Please use a PC Browser to access Register-Tadawul

3 Promising Penny Stocks With Market Caps Over $10M

Alpha Teknova, Inc. TKNO | 4.71 | 0.00% |

As the U.S. stock market navigates a landscape marked by anticipation of Federal Reserve interest rate decisions and major tech earnings, investors are exploring diverse opportunities for growth. Penny stocks, often associated with smaller or emerging companies, continue to capture attention due to their affordability and potential for significant returns. Despite being considered an outdated term, these stocks can still offer valuable prospects when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| ATRenew (RERE) | $3.19 | $732.46M | ✅ 3 ⚠️ 1 View Analysis > |

| Waterdrop (WDH) | $1.77 | $683.54M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.935 | $162.53M | ✅ 4 ⚠️ 1 View Analysis > |

| Puma Biotechnology (PBYI) | $3.18 | $165.79M | ✅ 2 ⚠️ 1 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $98.62M | ✅ 3 ⚠️ 2 View Analysis > |

| Cardno (COLD.F) | $0.1701 | $6.64M | ✅ 2 ⚠️ 4 View Analysis > |

| Data Storage (DTST) | $4.72 | $33.7M | ✅ 1 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.89693 | $6.25M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.62 | $106.02M | ✅ 3 ⚠️ 2 View Analysis > |

| Tandy Leather Factory (TLF) | $3.55 | $30.43M | ✅ 2 ⚠️ 2 View Analysis > |

Let's uncover some gems from our specialized screener.

DURECT (DRRX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: DURECT Corporation is a biopharmaceutical company focused on developing medicines through its epigenetic regulator program, with a market cap of $17.16 million.

Operations: The company's revenue of $1.86 million is derived from its research, development, and manufacturing activities in the pharmaceutical sector.

Market Cap: $17.16M

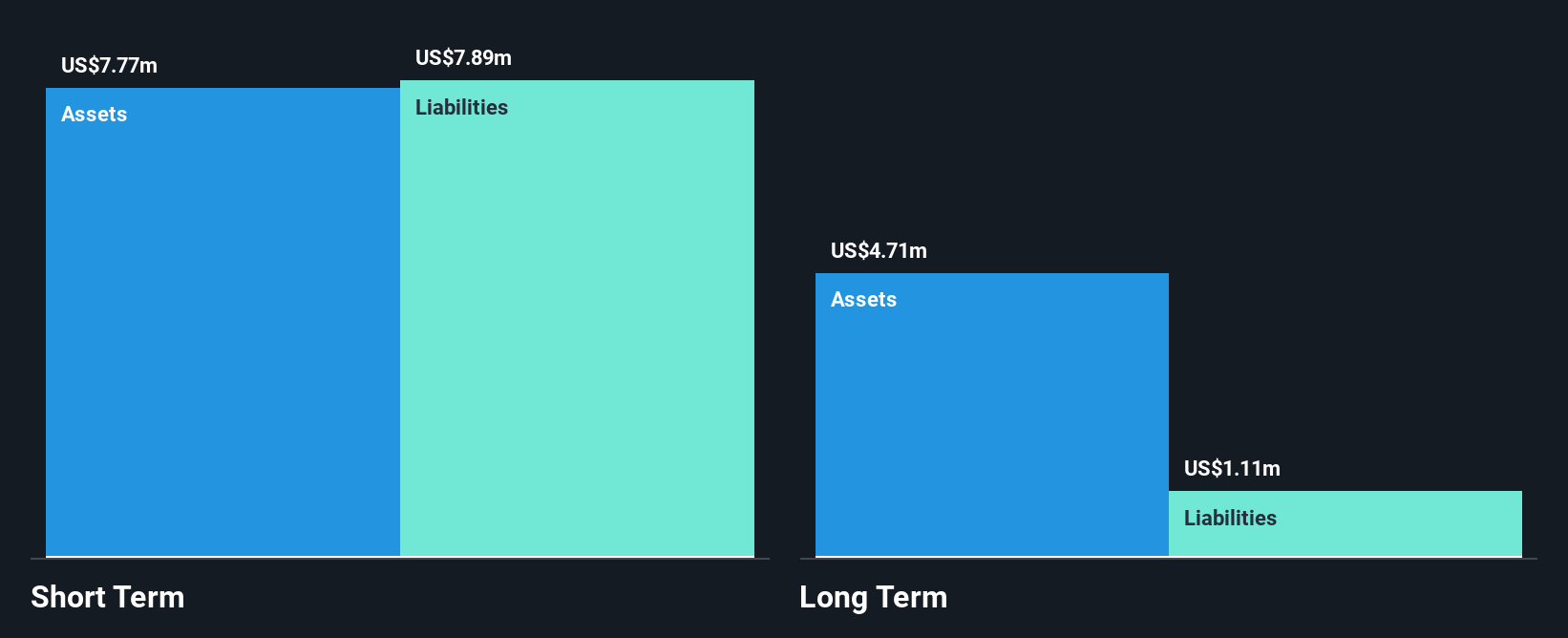

DURECT Corporation, with a market cap of US$17.16 million, is undergoing significant changes as Bausch Health Companies Inc. plans to acquire it for US$55.5 million in an all-cash transaction. Despite its seasoned management and board, the company faces challenges such as high volatility and unprofitability, with less than a year of cash runway if current trends continue. Though debt-free and having short-term assets exceeding liabilities, DURECT struggles with maintaining Nasdaq listing compliance due to its low share price but has secured an additional grace period until January 2026 to address this issue.

Alpha Teknova (TKNO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Alpha Teknova, Inc. specializes in producing essential reagents for the discovery, development, and commercialization of novel therapies, vaccines, and molecular diagnostics globally, with a market cap of approximately $274.69 million.

Operations: The company generates revenue from its Specialty Chemicals segment, totaling $38.25 million.

Market Cap: $274.69M

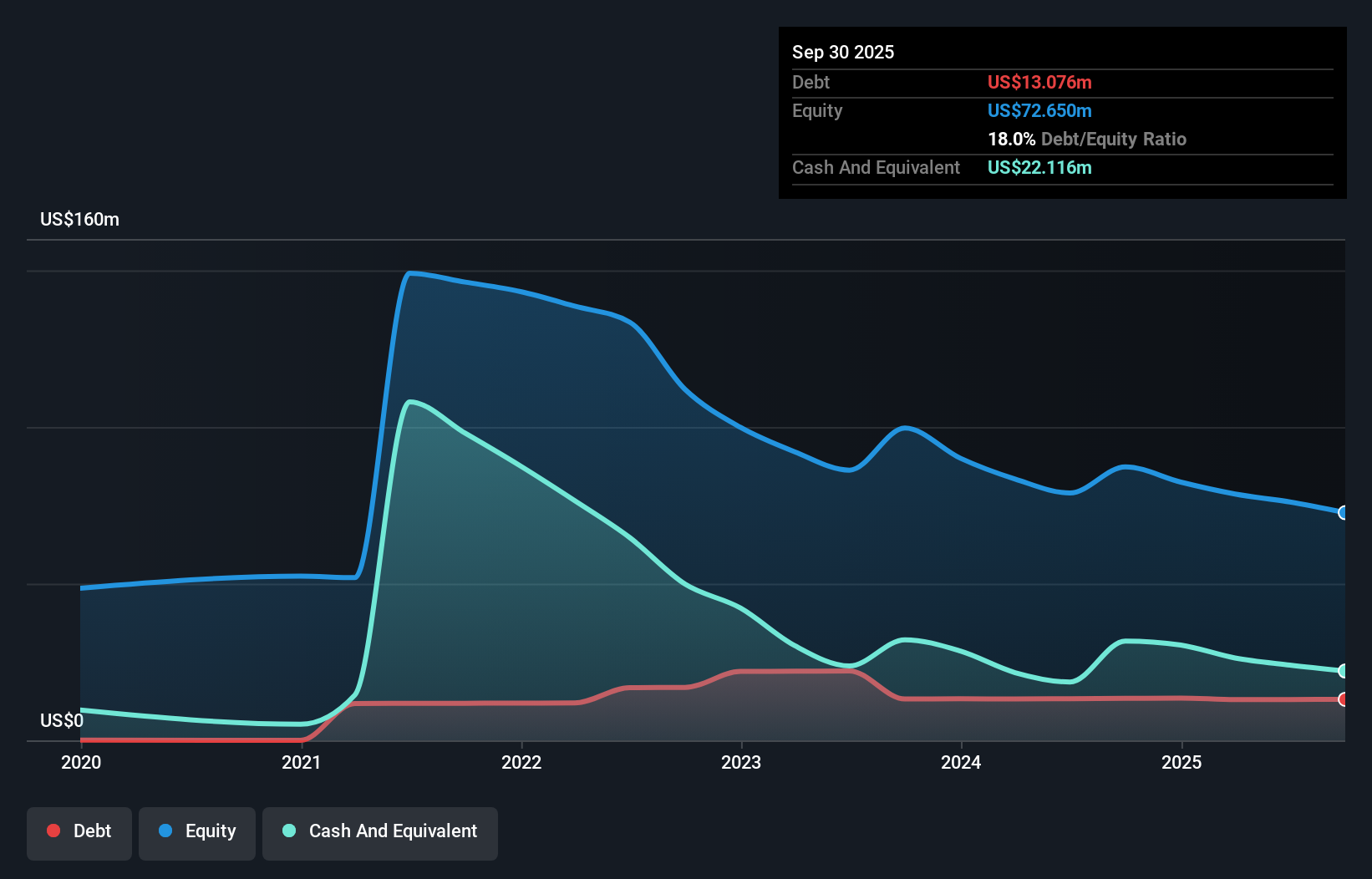

Alpha Teknova, Inc., with a market cap of approximately US$274.69 million, is navigating the penny stock landscape by focusing on revenue growth in its Specialty Chemicals segment, which totaled US$38.25 million. Despite being unprofitable and having increased losses over the past five years, the company has not faced significant shareholder dilution recently and maintains more cash than total debt. The management team is experienced with an average tenure of 4.7 years. Recent developments include filing a US$225 million Shelf Registration and inclusion in multiple Russell indices, potentially increasing visibility among investors while it continues to anticipate annual revenue between US$39-42 million for 2025.

Qudian (QD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Qudian Inc. is a consumer-oriented technology company in China with a market cap of approximately $554.83 million.

Operations: The company's revenue is primarily derived from its Installment Credit Services segment, which generated CN¥186.37 million.

Market Cap: $554.83M

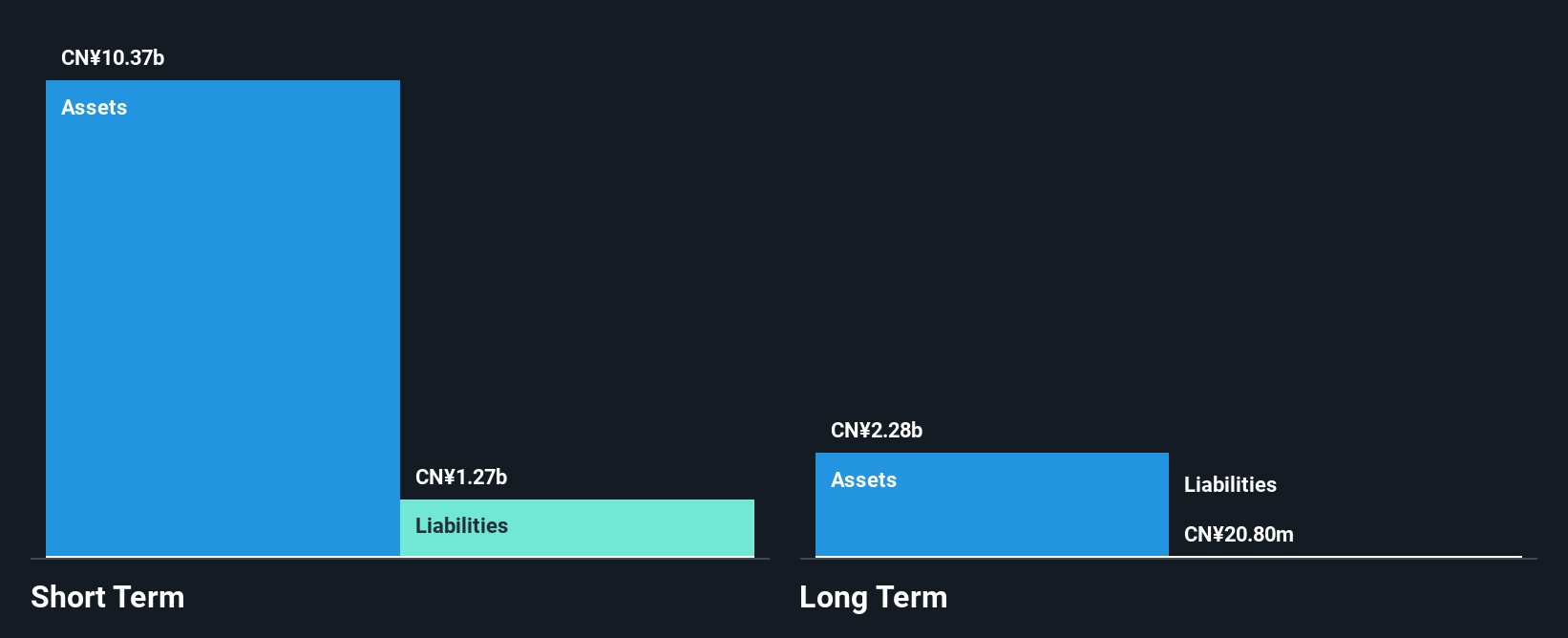

Qudian Inc., with a market cap of approximately US$554.83 million, has recently transitioned to profitability, reporting a net income of CN¥150.11 million for the first quarter of 2025 despite declining revenues from CN¥55.85 million to CN¥25.79 million year-over-year. The company has successfully completed a share buyback program, repurchasing 12.26% of its shares for $52 million, which may indicate management's confidence in its valuation. While Qudian boasts more cash than debt and covers both short- and long-term liabilities effectively with assets totaling CN¥10.4 billion, challenges include negative operating cash flow and low return on equity at 2.8%.

Seize The Opportunity

- Discover the full array of 415 US Penny Stocks right here.

- Ready To Venture Into Other Investment Styles? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.