Please use a PC Browser to access Register-Tadawul

A Fresh Look at Ardent Health’s (ARDT) Valuation Following Strong Profitability and Investor Optimism

Ardent Health Partners (2024 New Filing) ARDT | 8.88 | +1.08% |

If you have been tracking Ardent Health (ARDT), the latest move in its stock might have caught your eye. The company’s shares jumped by 14% over the past month, a change likely fueled by consistently strong financial results. Ardent Health’s return on equity is 21%, compared to the industry average of just 13%. Efficient profitability and solid net income expansion seem to be boosting investor confidence even as some foresee future growth slowing down.

This uptick follows strong operational execution at Ardent Health, which continues to reinvest all profits into the business. This approach has led to 11% net income growth over the last five years. Looking at the broader trend, the recent surge comes after a tough start to the year for the stock, with its price still down 28% over the last twelve months. Despite the latest momentum, long-term shareholders may still be waiting for a full recovery.

With the mix of higher profitability and lingering concerns about slowing growth, some may wonder whether Ardent Health presents an opportunity for a turnaround or if the market has already accounted for its best days ahead.

Most Popular Narrative: 31.5% Undervalued

According to the leading narrative, Ardent Health's shares are trading at a sizeable discount to consensus fair value, with a price target that is notably higher than current levels.

"Ardent's strong presence in fast-growing, midsized U.S. markets with favorable demographic trends means it will continue to benefit from increasing healthcare demand driven by an aging population and rising chronic disease prevalence. This supports top-line revenue growth and improved patient volumes."

Curious about what truly powers this bullish outlook? There is a hidden engine of projected growth, margin expansion, and sector-defying profitability targets at the core of this narrative. Want to know which bold strategic moves and quantitative forecasts are fueling such a dramatic undervaluation call? The financial roadmap behind that fair value could defy your expectations.

Result: Fair Value of $19.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, regulatory uncertainty and insurance contract disputes could easily disrupt Ardent Health’s positive trajectory. This reminds investors that risks remain in play.

Find out about the key risks to this Ardent Health narrative.Another View: Discounted Cash Flow Model Suggests a Different Story

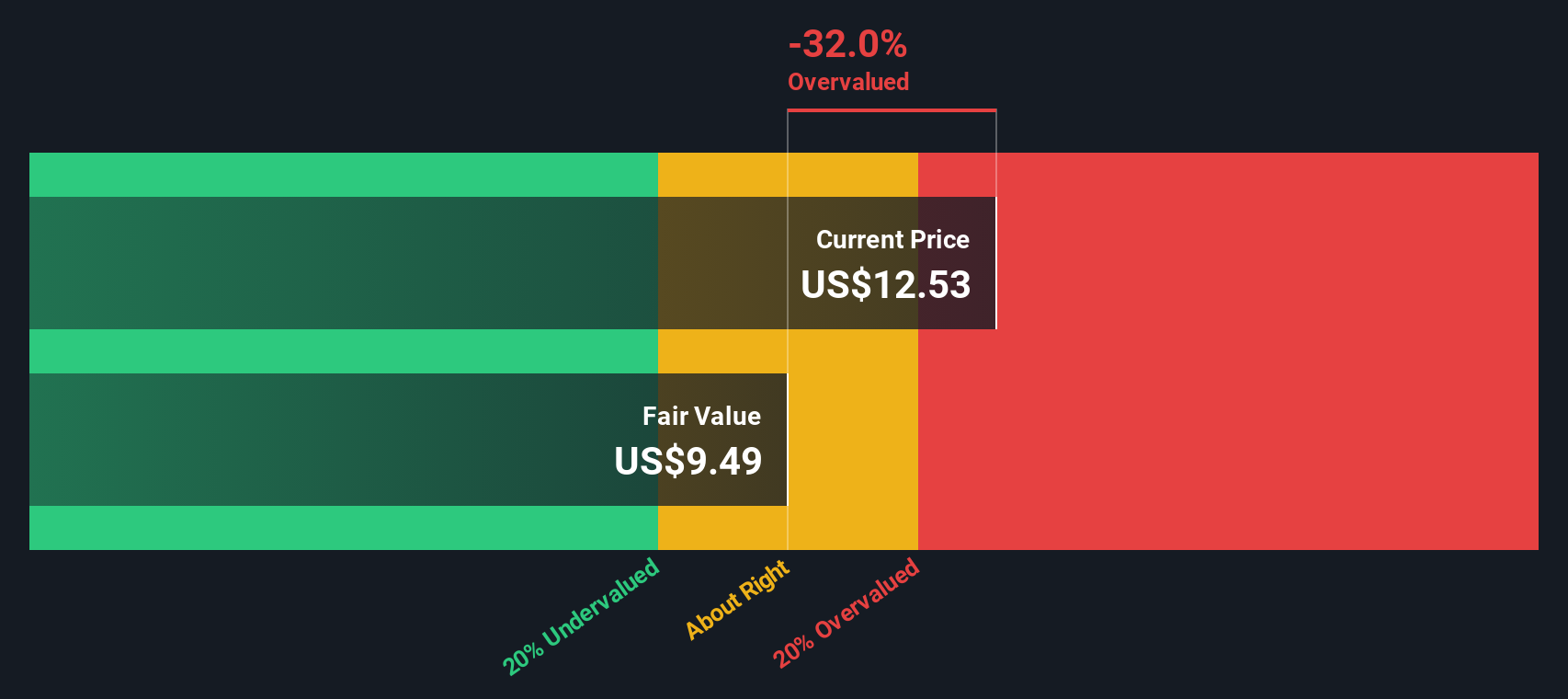

Looking from a different angle, our DCF model tells a less optimistic tale. By its calculations, the stock appears overvalued, not undervalued. Are analyst targets too bullish, or is the market missing something?

Build Your Own Ardent Health Narrative

If you see things differently or want to dig into the numbers yourself, you can put together your own perspective in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Ardent Health.

Looking for More Smart Investment Opportunities?

Don't settle for just one great idea when there are countless possibilities waiting. Use these tools to uncover companies poised for big gains and avoid missing out:

- Boost your portfolio potential by targeting hidden gems in the market with undervalued stocks based on cash flows.

- Ride the wave of technological innovation by sizing up top-performing healthcare companies powered by artificial intelligence with healthcare AI stocks.

- Capture income opportunities with leading shares offering attractive returns using dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.