "Buy" rating on Nektar Therapeutics Nektar Therapeutics(NKTR.US) ), raising the price target from $6.5 to $120.

Benchmark: Maintained a "Buy" rating on Indie Semiconductor Inc Ordinary Shares - Class A(INDI.US) ), raising the price target from $6 to $8.

Loop Capital: Maintained a “Buy” rating on NVIDIA NVIDIA Corporation(NVDA.US) ), raising the price target from $175 to $250.

B. Riley Securities: Initial rating for The Real Brokerage Inc. Ordinary Shares(REAX.US) with a "Buy" recommendation and a $7 price target.

Jones Trading: Maintained a "Buy" rating on Capricor Therapeutics, Inc.(CAPR.US) ), lowering the price target from $40 to $29.

| The symbol | Classification | Target price | Current price | Potential increase/decrease rate | (Classification) Agency |

| Nektar Therapeutics(NKTR.US) | to lift | $120.0 | $29.12 | 312.09% | HC Wainwright & Co. |

| Indie Semiconductor Inc Ordinary Shares - Class A(INDI.US) | to lift | $8.0 | $3.83 | 108.88% | Benchmark |

| NVIDIA Corporation(NVDA.US) | to lift | $250.0 | $154.31 | 62.01% | Loop Capital |

| DOMO, INC.(DOMO.US) | to lift | $20.0 | $12.69 | 57.6% | JMP Securities |

| TMC The Metals(TMC.US) | to lift | $11.0 | $7.49 | 46.86% | Wedbush |

| The Real Brokerage Inc. Ordinary Shares(REAX.US) | Initial classification | $7.0 | $4.29 | 63.17% | B. Riley Securities |

| Capricor Therapeutics, Inc.(CAPR.US) | cut | $29.0 | $10.05 | 188.56% | Jones Trading |

| Verastem, Inc.(VSTM.US) | cut | $12.0 | $4.3 | 179.07% | RBC Capital |

| Hudson Pacific Properties, Inc.(HPP.US) | cut | $4.75 | $2.69 | 76.58% | BTIG |

| FedEx Corporation(FDX.US) | cut | $329.0 | $222.0 | 48.2% | Stifel |

comments:

Target price unit and current price: US dollar;

Current Price: As of the latest closing price of US stocks;

Potential increase/decrease ratio = (Agency target price - current price) / current price 100% (Current price = last closing price up to the time of census)

Lifting

Goldman Sachs: Raised Ameren Ameren Corporation(AEE.US) ) to "Neutral", with a price target increase from $91 to $100.

BMO Capital: Maintained an “Outperform” rating for Alnylam Pharmaceuticals Alnylam Pharmaceuticals, Inc(ALNY.US) ), raising the price target from $300 to $360.

Morgan Stanley: Maintained Ardagh Metal Packaging ( Ardagh Metal Packaging S.A. Ordinary Shares(AMBP.US) ) rating at "market-weight," raising the price target from $3.5 to $4.1.

Goldman Sachs: Maintained a “sell” rating on Amarin Corp ( Amarin Corporation Plc Sponsored ADR(AMRN.US) ), raising the price target from $7 to $12.

RBC Capital: Maintains BlackBerry BlackBerry Limited(BB.US) Sector Match rating, raises price target from $3.75 to $4.

Baird: Maintains a "Neutral" rating on BlackBerry BlackBerry Limited(BB.US) ), raising the price target from $4 to $5.

B of A Securities: Maintained a "Buy" rating on BridgeBio Pharma ( BridgeBio Pharma(BBIO.US) ), raising the price target from $50 to $54.

JP Morgan: Maintained a "Neutral" rating on Bloomin' Brands, Inc.(BLMN.US) ), raising the price target from $9 to $10.

First coverage

RBC Capital: Initial rating for Autoliv Inc.(ALV.US) ) at "Outperform", with a price target of $133.

Truist Securities: Initial rating for Amrize ( Amrize Ltd(AMRZ.US) ) with a "Buy" recommendation and a $60 price target.

B of A Securities: has assigned a preliminary rating of "Neutral" to AST SpaceMobile ( AST SPACEMOBILE INC(ASTS.US) ), with a target price of $55.

Stifel: Initial rating for AeroVironment, Inc.(AVAV.US) with a "Buy" recommendation and a $240 price target.

Clear Street: Initial rating for ArriVent BioPharma, Inc.(AVBP.US) ) with a "Buy" recommendation and a $32 price target.

Stifel: Initial rating for Crescent Biopharma ( Catalyst Biosciences, Inc.(CBIO.US) ) with a "Buy" recommendation and a $28 price target.

reduction

B. Riley Securities: Maintained a "Buy" rating on Alcoa Inc.(AA.US) ) while lowering the price target from $43 to $38.

Stifel: Downgraded Couchbase ( Couchbase, Inc.(BASE.US) ) to "Hold," raising the price target from $22 to $24.5.

Jones Trading: Maintained a "Buy" rating on Capricor Therapeutics, Inc.(CAPR.US) ), lowering the price target from $40 to $29.

JP Morgan: Maintained an “Overweight” rating on Cava Group CAVA Group Inc.(CAVA.US) ), lowering the price target from $115 to $95.

BMO Capital: Maintained Commercial Commercial Metals Company(CMC.US) "Market Match" rating, lowered the price target to $55 from $57.

DA Davidson: Maintains a “Buy” rating on Duolingo ( Duolingo, Inc.(DUOL.US) ), lowers the price target from $600 to $500.

Truist Securities: Maintained a "Hold" rating on Expedia Group ( Expedia Group(EXPE.US) ), lowering the price target from $175 to $168.

B of A Securities: Maintained a "Buy" rating on FedEx Corporation(FDX.US) ), lowering the price target from $270 to $245.

Editor's Note: This content was generated by Sahm's AI-powered SaaS tool and reviewed by our editorial team.

Risk Warning: Investing involves risks, and securities prices may rise, fall, or even become worthless. Investing does not guarantee profits and may result in losses. Past performance does not necessarily reflect future performance. Before making any investment decision, investors should evaluate their financial situation, investment objectives, experience, and risk tolerance, and understand the nature of the investment products and the risks associated with them. For further details on the nature and risks of each investment product, please read the relevant offering documents carefully. If you have any questions, you are advised to seek independent professional advice.