Please use a PC Browser to access Register-Tadawul

10x Genomics (TXG) Is Up 6.3% After AI Spatial Biology Collaboration With A*STAR Genome Institute - Has The Bull Case Changed?

10x Genomics TXG | 15.46 | -6.53% |

- Earlier this month, 10x Genomics and the A*STAR Genome Institute of Singapore announced a research collaboration using the Xenium platform and artificial intelligence to accelerate drug target discovery and precision medicine for cancer and inflammatory diseases through the TISHUMAP project.

- This partnership allows for unprecedented mapping of gene activity within intact tissues, enabling researchers to uncover new biomarkers and advance personalized treatment approaches.

- We'll now explore how this collaboration, highlighted by its AI-powered spatial biology capabilities, may influence 10x Genomics' investment narrative.

10x Genomics Investment Narrative Recap

To be a shareholder in 10x Genomics, you need to believe in the long-term potential of cutting-edge spatial biology platforms and the value of collaborative research with leading institutions. The recent A*STAR partnership advances technology leadership, but the most important short-term catalyst remains broader adoption and increased sales of spatial platforms, while a key risk is the impact of reduced instrument sales and academic funding uncertainty. The direct investment impact of the A*STAR news is unlikely to materially shift these near-term dynamics.

The recent launch of new Chromium and Visium products earlier in 2025 aligns closely with this AI-driven collaboration, as both seek to boost high-performance single-cell and spatial biology adoption. This context may further support volume growth, though pricing pressures and competitive dynamics still present challenges for near-term revenue and margin expansion.

However, while product innovation captures headlines, the strain from declining spatial instrument sales and ongoing funding risks quietly continues to be an issue investors should be aware of...

10x Genomics' outlook anticipates $717.3 million in revenue and $92.5 million in earnings by 2028. This is based on analysts expecting a 5.5% annual revenue growth rate and an improvement in earnings of $275.1 million from the current loss of $-182.6 million.

Exploring Other Perspectives

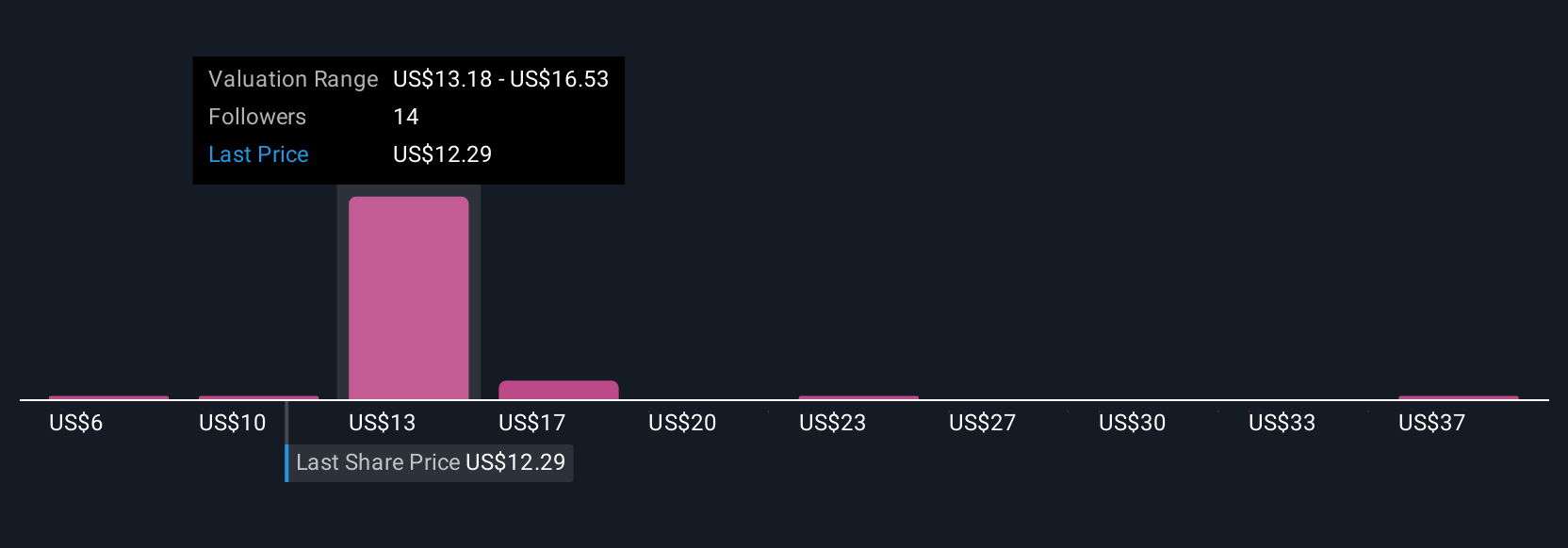

Six fair value estimates from the Simply Wall St Community range from US$6.47 to US$40 per share, with a wide spread across the spectrum. These contrasting views come amid ongoing pressure from lagging spatial instrument sales and highlight why it pays to consider multiple perspectives on 10x Genomics’ outlook.

Build Your Own 10x Genomics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your 10x Genomics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free 10x Genomics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate 10x Genomics' overall financial health at a glance.

No Opportunity In 10x Genomics?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.