Please use a PC Browser to access Register-Tadawul

A Fresh Look at Amprius Technologies (AMPX) Valuation Following Nordic Wing’s Drone Battery Deal

Amprius Technologies, Inc. Common Stock AMPX | 10.01 | -0.40% |

If you’re watching Amprius Technologies (NYSE:AMPX) right now, you’re not alone. Interest around the stock has climbed after the company announced that Nordic Wing is integrating Amprius’ SiCore cells into its ASTERO ISR drone platform. This deal isn’t just a publicity win; the selection follows performance testing that delivered an impressive 90% boost in flight endurance, positioning Amprius’ technology as an enabler for longer missions and more reliable operation in demanding defense environments. For any investor weighing what’s next, real-world validation like this could mean more than any press release or prototype.

To put this into context, Amprius Technologies has been quietly building credibility over the past year with consistent commercial progress and expanding applications of its silicon anode batteries. Despite a 9% gain over the last twelve months, most of that momentum has gathered in recent months, suggesting renewed confidence in both the company’s direction and market potential. Alongside news of the CFO’s upcoming retirement and high-profile presentations to investors, the Nordic Wing partnership marks a meaningful inflection point that could reshape perceptions of risk and reward in this stock.

So with investors clearly paying attention after the latest breakthrough, is Amprius trading below its true potential, or are expectations for future growth already reflected in the current price?

Most Popular Narrative: 40.8% Undervalued

The most widely followed narrative in the market values Amprius Technologies at a significant discount to fair value, forecasting substantial upside from current levels.

Ongoing investment in automation and manufacturing capacity, supported by government contracts like the $10.5M Defense Innovation Unit award, positions Amprius to capture a larger share of future high-margin opportunities in defense and critical infrastructure. This is expected to enhance both revenue visibility and earnings stability.

Think these numbers are just hype? This narrative includes catch-up revenue growth and a future profit engine that could rival industry leaders. Curious about just how aggressive the analysts’ projections are and which pieces of the financial puzzle really set the bar so high? The real details might surprise you.

Result: Fair Value of $13.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent manufacturing challenges or a slowdown in drone sector demand could quickly undermine these bullish expectations. This situation reminds investors how fast things can change.

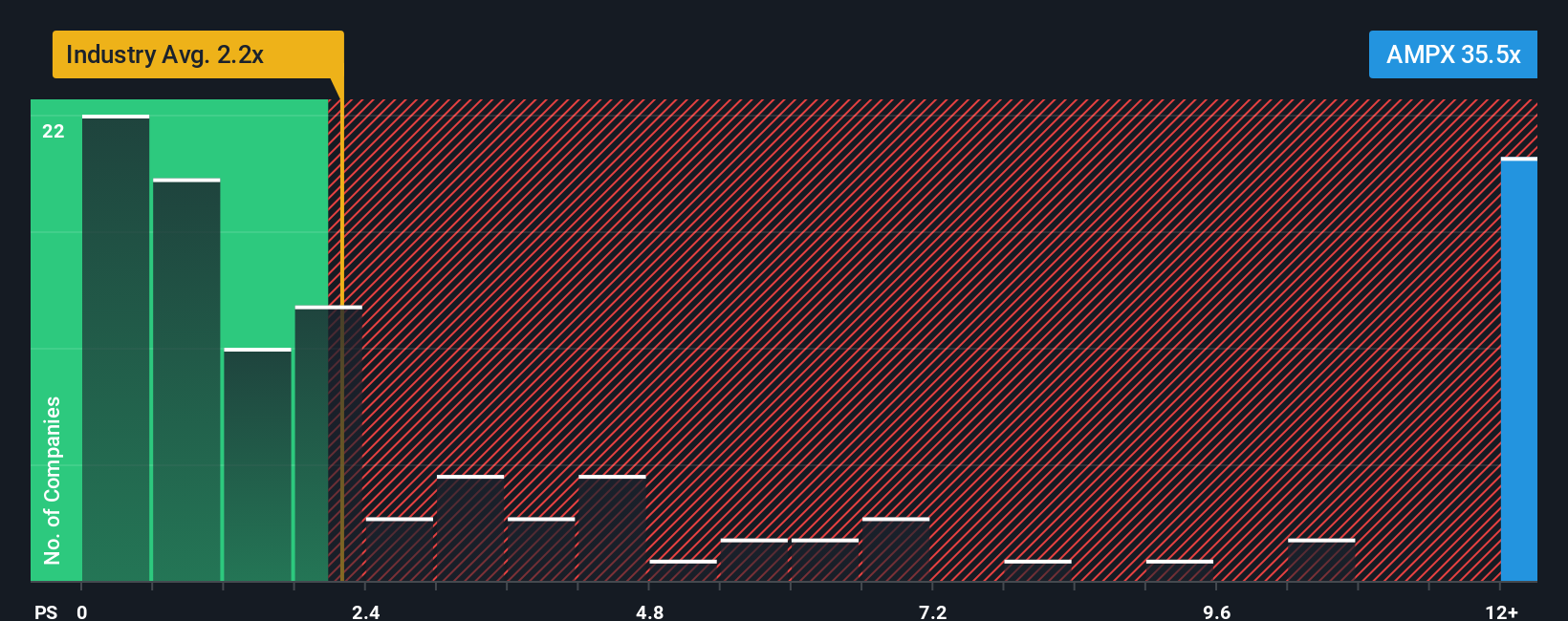

Find out about the key risks to this Amprius Technologies narrative.Another View: Industry Ratio Reality Check

While some see future growth as a reason for a higher price, others note Amprius trades at a much higher sales-based valuation than industry peers. Could this premium signal untapped upside, or serve as a warning sign?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amprius Technologies Narrative

If you’d rather dig into the numbers and form your own perspective, you can easily build a case for Amprius Technologies in just a few minutes. Afterward, share your view: Do it your way.

A great starting point for your Amprius Technologies research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Opportunities abound beyond just Amprius Technologies. Don’t let the next big opportunity slip by. Open the door to powerful investment trends using these hand-picked screeners:

- Catch undervalued gems poised for a comeback and see which stocks stand out as great value with undervalued stocks based on cash flows.

- Pinpoint companies using breakthrough AI in healthcare with healthcare AI stocks and spot innovation that’s reshaping patient care.

- Start building wealth with strong-yielding stocks. Find those paying dividends above 3% through dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.