Please use a PC Browser to access Register-Tadawul

3 Stocks Estimated To Be 20.7% To 29.7% Below Intrinsic Value

Hope Bancorp, Inc. HOPE | 11.01 | -1.17% |

As the U.S. stock market experiences fluctuations with major indices like the S&P 500 and Nasdaq recently hitting new highs before retreating, investors are keenly observing opportunities amidst these shifts. In such a climate, identifying undervalued stocks—those trading below their intrinsic value—can offer potential for growth as they may be poised to benefit from broader market movements.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Udemy (UDMY) | $6.865 | $13.43 | 48.9% |

| SLM (SLM) | $27.12 | $53.65 | 49.4% |

| Metropolitan Bank Holding (MCB) | $76.68 | $150.26 | 49% |

| Investar Holding (ISTR) | $22.92 | $45.29 | 49.4% |

| HCI Group (HCI) | $194.55 | $376.13 | 48.3% |

| First Commonwealth Financial (FCF) | $17.00 | $32.97 | 48.4% |

| First Busey (BUSE) | $23.37 | $45.30 | 48.4% |

| Customers Bancorp (CUBI) | $65.85 | $131.62 | 50% |

| Alnylam Pharmaceuticals (ALNY) | $452.00 | $884.80 | 48.9% |

| AGNC Investment (AGNC) | $9.88 | $19.36 | 49% |

Let's explore several standout options from the results in the screener.

Hope Bancorp (HOPE)

Overview: Hope Bancorp, Inc. is the bank holding company for Bank of Hope, offering retail and commercial banking services to businesses and individuals in the United States, with a market cap of $1.38 billion.

Operations: The company generates revenue of $412.69 million from its banking segment, which includes retail and commercial banking services for businesses and individuals in the United States.

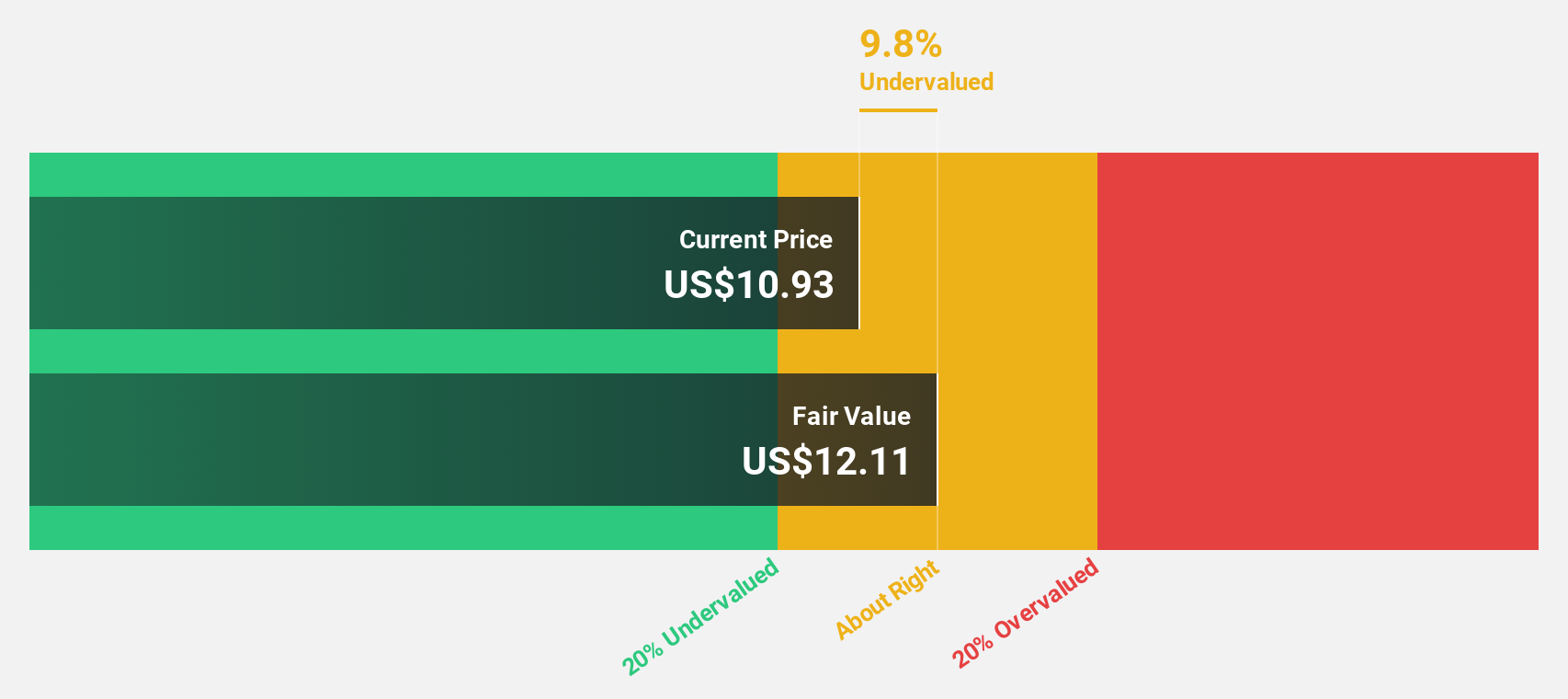

Estimated Discount To Fair Value: 29.7%

Hope Bancorp is trading at US$11.12, below its estimated fair value of US$15.81, indicating potential undervaluation based on discounted cash flow analysis. Despite a recent net loss of US$27.88 million for Q2 2025, earnings are forecast to grow significantly at 92.1% annually over the next three years, outpacing the broader U.S. market's growth rate. However, profit margins have decreased from 21.7% to 10.1%, and dividend coverage remains a concern.

Cadre Holdings (CDRE)

Overview: Cadre Holdings, Inc. manufactures and distributes safety equipment and related products for protection in hazardous situations globally, with a market cap of approximately $1.49 billion.

Operations: The company's revenue is comprised of $503.28 million from product sales and $104.99 million from distribution activities.

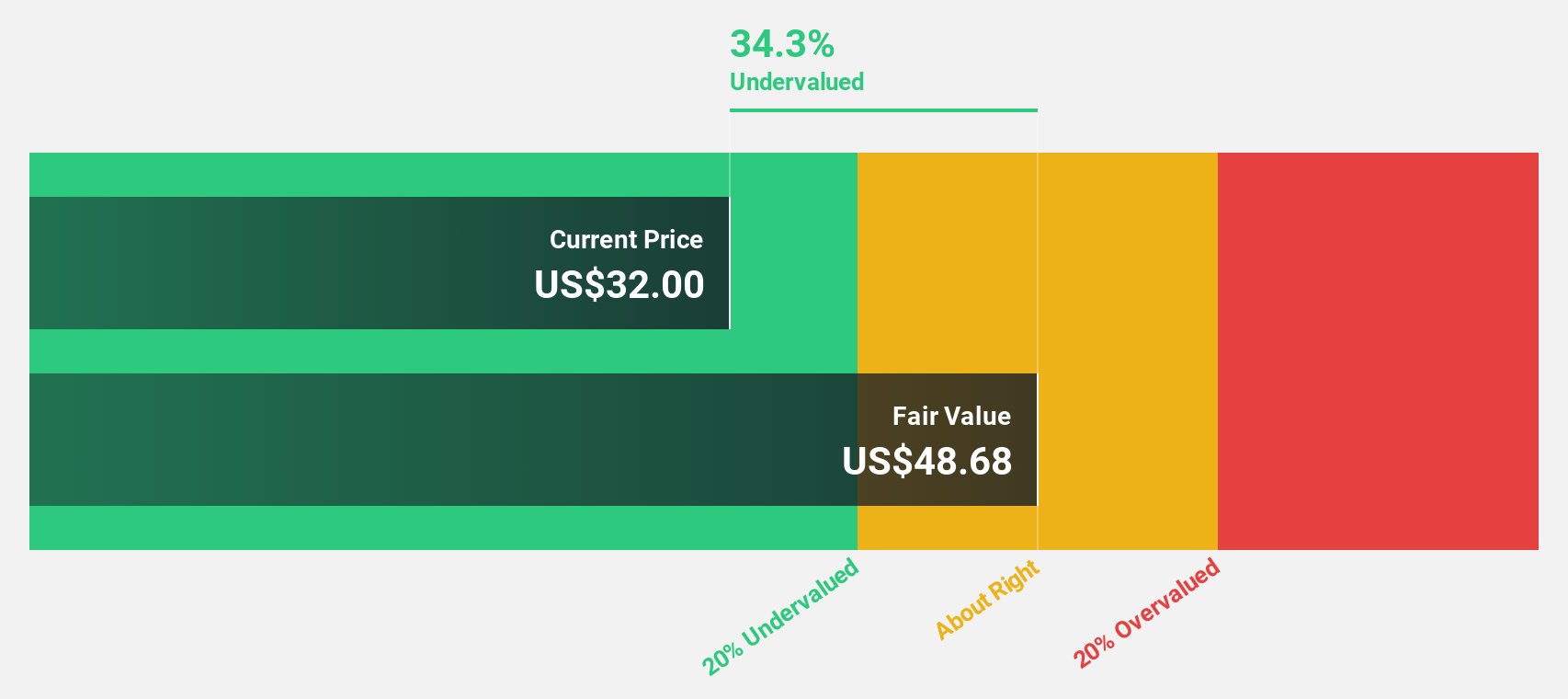

Estimated Discount To Fair Value: 23.3%

Cadre Holdings is trading at US$37.52, below its estimated fair value of US$48.92, suggesting potential undervaluation based on discounted cash flow analysis. Recent earnings reports show steady sales growth with net income of US$21.46 million for the first half of 2025, up from US$19.5 million a year ago. While earnings are forecast to grow significantly at 21.9% annually, debt coverage by operating cash flow remains insufficient and warrants attention.

Renasant (RNST)

Overview: Renasant Corporation operates as a bank holding company for Renasant Bank, offering financial, wealth management, fiduciary, and insurance services to retail and commercial customers, with a market cap of approximately $3.50 billion.

Operations: Renasant generates revenue primarily from its Community Banks segment, which accounts for $738.50 million, and its Wealth Management segment, contributing $27.59 million.

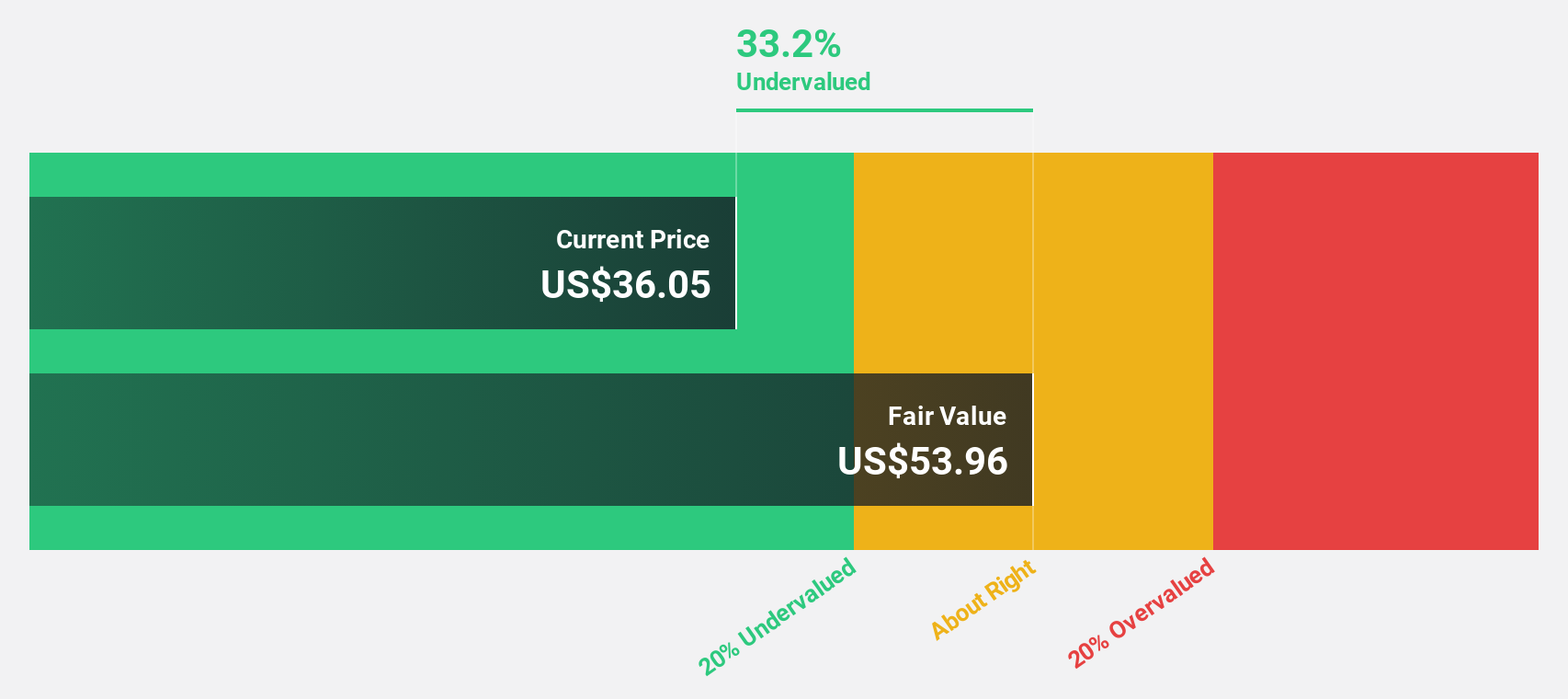

Estimated Discount To Fair Value: 20.7%

Renasant, trading at US$37.31, is considered undervalued with an estimated fair value of US$47.07 based on discounted cash flow analysis. Despite recent net income decline to US$1.02 million in Q2 2025 from US$38.85 million a year ago and substantial shareholder dilution, earnings are forecast to grow significantly at 40.84% annually over the next three years, surpassing market expectations. The company maintains a reliable dividend yield of 2.36%.

Seize The Opportunity

- Unlock more gems! Our Undervalued US Stocks Based On Cash Flows screener has unearthed 190 more companies for you to explore.Click here to unveil our expertly curated list of 193 Undervalued US Stocks Based On Cash Flows.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.