Please use a PC Browser to access Register-Tadawul

3 Dividend Stocks To Consider With Yields Up To 6%

Chord Energy Corporation - Common Stock CHRD | 97.36 | -1.58% |

The United States market remained flat over the last week but has seen an 11% increase over the past year, with earnings expected to grow by 15% annually. In this environment, dividend stocks can offer a reliable income stream and potential for capital appreciation, making them an attractive option for investors seeking stability and growth.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Valley National Bancorp (VLY) | 4.63% | ★★★★★☆ |

| Universal (UVV) | 5.62% | ★★★★★★ |

| Huntington Bancshares (HBAN) | 3.57% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.06% | ★★★★★★ |

| Ennis (EBF) | 5.49% | ★★★★★★ |

| Dillard's (DDS) | 6.01% | ★★★★★★ |

| Credicorp (BAP) | 4.94% | ★★★★★☆ |

| Columbia Banking System (COLB) | 5.82% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.63% | ★★★★★☆ |

| Carter's (CRI) | 9.74% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

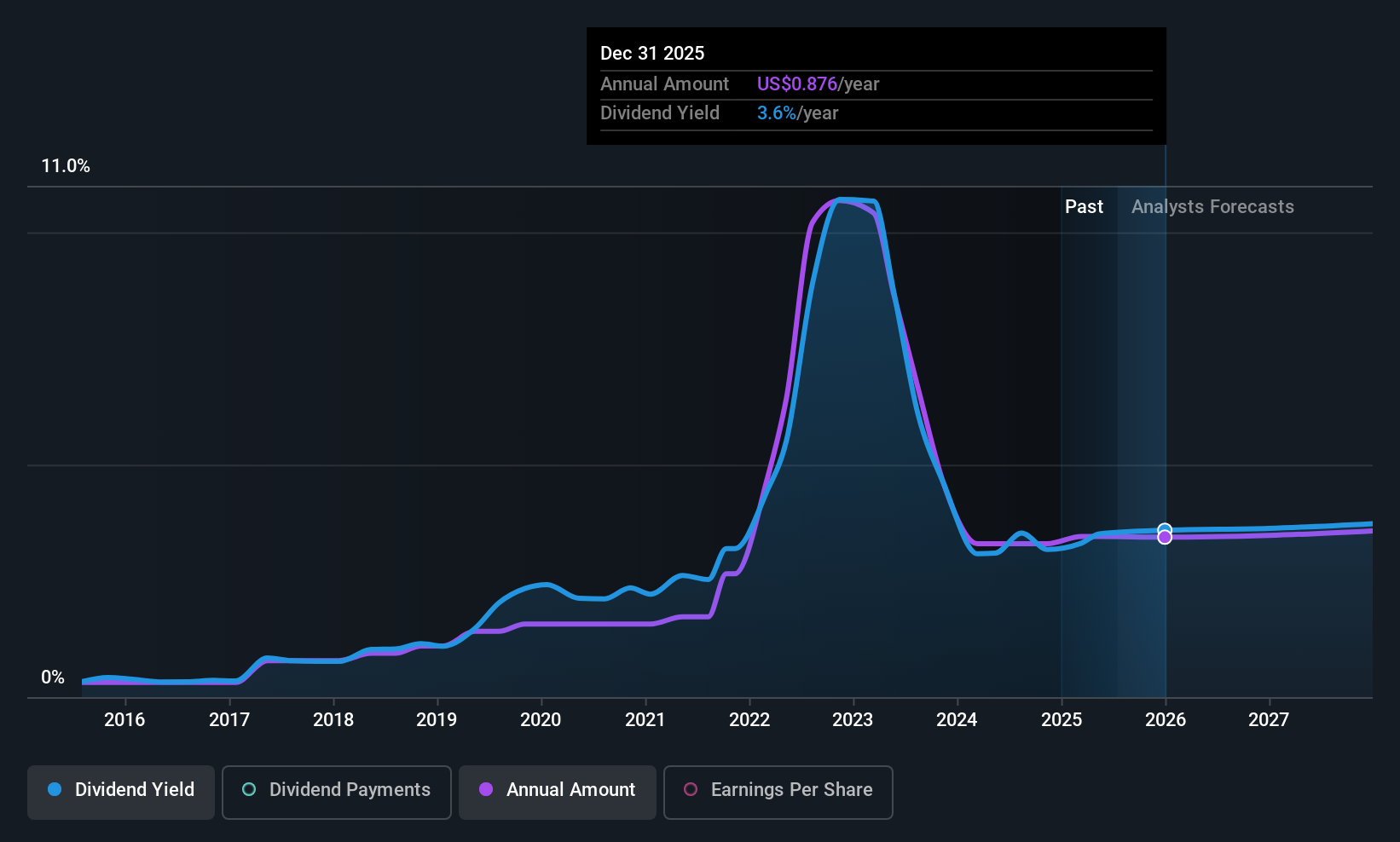

Isabella Bank (ISBA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Isabella Bank Corporation, with a market cap of $226.49 million, operates as the bank holding company for Isabella Bank, offering banking and wealth management services to businesses, institutions, and individuals in Michigan, United States.

Operations: Isabella Bank Corporation generates revenue primarily through its retail banking operations, amounting to $70.31 million.

Dividend Yield: 3.7%

Isabella Bank offers a stable dividend yield of 3.65%, supported by a reasonable payout ratio of 56.7%. The bank's dividends have been reliable and growing over the past decade, though they remain below the top tier in the US market. Recent developments include its addition to major indices like NASDAQ Composite, enhancing visibility. Despite executive changes, financial performance remains strong with increased earnings and an expanded buyback plan, reflecting confidence in future prospects.

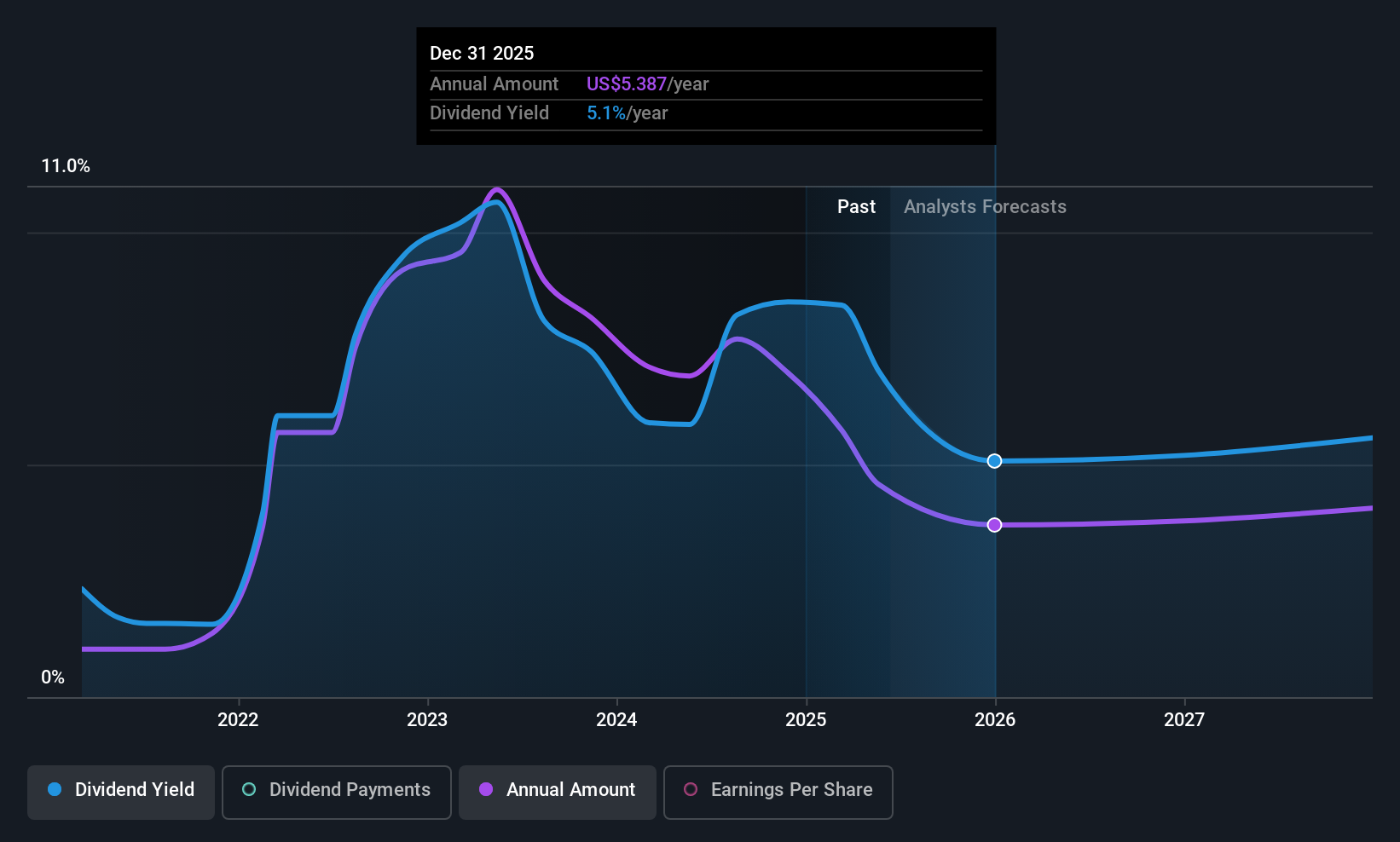

Chord Energy (CHRD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chord Energy Corporation is an independent exploration and production company operating in the United States with a market capitalization of approximately $6.31 billion.

Operations: Chord Energy Corporation generates its revenue primarily from the exploration and production of crude oil, natural gas liquids (NGLs), and natural gas, amounting to $5.04 billion.

Dividend Yield: 6.1%

Chord Energy's dividend yield of 6.1% ranks it among the top 25% of US payers, supported by a low payout ratio of 42.7%, indicating strong coverage by earnings and cash flows. However, its dividend history is unstable and volatile over the past four years. Recent events include being dropped from major indices and completing a buyback worth $218.02 million, which may affect future shareholder value despite declining earnings forecasts.

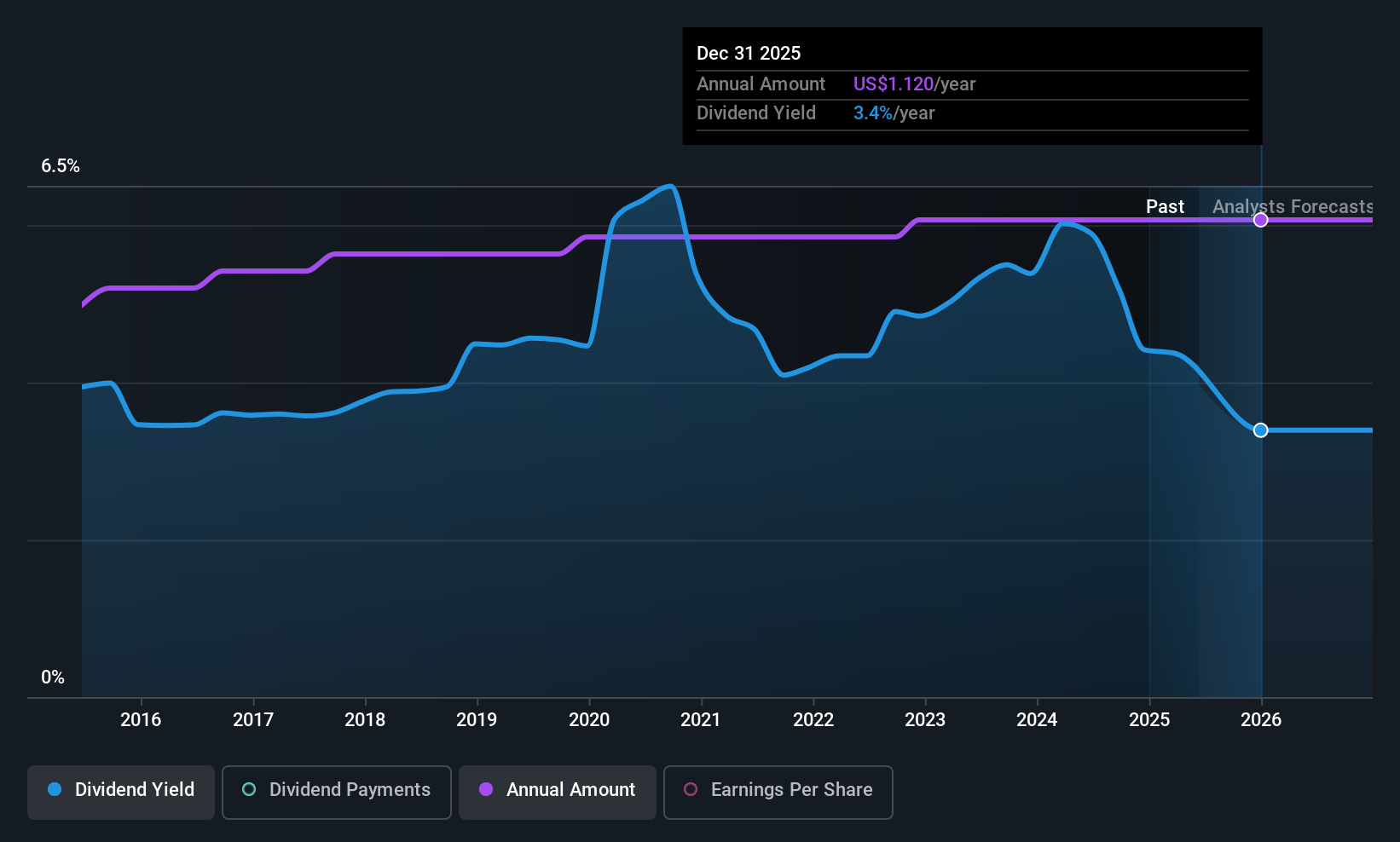

Coterra Energy (CTRA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Coterra Energy Inc. is an independent oil and gas company involved in the exploration, development, and production of oil, natural gas, and natural gas liquids in the United States with a market cap of approximately $19.30 billion.

Operations: Coterra Energy Inc. generates revenue primarily through its natural gas and oil development, exploitation, exploration, and production activities, amounting to $5.80 billion.

Dividend Yield: 3.5%

Coterra Energy's dividend yield of 3.48% is below the top 25% of US dividend payers, but its payout ratio of 49.2% suggests dividends are well-covered by earnings and cash flows. Despite a history of volatility in payments over the past decade, recent financial performance shows strength with Q1 revenue at $1.90 billion and net income at $516 million. The company has also completed significant share buybacks totaling $888.28 million since February 2023.

Key Takeaways

- Access the full spectrum of 138 Top US Dividend Stocks by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.