Please use a PC Browser to access Register-Tadawul

3 Promising Penny Stocks With Over $100M Market Cap

Kandi Technologies Group, Inc. KNDI | 1.03 | -5.91% |

As the U.S. stock market faces a sell-off driven by concerns over tariffs and economic uncertainty, investors are increasingly looking for opportunities that can offer resilience and potential growth. Penny stocks, while often associated with risk due to their smaller size and less-established nature, still hold promise when they are backed by strong financials. In this article, we explore three penny stocks that exhibit solid balance sheets and the potential for long-term value creation amidst current market challenges.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.82055 | $5.93M | ★★★★★★ |

| Sensus Healthcare (NasdaqCM:SRTS) | $4.45 | $71.75M | ★★★★★★ |

| Safe Bulkers (NYSE:SB) | $3.71 | $384.78M | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $135.96M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.36 | $70.37M | ★★★★★★ |

| Tuya (NYSE:TUYA) | $3.92 | $2.26B | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8627 | $78.36M | ★★★★★☆ |

| PHX Minerals (NYSE:PHX) | $3.77 | $136.8M | ★★★★★☆ |

| TETRA Technologies (NYSE:TTI) | $3.27 | $434.25M | ★★★★☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

Gossamer Bio (NasdaqGS:GOSS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Gossamer Bio, Inc. is a clinical-stage biopharmaceutical company dedicated to developing and commercializing seralutinib for treating pulmonary arterial hypertension in the United States, with a market cap of $260.59 million.

Operations: Gossamer Bio, Inc. has not reported any revenue segments as it is focused on the clinical development of seralutinib for pulmonary arterial hypertension in the United States.

Market Cap: $260.59M

Gossamer Bio, Inc. is a pre-revenue biopharmaceutical firm with a market cap of US$260.59 million, focusing on developing seralutinib for pulmonary arterial hypertension. Despite being unprofitable, it has reduced losses by 7.7% annually over five years and maintains a strong cash position exceeding its total debt and liabilities, providing a cash runway of over three years. The management team is experienced with an average tenure of 3.2 years, and the stock trades at what appears to be good value compared to peers despite high volatility and significant debt increases over five years.

Kandi Technologies Group (NasdaqGS:KNDI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kandi Technologies Group, Inc. designs, develops, manufactures, and commercializes electric vehicle products and parts in China and the United States with a market cap of approximately $135.13 million.

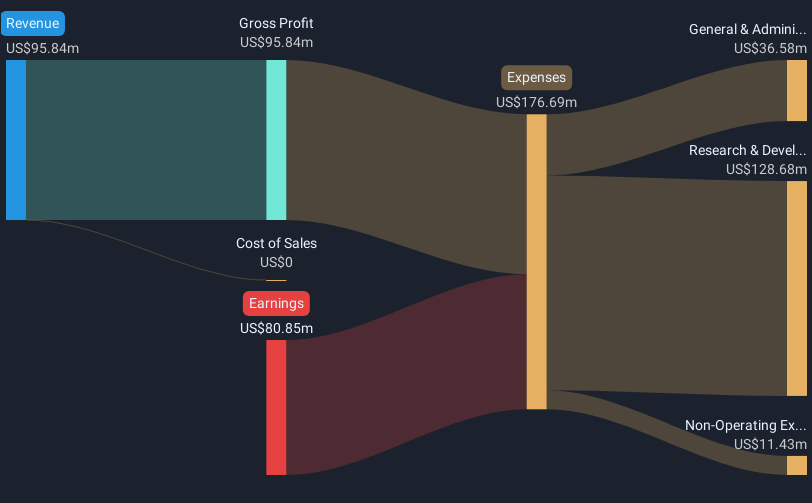

Operations: The company generates revenue of $118.13 million from its auto manufacturing segment.

Market Cap: $135.13M

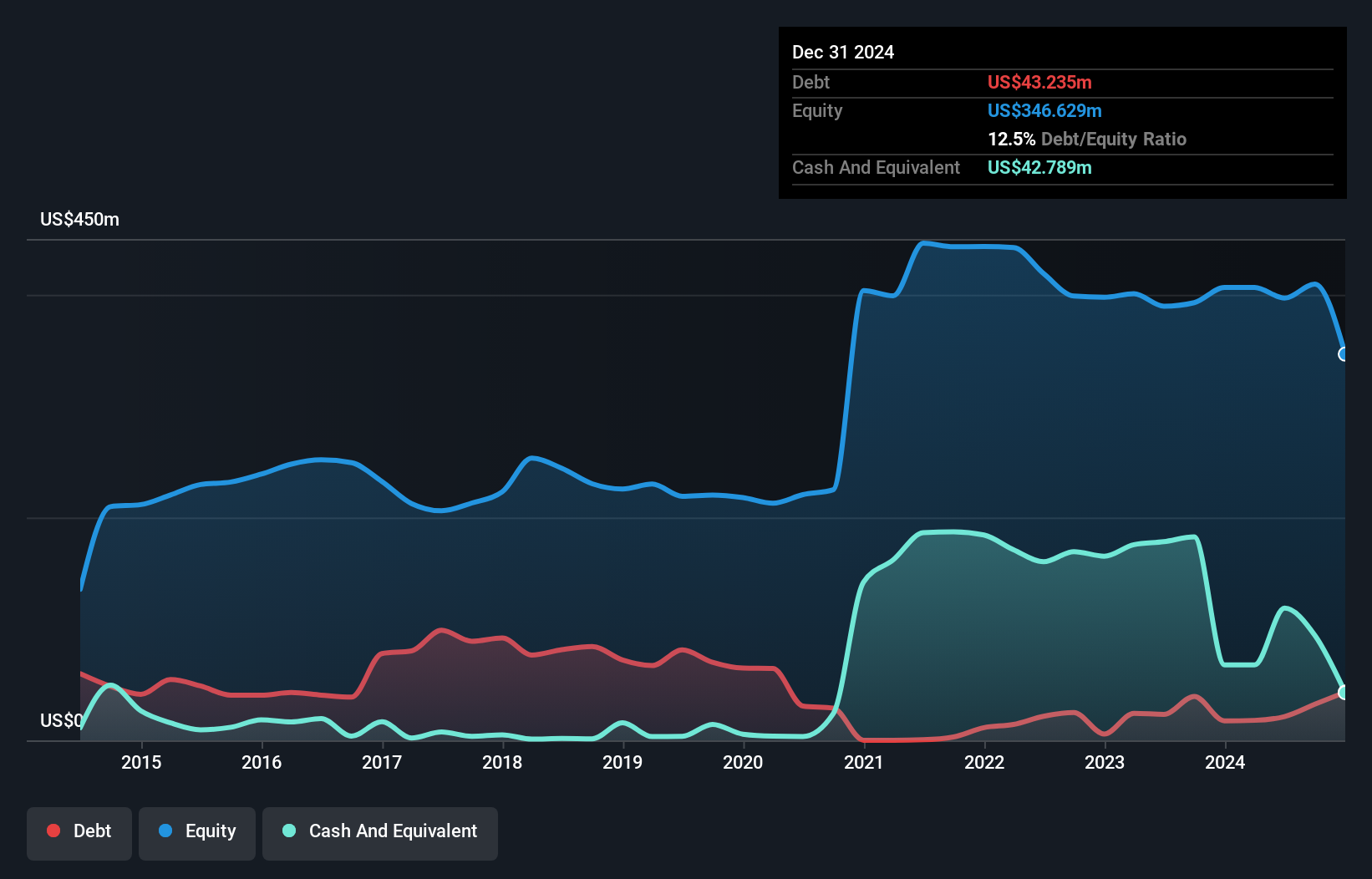

Kandi Technologies Group, with a market cap of US$135.13 million, operates in the electric vehicle sector and generates US$118.13 million in revenue from its auto manufacturing segment. Although currently unprofitable, Kandi's financial health is supported by short-term assets of $396.7M exceeding both short-term ($121.8M) and long-term liabilities ($10.9M). The company has reduced its debt to equity ratio significantly over five years from 31.8% to 7.9%, and it holds more cash than total debt, indicating prudent financial management despite high share price volatility recently observed over three months.

Acelyrin (NasdaqGS:SLRN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Acelyrin, Inc. is a clinical biopharma company dedicated to identifying, acquiring, and accelerating the development and commercialization of transformative medicines, with a market cap of approximately $262.33 million.

Operations: Acelyrin, Inc. currently does not report any revenue segments.

Market Cap: $262.33M

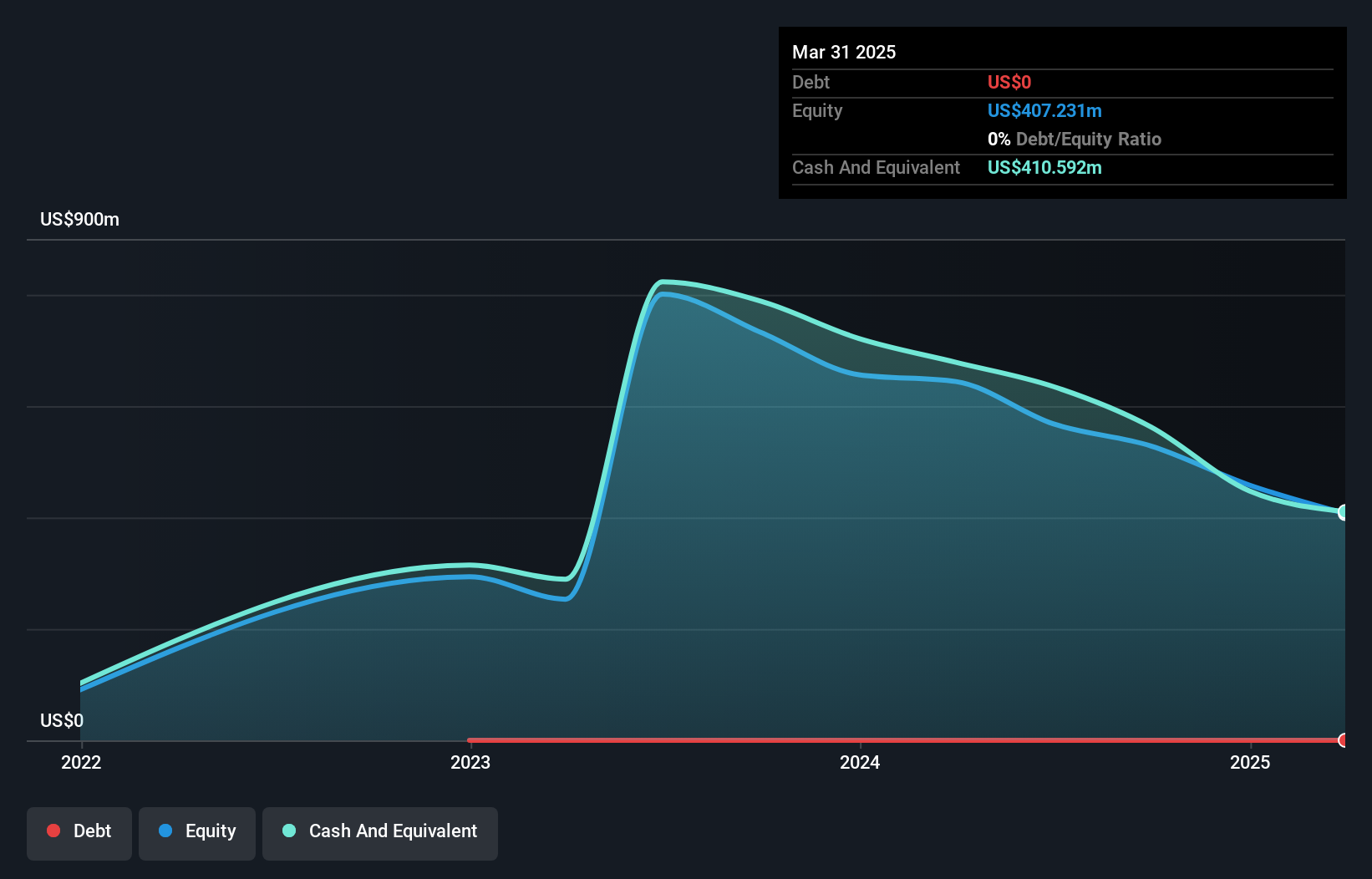

Acelyrin, Inc., a clinical biopharma company with a market cap of US$262.33 million, is pre-revenue and currently unprofitable. The firm has no debt and possesses short-term assets of $596.6M, which comfortably exceed its liabilities. Despite high share price volatility, Acelyrin's cash runway is sufficient for over three years if cash flow reductions persist at historical rates. Recent developments include two acquisition offers: one from Concentra Biosciences for approximately $310 million and another from Alumis Inc. valued at about $320 million, both subject to shareholder approval and regulatory conditions expected to conclude in 2025's second quarter.

Turning Ideas Into Actions

- Click here to access our complete index of 760 US Penny Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.