Please use a PC Browser to access Register-Tadawul

2024 Trading Insight | Big Banks Forecast 14% Upside in S&P 500, Signaling Market Optimism

Goldman Sachs Group, Inc. GS | 877.82 | -1.32% |

Deutsche Bank AG DB | 37.38 | -0.56% |

Bank of America Corporation BAC | 54.88 | -0.80% |

Royal Bank of Canada RY | 166.52 | -0.34% |

Bank of Montreal BMO | 130.35 | -1.30% |

Growing expectations of rate cuts are boosting optimism in the US stock market, with the three major US stock indices recording seven consecutive weeks of gains, and the S&P 500 nearing its all-time high.

Top investment banks have released their projections for the S&P 500, making bullish or bearish calls.

The question on many investors' minds is: Will this upward trend continue?

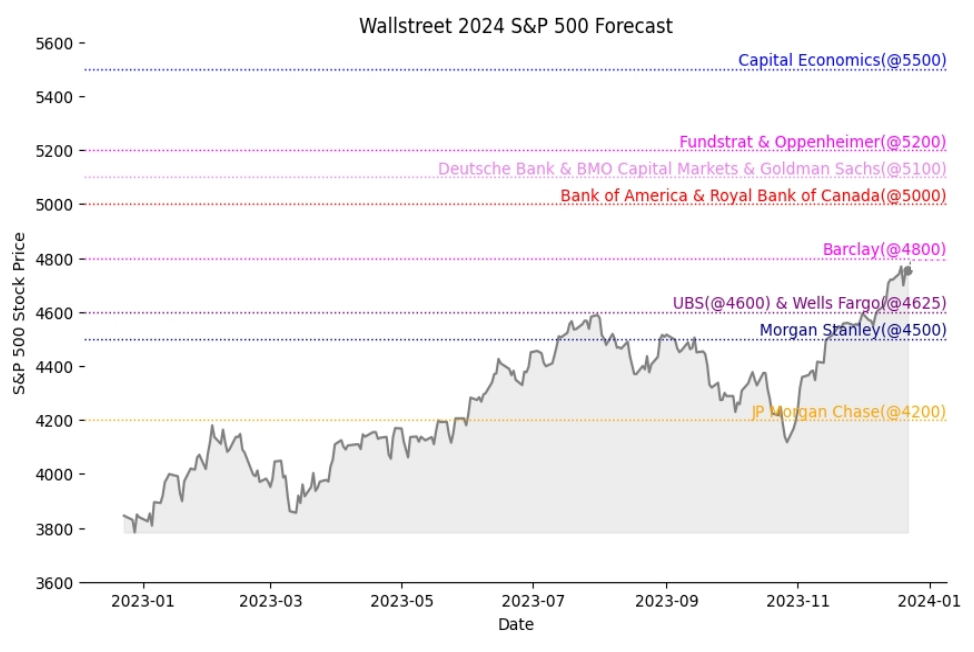

With eyes on the upcoming year, thirteen top-tier banks, identified in a graph, set their S&P 500 year-end 2024 targets, ranging from a bullish peak of 5500 points, suggesting a 13.9% potential rise, to a bearish floor of 4200 points, indicating a potential 10.6% decline.

The average target stands optimistically at 4827.5 points, hinting at stability or growth, with giants like Goldman Sachs Group, Inc.(GS.US) , Deutsche Bank AG(DB.US) , Bank of America Corporation(BAC.US), Royal Bank of Canada(RY.US) and Bank of Montreal(BMO.US)'s subsidiary BMO Capital among those predicting an upbeat 2024 for US equities.

Wall Street Giants Holding Bullish S&P 500 Targets for 2024

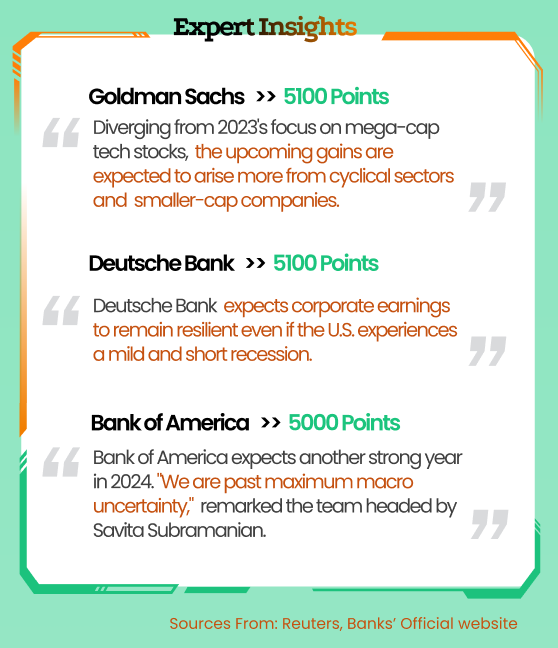

Goldman Sachs Group, Inc.(GS.US) projects a bright future for U.S. equities, predicting the S&P 500 to reach 5100 points. This optimism is supported by expectations of ebbing inflation and lower interest rates, with a shift in market drivers from the mega-cap tech companies of 2023 to a diverse mix of cyclical sectors and small-cap firms.

Similarly, Deutsche Bank AG(DB.US) analysts expect the index to end 2024 at 5,100 points. The bank expects corporate earnings to remain resilient even if the United States experiences a mild and short recession.

Bank of America Corporation(BAC.US) joins the bullish chorus with an anticipated surge to 5000 points. The team, led by Savita Subramanian, believes the U.S. has "past maximum macro uncertainty", setting the stage for another strong year in 2024.

Wall Street Giants Holding Bearish S&P 500 Targets for 2024

Some of Wall Street's leading banks express bearish views for the 2024 equity market.

Wells Fargo Securities foresees a potentially volatile path for the S&P 500, with a year-end target of 4,625. Chris Harvey, the head of equity strategy at the firm, recommends exploring oversold sectors, highlighting utilities and healthcare for their strong valuations and fundamentals, and relatively low investor participation so far.

Morgan Stanley(MS.US) expects 2024 to be a “tale of two halves,” with a cautious first half giving way to stronger performance in the second half of the year while monitoring persistent global growth risks and early-year earnings challenges.

JPMorgan Chase & Co.(JPM.US) forecasts a challenging macro backdrop for equities, setting a conservative target of 4200 points, reflecting concerns over subdued earnings and geopolitical uncertainties.

Strategic ETF Choices for Bullish and Bearish Market Trends

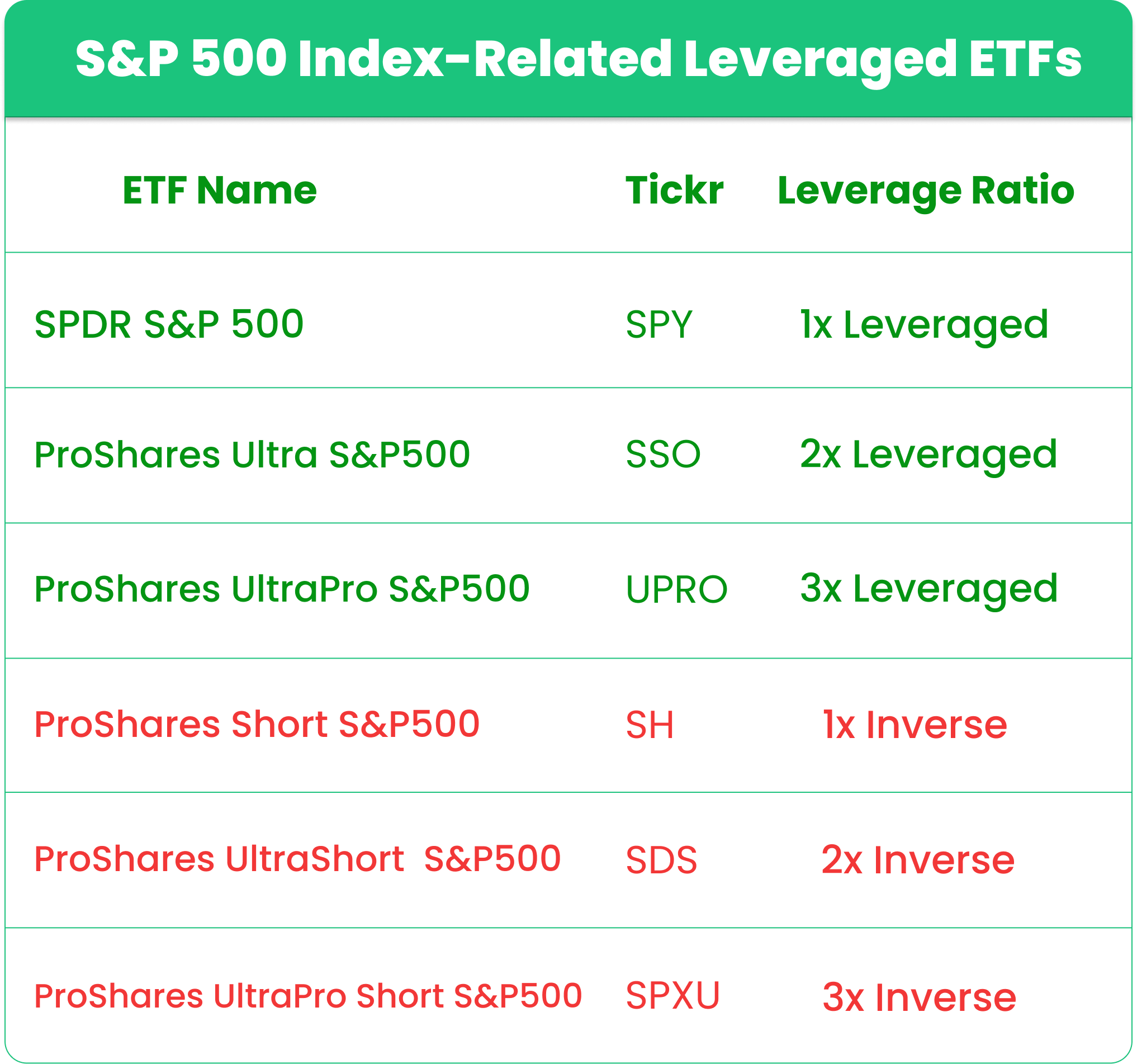

In anticipation of next year's market trends, investors have a range of S&P 500 Index-Related Leveraged ETFs to capitalize on movements. Options include SPDR S&P 500 (ETF-S&P 500(SPY.US)) for a 1x leverage, ProShares Ultra S&P500 (Proshares Ultra S&P500(SSO.US)) at 2x, and UltraPro (Ultrapro S&P 500 Proshares(UPRO.US)) for a 3x bullish position. For bearish strategies, there's ProShares Short S&P500 (Short S&P 500 Proshares(SH.US)) at 1x inverse, UltraShort (Ultrashort S&P 500 Proshares(SDS.US)) at 2x, and UltraPro Short (Proshares Trust Ultrapro Short S&P500(SPXU.US)) offering 3x inverse leverage.

[This newsletter is written and edited by Candice from Sahm News Team]