Please use a PC Browser to access Register-Tadawul

3 Top Undervalued Small Caps With Insider Buying To Consider

Enviri Corporation Common Stock NVRI | 18.12 | +0.33% |

Global markets have shown mixed performance recently, with small-cap and value shares outpacing large-cap growth stocks. Economic indicators have painted a varied picture, with consumer spending rising but the housing market continuing to slump. In this environment, identifying undervalued small-cap stocks can be particularly compelling. These companies often offer unique opportunities for growth and resilience amid broader market fluctuations.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Dundee Precious Metals | 8.6x | 2.9x | 38.41% | ★★★★★★ |

| Nexus Industrial REIT | 2.7x | 3.4x | 23.34% | ★★★★★☆ |

| Citizens & Northern | 12.7x | 2.8x | 44.19% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 11.44% | ★★★★☆☆ |

| Hemisphere Energy | 6.9x | 2.5x | 11.31% | ★★★☆☆☆ |

| Sopharma AD | 11.4x | 0.5x | 4.50% | ★★★☆☆☆ |

| Papa John's International | 19.5x | 0.7x | 44.04% | ★★★☆☆☆ |

| Freehold Royalties | 13.8x | 6.4x | 2.41% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Alta Equipment Group | NA | 0.2x | -189.41% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

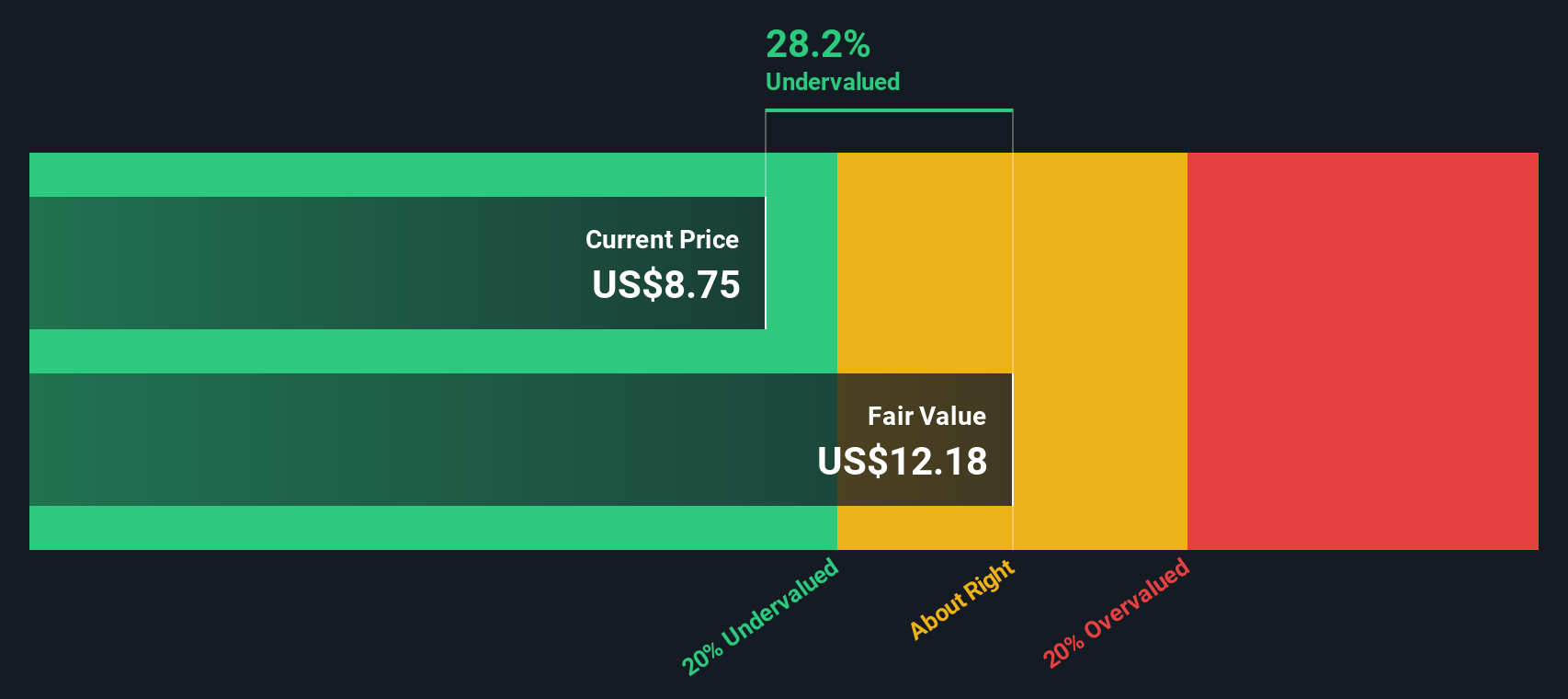

Enviri (NYSE:NVRI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Enviri is a company specializing in environmental solutions, operating through its Clean Earth and Harsco Environmental segments, with a market cap of $1.50 billion.

Operations: The company generates revenue primarily from Clean Earth ($931.89 million) and Harsco Environmental ($1.17 billion). The gross profit margin has shown variability, with the most recent figure at 21.29%.

PE: -18.4x

Enviri Corporation, a small cap stock, has shown mixed financial performance recently. For Q2 2024, revenue was US$609.99 million with a net loss of US$13.6 million, compared to last year's US$11.44 million loss. Despite the losses, insider confidence is evident with recent share purchases by executives in June 2024. The company revised its full-year 2024 GAAP operating income guidance to US$128-$141 million and expects diluted loss per share from continuing operations between $0.42 and $0.58 for the same period.

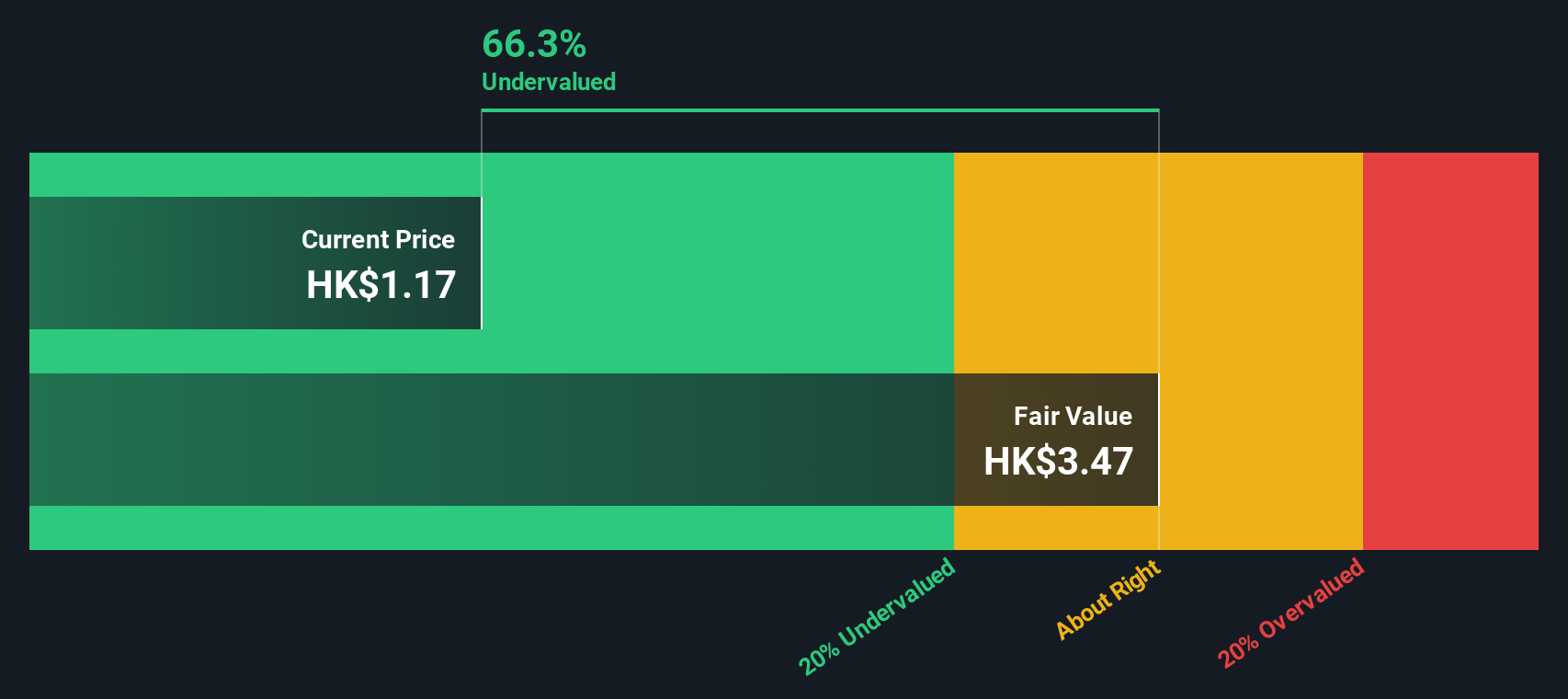

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Kinetic Development Group is a company engaged in property development and investment, with a market cap of CN¥5.23 billion.

Operations: Kinetic Development Group generates revenue primarily through sales, with significant costs attributed to COGS. Notably, the gross profit margin has shown an upward trend, reaching 69.80% as of June 30, 2022. Operating expenses include general and administrative expenses and sales & marketing expenses.

PE: 4.3x

Kinetic Development Group, a smaller company in its sector, recently approved a final dividend of HK$0.05 per share for the year ending December 2023 and amended its bylaws during the May 2024 annual meeting. The company's funding is entirely reliant on external borrowing, which poses higher risk compared to customer deposits. Insider confidence is evident as key individuals have increased their stock purchases over the past six months, signaling potential growth and stability despite recent changes in dividends and corporate governance structure.

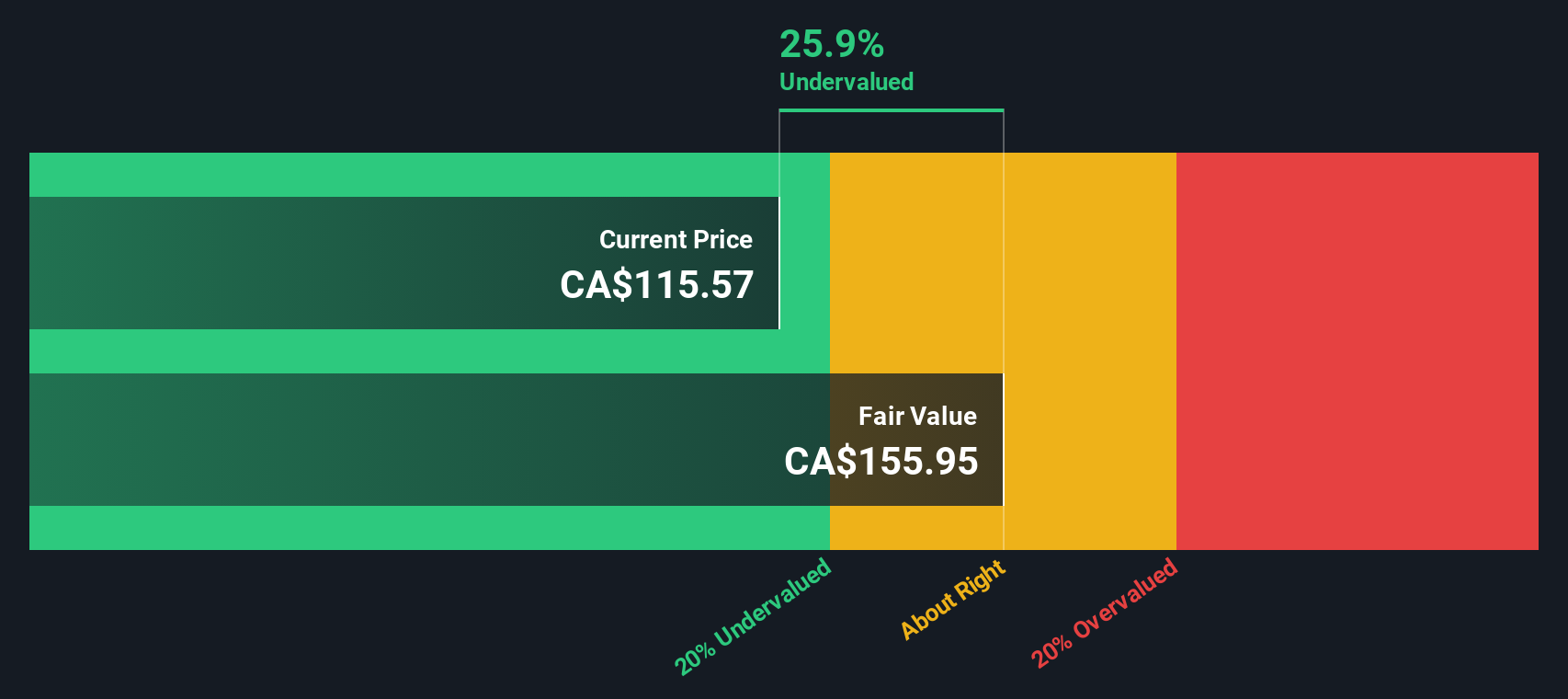

Hammond Power Solutions (TSX:HPS.A)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Hammond Power Solutions specializes in the manufacture and sale of transformers, operating with a market cap of CA$0.37 billion.

Operations: The company generated revenue of CA$754.37 million from the manufacture and sale of transformers, with a gross profit margin of 32.94% in the most recent period. Operating expenses amounted to CA$157.95 million, and net income was CA$65.88 million, resulting in a net income margin of 8.73%.

PE: 21.2x

Hammond Power Solutions, a small cap stock, has shown solid financial performance recently. For Q2 2024, the company reported CAD 197.21 million in sales and CAD 23.59 million in net income, up from CAD 172.45 million and CAD 13.33 million respectively a year ago. Basic earnings per share increased to CAD 1.98 from CAD 1.12 last year, reflecting strong operational efficiency and profitability growth despite relying solely on external borrowing for funding sources which presents higher risk compared to customer deposits . Notably, insider confidence is evident with recent purchases by executives within the past quarter indicating their belief in the company's future prospects .

Next Steps

- Take a closer look at our Undervalued Small Caps With Insider Buying list of 217 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.