Please use a PC Browser to access Register-Tadawul

3 Promising Penny Stocks With Under $2B Market Cap

TETRA Technologies, Inc. TTI | 8.88 | +0.91% |

As the U.S. market experiences fluctuations with major indices like the S&P 500 and Nasdaq sliding amidst a tech stock slump, investors are searching for opportunities that may not be as affected by these broader trends. Penny stocks, though often considered relics of past market eras, can still offer intriguing investment potential when backed by solid financials and growth prospects. In this article, we explore several penny stocks that exhibit financial strength and could present promising opportunities for investors interested in smaller or newer companies.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.78 | $650.99M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.21 | $233.46M | ✅ 4 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $1.87 | $23.12M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $92.82M | ✅ 3 ⚠️ 2 View Analysis > |

| Table Trac (TBTC) | $4.87 | $22.46M | ✅ 2 ⚠️ 2 View Analysis > |

| Riverview Bancorp (RVSB) | $4.94 | $106M | ✅ 2 ⚠️ 1 View Analysis > |

| BAB (BABB) | $0.9475 | $6.65M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.83 | $87.46M | ✅ 3 ⚠️ 3 View Analysis > |

| Resources Connection (RGP) | $4.75 | $154.36M | ✅ 3 ⚠️ 1 View Analysis > |

| TETRA Technologies (TTI) | $4.18 | $522.46M | ✅ 3 ⚠️ 2 View Analysis > |

Underneath we present a selection of stocks filtered out by our screen.

Smart Share Global (EM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Smart Share Global Limited is a consumer tech company offering mobile device charging services through an online and offline network in China, with a market cap of $297.98 million.

Operations: The company generates revenue from two main segments: Mobile Device Charging, which accounts for CN¥1.41 billion, and Pv Business, contributing CN¥479.85 million.

Market Cap: $297.98M

Smart Share Global's market cap stands at US$297.98 million, with significant revenue streams from its Mobile Device Charging (CN¥1.41 billion) and Pv Business (CN¥479.85 million). Despite being unprofitable, the company has reduced losses by 57.7% annually over five years and maintains a robust cash runway of more than three years based on current free cash flow trends. The firm is debt-free, with short-term assets covering both short-term and long-term liabilities comfortably. Its board and management teams are experienced, but it still faces challenges in achieving profitability within the competitive consumer tech sector in China.

Alight (ALIT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Alight, Inc. is a technology-enabled services company operating globally with a market cap of approximately $1.94 billion.

Operations: The company generates revenue primarily from its Employer Solutions segment, which accounts for $2.31 billion.

Market Cap: $1.94B

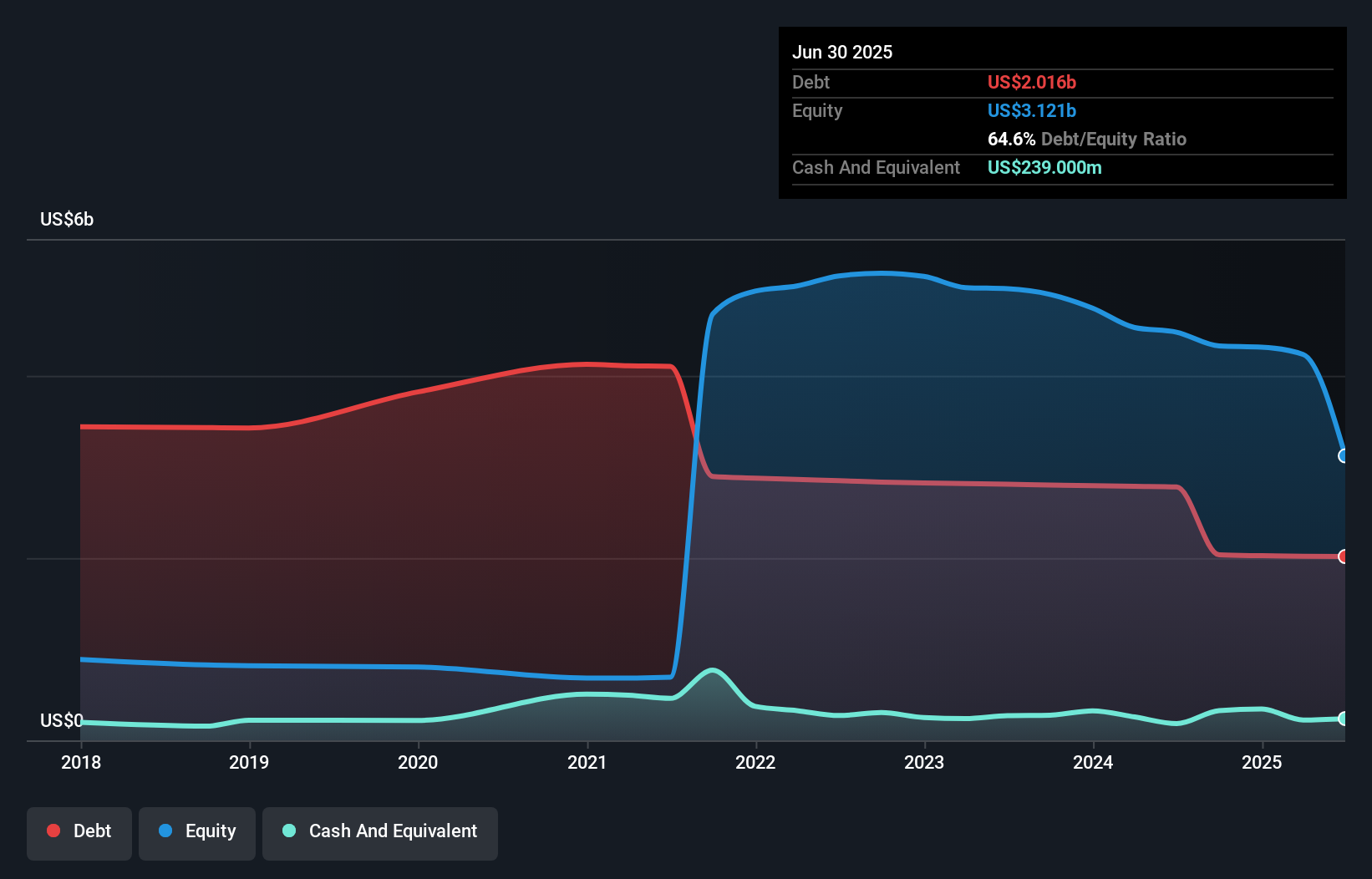

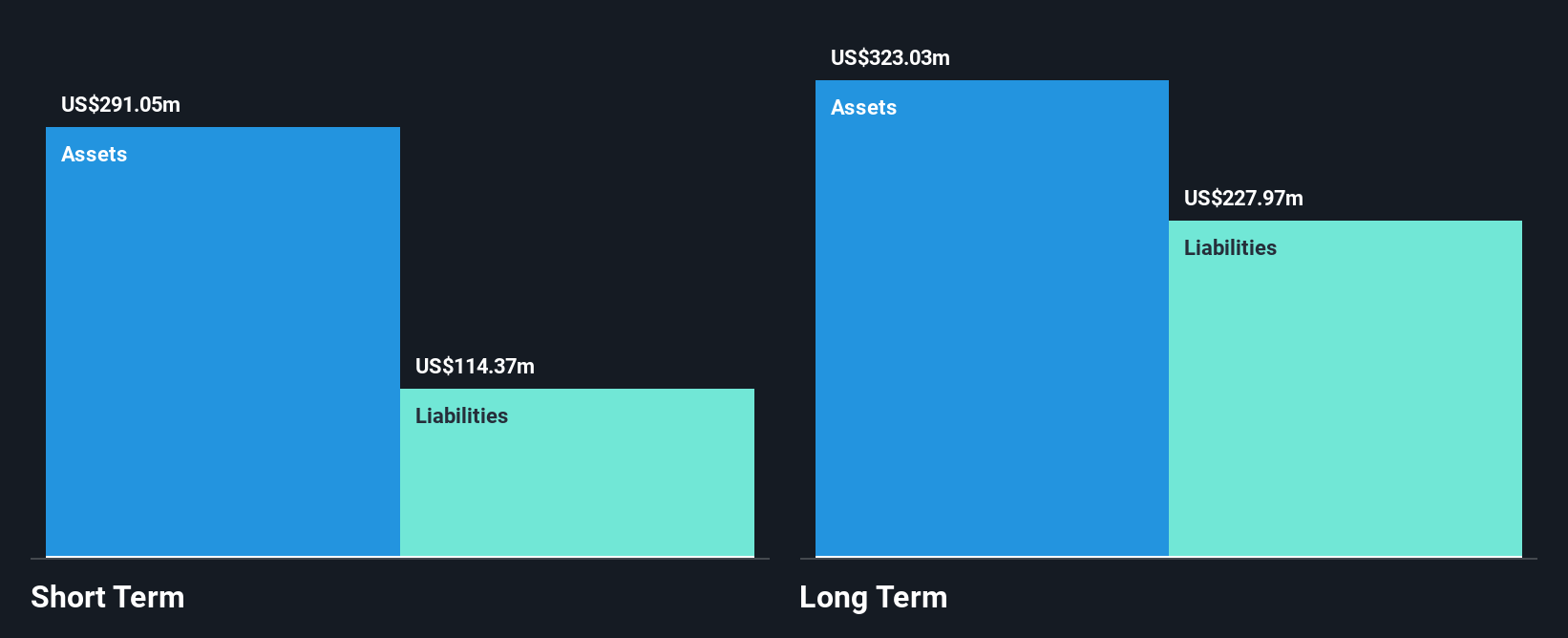

Alight, Inc. faces challenges typical of penny stocks, with a market cap of US$1.94 billion and ongoing unprofitability. The company reported a significant net loss of US$1.07 billion in Q2 2025, exacerbated by a goodwill impairment charge of US$983 million. Despite this, Alight maintains over three years of cash runway due to positive free cash flow growth and has undertaken share buybacks worth US$259.4 million since 2022. While its short-term assets cover current liabilities, long-term liabilities remain uncovered, and the high net debt to equity ratio poses financial risks amidst management's limited experience (0.8 years average tenure).

TETRA Technologies (TTI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: TETRA Technologies, Inc., along with its subsidiaries, functions as an energy services and solutions company with a market cap of approximately $522.46 million.

Operations: The company generates revenue from two main segments: Water & Flowback Services, which contributes $270.75 million, and Completion Fluids & Products, accounting for $336.46 million.

Market Cap: $522.46M

TETRA Technologies, Inc. demonstrates attributes of a compelling penny stock with its robust financial health and strategic positioning in the energy sector. The company reported US$173.87 million in revenue for Q2 2025, with net income rising to US$11.31 million from the previous year, reflecting strong profit growth and improved net profit margins at 19.8%. Despite potential risks like project delays and macroeconomic impacts, TETRA's debt is well-managed with a satisfactory net debt to equity ratio of 38.6%, supported by operating cash flow coverage. Furthermore, its seasoned management team enhances stability as it navigates market challenges effectively.

Key Takeaways

- Jump into our full catalog of 388 US Penny Stocks here.

- Searching for a Fresh Perspective? The end of cancer? These 26 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.