Please use a PC Browser to access Register-Tadawul

3 Middle Eastern Dividend Stocks Yielding Up To 7.0%

SAIB 1030.SA | 13.02 | -1.36% |

As most Gulf markets experience gains amid easing tensions between the U.S. and China, investors are increasingly turning their attention to dividend stocks in the Middle East for stable income opportunities. In such a dynamic environment, selecting stocks with strong dividend yields can be a prudent strategy to capitalize on market movements while ensuring steady returns.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Emaar Properties PJSC (DFM:EMAAR) | 7.81% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 7.58% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 6.66% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.77% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.60% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 5.71% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 5.60% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 4.90% | ★★★★★☆ |

| Saudi Telecom (SASE:7010) | 8.88% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 6.60% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

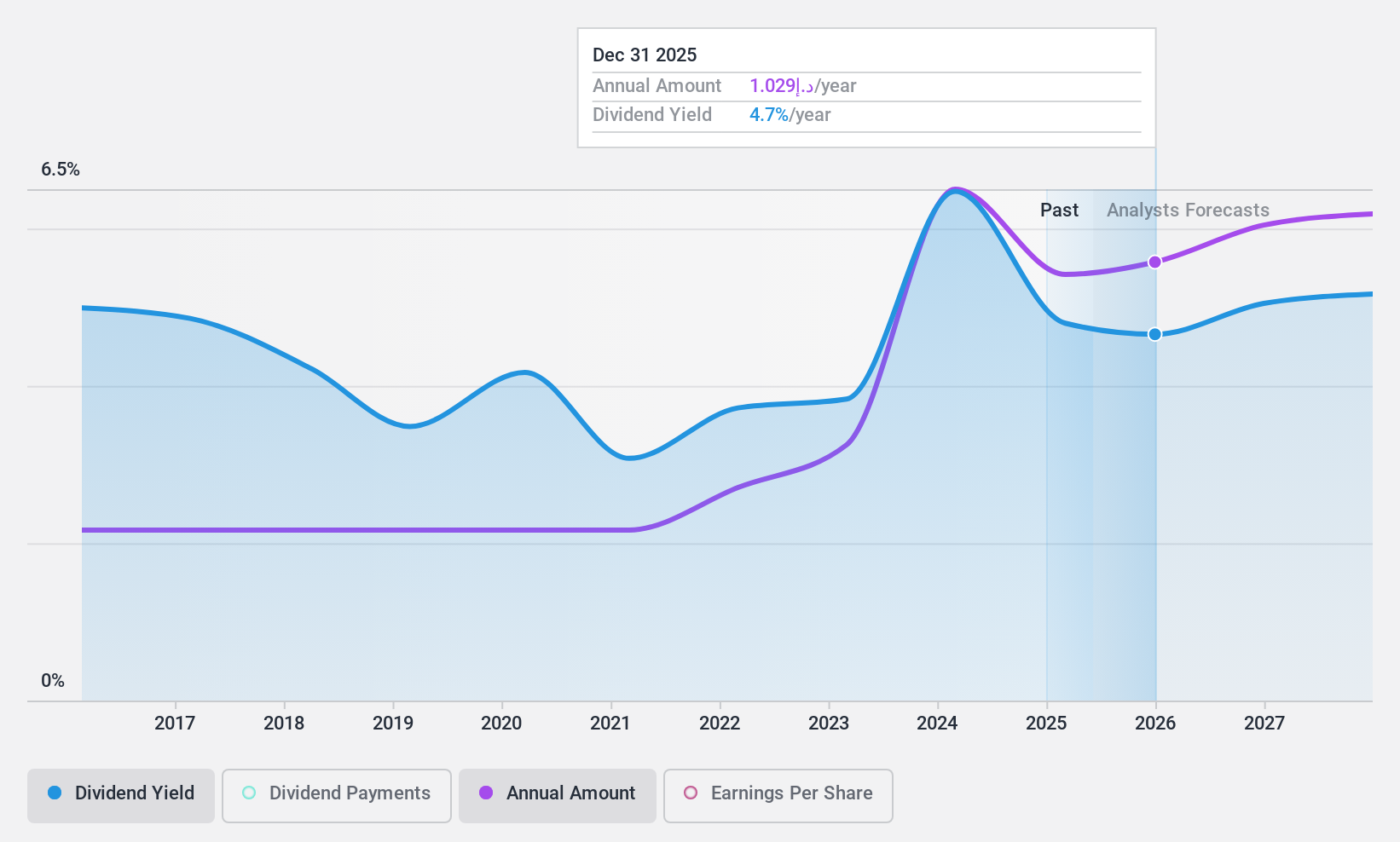

Emirates NBD Bank PJSC (DFM:EMIRATESNBD)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Emirates NBD Bank PJSC, along with its subsidiaries, offers a range of services including corporate, institutional, retail, treasury, and Islamic banking, with a market capitalization of AED128.86 billion.

Operations: Emirates NBD Bank PJSC generates revenue through its diverse operations in corporate, institutional, retail, treasury, and Islamic banking services.

Dividend Yield: 4.9%

Emirates NBD Bank PJSC offers a stable dividend yield of 4.9%, with dividends well-covered by earnings, maintaining a low payout ratio of 28.1%. Despite trading at a good value relative to peers, the bank faces challenges with high non-performing loans at 3.3%. Recent earnings showed an increase in net interest income to AED 8.46 billion but a slight decrease in net income, highlighting ongoing profitability amidst market conditions.

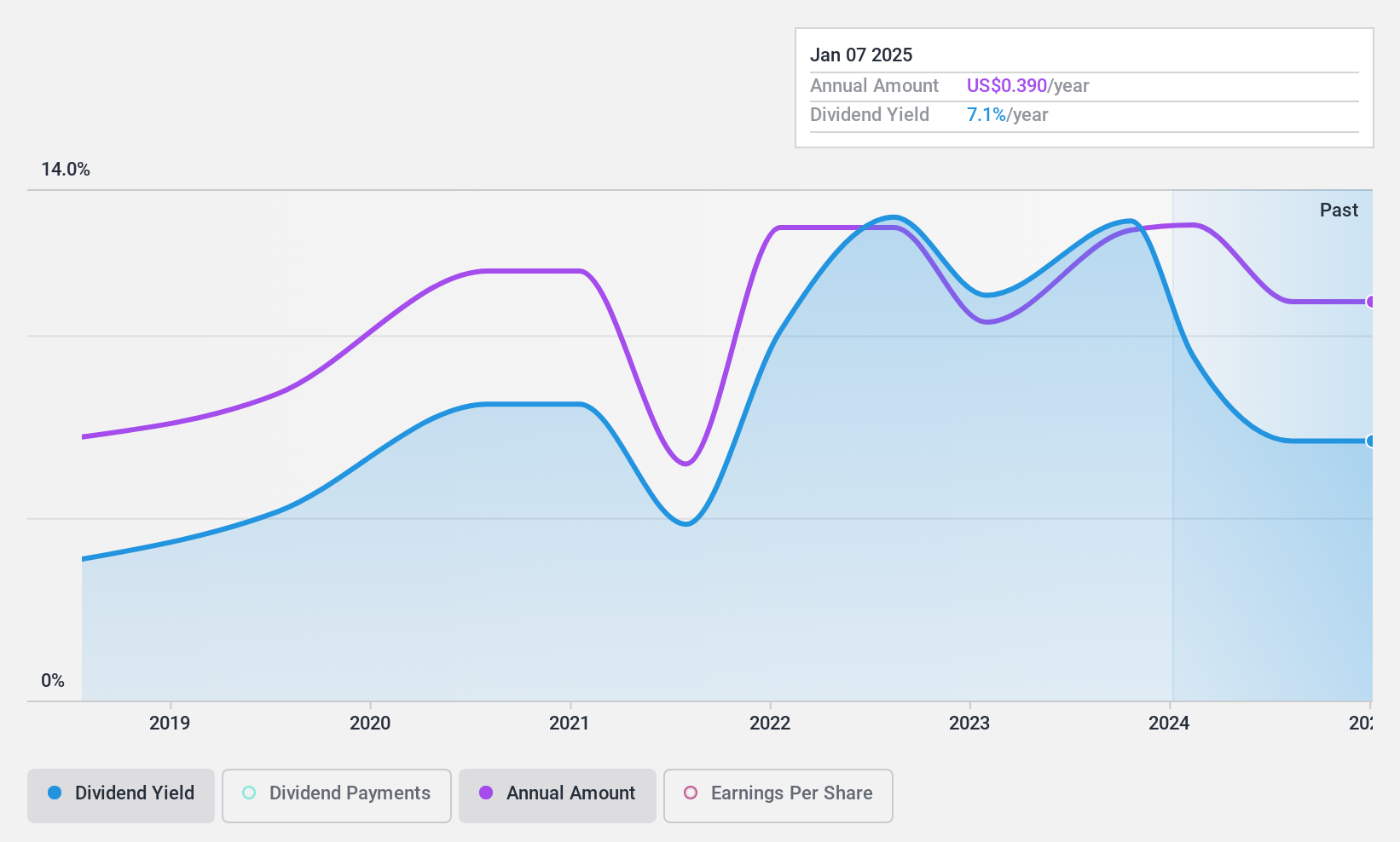

Orascom Construction (DIFX:OC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Orascom Construction PLC is an engineering and construction contractor involved in infrastructure, industrial, and high-end commercial projects across the United States, the Middle East, Africa, and Central Asia with a market cap of $606.34 million.

Operations: Orascom Construction PLC generates its revenue primarily from the Middle East and Africa segment, contributing $1.61 billion, and the United States segment, contributing $1.64 billion.

Dividend Yield: 7.1%

Orascom Construction's dividend yield of 7.09% ranks it among the top payers in the AE market, supported by a low payout ratio of 35.4% and cash payout ratio of 7.5%, indicating strong coverage by earnings and cash flows. However, its seven-year history shows volatile dividends with periods of decline over 20%. Recent financials reveal a drop in both quarterly and annual net income, reflecting potential challenges despite revenue growth forecasts.

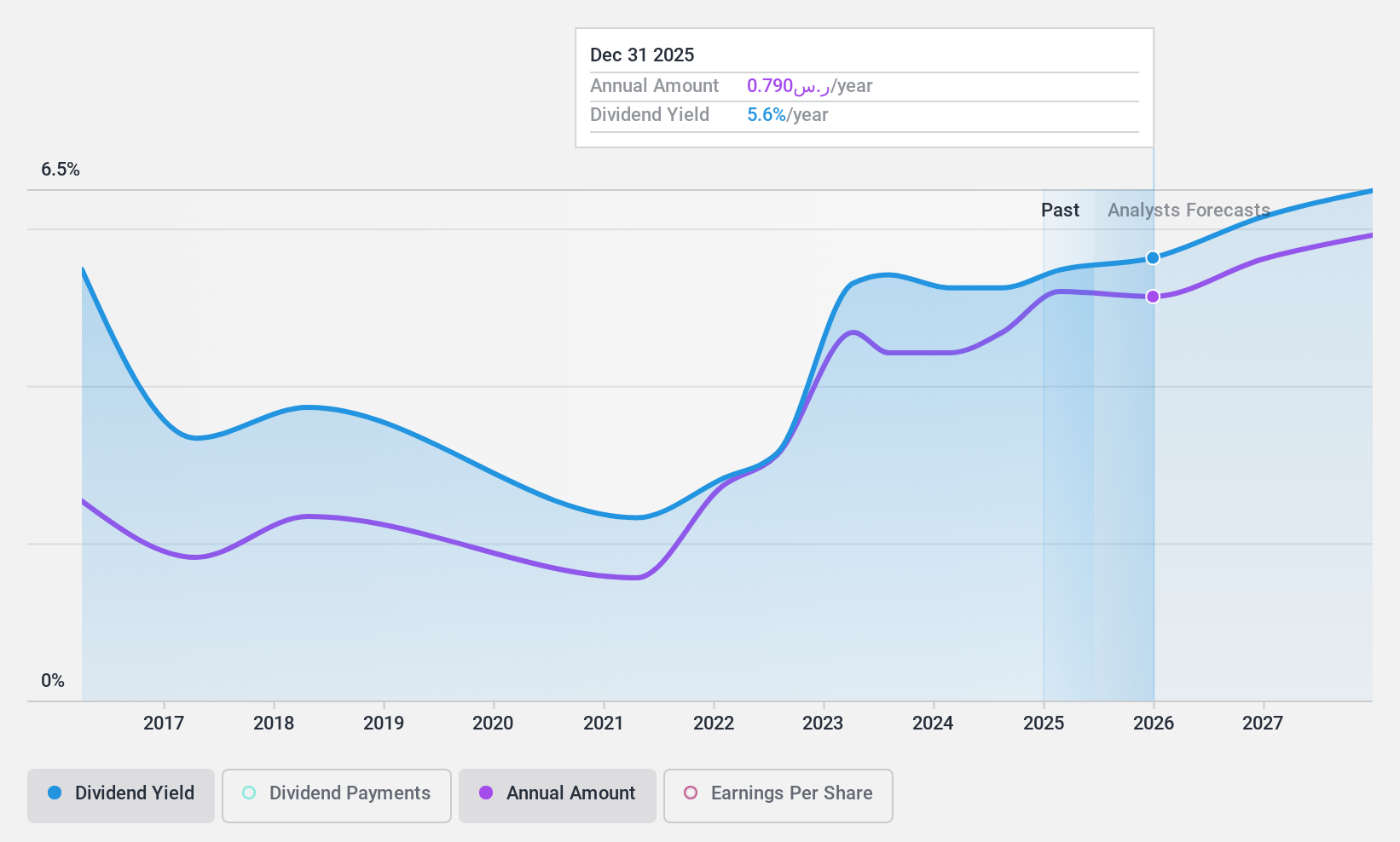

Saudi Investment Bank (SASE:1030)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The Saudi Investment Bank offers commercial and retail banking services to individuals, small to medium-sized businesses, and corporate and institutional clients in Saudi Arabia, with a market cap of SAR18.90 billion.

Operations: The Saudi Investment Bank's revenue segments include Retail Banking (SAR1.55 billion), Corporate Banking (SAR1.32 billion), Asset Management and Brokerage (SAR234.50 million), and Treasury and Investments, including Business Partners (SAR1.09 billion).

Dividend Yield: 5.3%

Saudi Investment Bank's dividend yield of 5.28% places it in the top 25% of payers in the SA market, backed by a reasonable payout ratio of 53%. While dividends have grown over the past decade, their volatility suggests an unstable track record. Recent financials show net income increased to SAR 1.96 billion from SAR 1.76 billion year-over-year, indicating robust earnings growth that supports future dividend coverage despite past payment inconsistencies.

Taking Advantage

- Click through to start exploring the rest of the 61 Top Middle Eastern Dividend Stocks now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.