Please use a PC Browser to access Register-Tadawul

A Fresh Look at Alamo Group (ALG) Valuation After Recent Momentum Shift

Alamo Group Inc. ALG | 208.30 | -0.04% |

Most Popular Narrative: 15.8% Undervalued

According to the most popular narrative, Alamo Group is viewed as notably undervalued, with analysts projecting significant upside potential from the current share price.

“Robust organic growth in the Industrial Equipment division, evidenced by record sales (+17.6% YoY), soaring backlog (approximately $510 million), and strong order bookings (+21% YoY in Q2), is directly tied to rising infrastructure investments and government spending. These conditions are expected to persist globally, supporting continued revenue expansion and earnings growth. Sequential improvements and five straight quarters of increasing order bookings in Vegetation Management, along with efficiency gains from plant consolidations and cost reductions, signal operational recovery and margin tailwinds. As demand for automated, sustainable land management solutions accelerates, both revenues and net margins are poised to increase over time.”

Curious how bullish assumptions and evolving sector forces set up Alamo Group for a valuation leap? This narrative highlights a future shaped by growth engines, margin upgrades, and analyst buy-in on key financial metrics. Which bold projections tip the scales toward this substantial price target? Dive in to see the data foundation that makes the analysts’ call so compelling.

Result: Fair Value of $244.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, supply chain challenges or prolonged weakness in the Vegetation Management division could slow momentum and cast doubt on the bullish outlook.

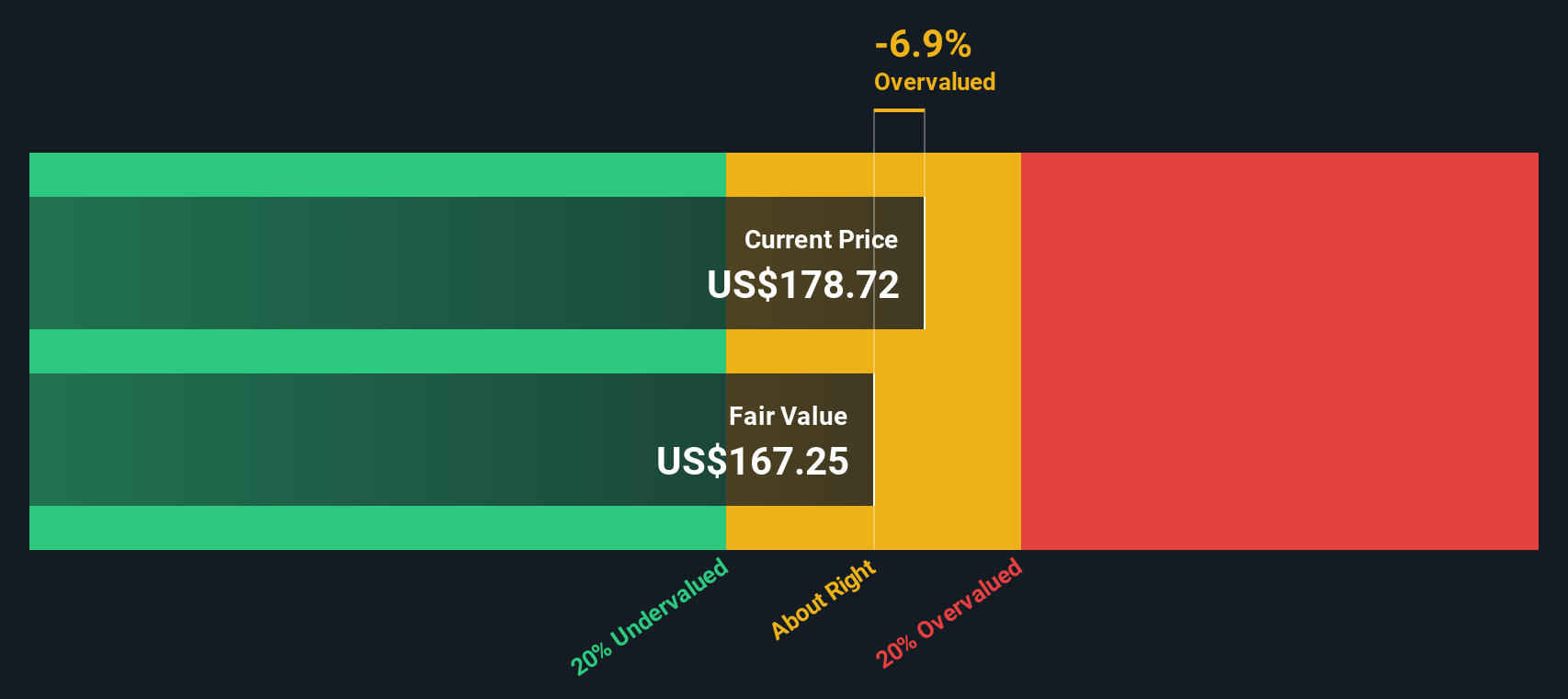

Find out about the key risks to this Alamo Group narrative.Another View: DCF Model Challenges the Undervaluation

While analysts see upside based on growth projections and recent momentum, the SWS DCF model paints a more cautious picture. It suggests shares may be trading above their calculated fair value. Does this alternative lens expose hidden risks, or is the market betting on more than just the math?

Build Your Own Alamo Group Narrative

If you have your own perspective or want to dig into the numbers yourself, you can shape a custom valuation in just a few minutes. Do it your way.

A great starting point for your Alamo Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your strategy to a single stock. If you want to spot smarter trends before the crowd does, use these powerful tools to uncover real opportunities you could be missing:

- Uncover hidden gems with strong balance sheets by searching for penny stocks with impressive fundamentals through our penny stocks with strong financials.

- Shape your dividend portfolio for success by focusing on companies offering attractive yields and financial strength with the help of our dividend stocks with yields > 3%.

- Get ahead of the curve and identify tomorrow’s leaders trading below their fair value by using our tailored tool for undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.