Please use a PC Browser to access Register-Tadawul

Details of Flynas' IPO on the Saudi Stock Market

Tadawul All Shares Index TASI.SA | 10715.98 | -0.09% |

Riyadh – Mubasher: Flynas, one of the low-cost airlines in the Middle East and North Africa, announced on Tuesday its intention to proceed with its initial public offering (IPO) and list its ordinary shares on the main market of the Saudi Stock Exchange (Tadawul).

Flynas has announced the prospectus for its offering of shares on the Saudi Stock Exchange. Subscription to the offering shares is limited to qualified investors (any investor approved by the Saudi Capital Market Authority) and individual investors (Saudi citizens, citizens of the Gulf Cooperation Council countries, and foreigners residing in the Kingdom of Saudi Arabia, who have an active bank account with one of the participating banks).

Offering Shares and Selling Shareholders

On March 26, 2025, the Capital Market Authority approved Flynas' request to register its shares and offer 51.256 million ordinary shares, representing 30% of the company's shares after the offering and 33.4% of the company's shares before the capital increase.

The initial public offering is planned to be conducted through the sale of 33.828 million existing common shares (“Offering Shares”) by the Company’s existing shareholders, plus the Company’s 8.32 million treasury shares, and the issuance of 17.427 million new common shares (“New Shares”). The New Shares and Offering Shares are collectively referred to as the “Offering Shares.”

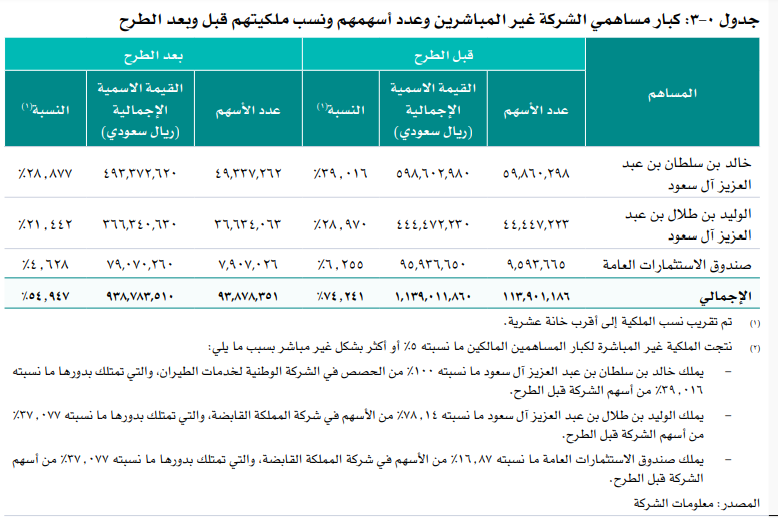

It is noteworthy that the selling shareholders are: National Aviation Services Company, Kingdom Holding Company, Nasser Ibrahim Rashid Al Rashid, Al Mawarid Investment Company, Hamza Bahi El Din Al Sayed Al Kholi, the Saudi General Company for Commercial Investments and Services, Salman Mohammed Khaled Bin Hathleen, and Yousef Abdul Sattar Qasim Al Maimani (the selling shareholders).

According to the offering prospectus and the company's disclosure today, the selling shares will represent 19.8% and the new shares 10.2% of the company's total capital upon completion of the offering, representing 30% of the company's capital after the offering.

The net proceeds from the offering shares (“Net Offering Proceeds”), after deducting the offering expenses estimated at SAR 100 million, will be distributed to the selling shareholders on a pro rata basis based on each of their respective ownership percentages in the selling shares. The Company will use the net proceeds from the new shares to finance the growth of its fleet, expand its network, establish new operations centers, and for other general corporate purposes.

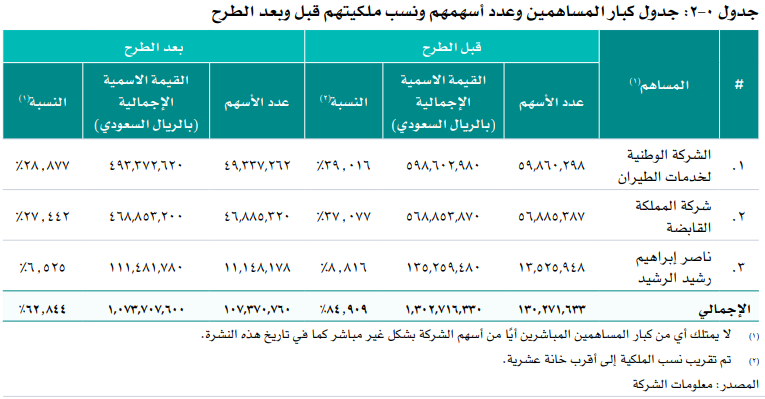

Shareholder ownership and company capital before and after the offering:

It should be noted that following the completion of the offering, existing shareholders will collectively own 70% of the company's capital and will be subject to a six-month trading lock-up period. The company will also adhere to the same trading lock-up period. The percentage of shares available for free trading immediately after listing is expected to reach 30% of the total offering.

Flynas' fully paid-up capital is SAR 1.534 billion prior to the offering. The company's capital after the offering will be SAR 1.708 billion. The total number of shares outstanding before the offering is 153.43 million ordinary shares, and will reach 170.85 million ordinary shares after the offering. The nominal value of each share is SAR 10.

Number of offering shares for each category of targeted investors:

- Number of offering shares for participating categories: 51.255 million offering shares representing 100% of the total offering shares. In the event that individual subscribers subscribe to all the offering shares allocated to them, the financial advisors have the right, in coordination with the company, to reduce the number of shares allocated to participating entities to a minimum of 41.004 million offering shares representing 80% of the total offering shares.

- Number of offering shares for individual subscribers: 10.251 million offering shares as a maximum, representing 20% of the total offering shares.

How many shares can be subscribed for:

For institutions:

- 100,000 shares is the minimum number of shares that can be subscribed for by participating entities.

- 8.542 million shares is the maximum number of shares that can be subscribed for by each category of targeted investors.

For individuals:

- 10 shares is the minimum number of shares that can be subscribed for by individual subscribers.

- 250,000 shares is the maximum number of shares that can be subscribed for by individual subscribers.

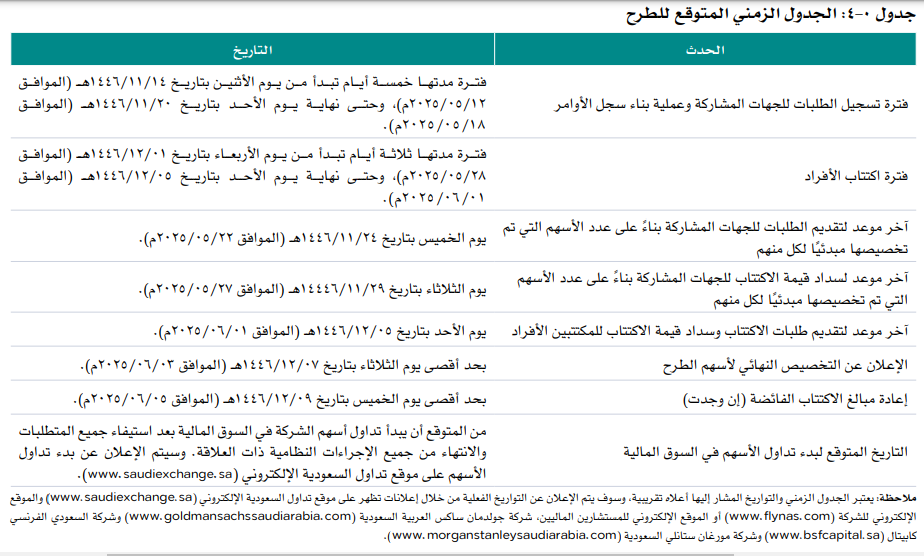

Expected launch timeline:

According to the prospectus, Flynas explained the expected timeline for the company's initial public offering (IPO) on the Saudi Stock Exchange (Tadawul) as follows:

- May 12: Price range set and order book building begins for institutional tranche.

- May 18th.. The order book building for the institutional tranche is complete.

- May 28th.. Individual subscription period begins (from 12 AM Saudi time).

- June 1st.. End of the individual subscription period (at 12 noon Saudi time).

- June 3rd.. Final allocation of offering shares.

June 5th: Any excess subscription amounts, if any, will be refunded to subscribers without any commissions or deductions. They will be deposited into the subscriber’s account specified in the subscription application form.

- The first day of trading in flynas shares. Trading in the company's shares is expected to begin on the stock market after all requirements have been met and all relevant regulatory procedures have been completed. The commencement of trading will be announced on the Saudi Stock Exchange's website.

How to subscribe:

- Make sure you have an active checking account with one of the receiving banks.

- Visit the IPO page link for more information about Flynas and its IPO through the Notice of Intent to Offer and the Prospectus.

Make an investment decision after reviewing the prospectus and discussing the details with your financial advisor.

- Subscribing at the offering price by submitting an electronic application via the receiving banks’ websites or digital applications.

Once shares are allocated, you may or may not receive all the shares you subscribed for, and any excess will be refunded to you.

Flynas will be listed on the Saudi Stock Exchange (Tadawul), and changes in the share price will be monitored on the trading market.

Lead Managers, Underwriters and Receiving Entities

- Subscription Manager: Saudi Fransi Capital.

Financial Advisors and Underwriters: Morgan Stanley Saudi Arabia, Saudi Fransi Capital, Goldman Sachs Saudi Arabia.

Bookrunners: Morgan Stanley Saudi Arabia, Goldman Sachs Saudi Arabia, Saudi Fransi Capital, Al Rajhi Capital, Emirates NBD Capital Saudi Arabia, Citigroup Saudi Arabia, and Arab Bank Capital.

Recipients: Daraya Financial, Alinma Financial, Al Rajhi Financial, Al Ahli Financial, Riyad Financial, Arab Financial, Al Istithmar Capital, GIB Capital, Al Khair Financial, Al Awwal Investment, Al Jazira Capital, Sahm Capital Financial, Yaqeen Capital, and Saudi Fransi Capital.

Information about Flynas

Founded in 2007 in Saudi Arabia, flynas is the leading low-cost airline in the Middle East and North Africa (MENA) region for short and medium-haul flights.

Flynas aims to connect the world to the Kingdom, operating a fleet of 61 Airbus aircraft from its four main hubs in Riyadh, Jeddah, Dammam, and Medina.

Flynas serves 72 destinations, including 16 domestic and 56 international destinations (as of September 30, 2024), in addition to access to 128 destinations through codeshare and interline agreements with international airlines that provide full service.

Flynas has the largest fleet among Saudi Arabia's low-cost airlines, with 61 aircraft and a strong order book of 225 aircraft.

During the first nine months of 2024, flynas carried 10.9 million passengers, operating 1,861 flights per week, with a seat occupancy rate of 85.2%.