Please use a PC Browser to access Register-Tadawul

A Closer Look at Verra Mobility (VRRM) Valuation as Momentum Softens and Discount Persists

Verra Mobility Corporation - Class A Common Stock VRRM | 21.88 | +0.37% |

Verra Mobility (VRRM) has caught some investor attention lately as its stock has given up a slight 2% over the past month and about 6% in the past 3 months. This movement comes as the company’s long-term returns and recent growth remain part of the conversation.

While Verra Mobility's share price has softened slightly recently, momentum appears to be fading compared to last year's action. Over the past twelve months, the total shareholder return has dipped about 8.7%, a contrast to the robust gains of prior years. This suggests investors may be reassessing the stock’s near-term growth prospects in light of its long-term story.

If you’re scanning the market for what’s generating fresh momentum, now could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares currently trading nearly 20% below analyst targets and the long-term returns still positive, the question remains: Is Verra Mobility a bargain right now, or is the stock’s future already priced in?

Most Popular Narrative: 16.9% Undervalued

At $24.23, Verra Mobility is trading well below the $29.17 fair value projected by the most widely followed narrative. This creates a notable gap to the consensus outlook and opens the floor to what is driving this valuation.

Recent legislation in Colorado and Nevada authorizing new photo enforcement programs, along with enabling legislation across the U.S. (including California), is expanding the total addressable market for automated traffic enforcement. This creates multi-year visibility and potential double-digit revenue growth in Government Solutions as new contracts convert to recurring ARR and begin contributing to top-line results.

Curious what powers this upside? The current narrative is built on forecasts for surging recurring revenue and improving profit margins, supported by aggressive legislative changes and rapid adoption. What numbers have analysts plugged in to craft such a bold case? Take a closer look at the blueprint behind this valuation shift to understand what is driving it.

Result: Fair Value of $29.17 (UNDERVALUED)

However, risks remain, including potential revenue declines from customer churn and the possibility that contract concentration could impact performance if key renewals stumble.

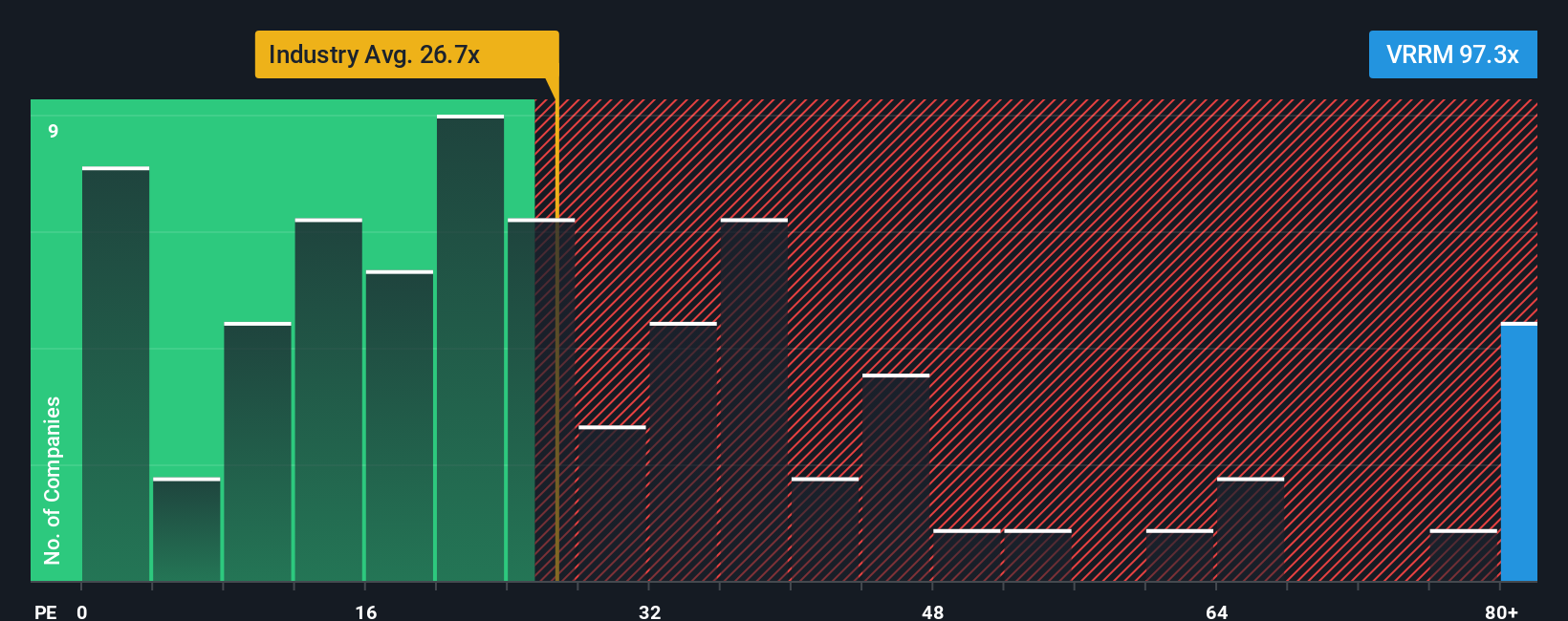

Another View: Trading on a Lofty PE Ratio

Looking from another angle, Verra Mobility’s current price-to-earnings ratio sits at 99.1x. This is much higher than both its peer average of 18x and the US Professional Services industry’s 26.7x. Even the fair ratio estimate is 42.4x, which is well below where the stock trades now. This significant gap suggests investors are paying up for future growth potential. However, could this optimism be too far ahead of reality?

Build Your Own Verra Mobility Narrative

If the thesis doesn’t match your outlook or you’d rather investigate the numbers firsthand, you can build your own evidence-based view in just a few minutes. Do it your way.

A great starting point for your Verra Mobility research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Level up your portfolio right now with handpicked stocks built for the next wave of growth. Don’t let standout opportunities pass you by while others take action.

- Capitalize on surging tech trends by targeting these 24 AI penny stocks shaking up industries and building the tools of tomorrow.

- Strengthen your income stream by selecting these 19 dividend stocks with yields > 3% boasting yields over 3 percent and proven payout stability.

- Catch rising stars at the ground floor by scouting out these 3568 penny stocks with strong financials with strong financials and high momentum potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.