Please use a PC Browser to access Register-Tadawul

A Fresh Look at Ares Management’s Valuation Following Key Insurance Leadership Appointment

Ares Management LP ARES | 172.98 | +0.17% |

Thinking about what to do with Ares Management (ARES) after the company’s recent announcement? The firm just brought on Anup Agarwal as Partner and Chief Investment Officer of Ares Insurance Solutions, with Agarwal also stepping in as Head of the business. Leadership is calling this a key hire for expanding its insurance platform, particularly with aspirations to strengthen investment activities at Aspida Holdings Ltd. For current shareholders and potential investors alike, this appointment signals a calculated push into a strategically important segment for Ares Management.

This leadership change adds to the story of steady progression for Ares Management. Over the past year, the stock has climbed by 20%, outpacing broader market averages. In the shorter term, momentum appears strong, with a solid 11% gain over the past three months, building on years of impressive returns. The pace of the company’s revenue and profit growth, as seen in its latest updates, is keeping the market engaged as management works to diversify earnings sources.

The key question remains: Is the market underestimating what is ahead and leaving value on the table, or are investors already pricing in this future growth potential?

Most Popular Narrative: 5.5% Undervalued

According to the most widely followed set of analyst expectations, Ares Management is considered modestly undervalued versus its consensus fair value. This narrative is supported by long-term growth assumptions and strong operational momentum across multiple business lines.

Robust international fundraising, particularly in Europe and Asia-Pacific, and ongoing success in deepening distribution partnerships, are broadening Ares' addressable markets, increasing global deal flow, and positioning the company for sustained earnings growth. The significant ramp in perpetual capital (now nearly 50% of fee-paying AUM), combined with consistent investment performance and low client redemptions, is expected to drive higher recurring fee revenues, greater profitability, and improved earnings visibility.

Want to know what is powering this undervaluation rating? There is a bold outlook driving these numbers that hints at game-changing growth and a future financial profile not often seen for traditional asset managers. Curious which strategic moves and profit assumptions stand behind these projections? The full narrative reveals all.

Result: Fair Value of $193.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, growing competition in private credit and shifting retail investor sentiment could challenge both fee growth and revenue stability for Ares Management in the future.

Find out about the key risks to this Ares Management narrative.Another View: What Do the Numbers Say?

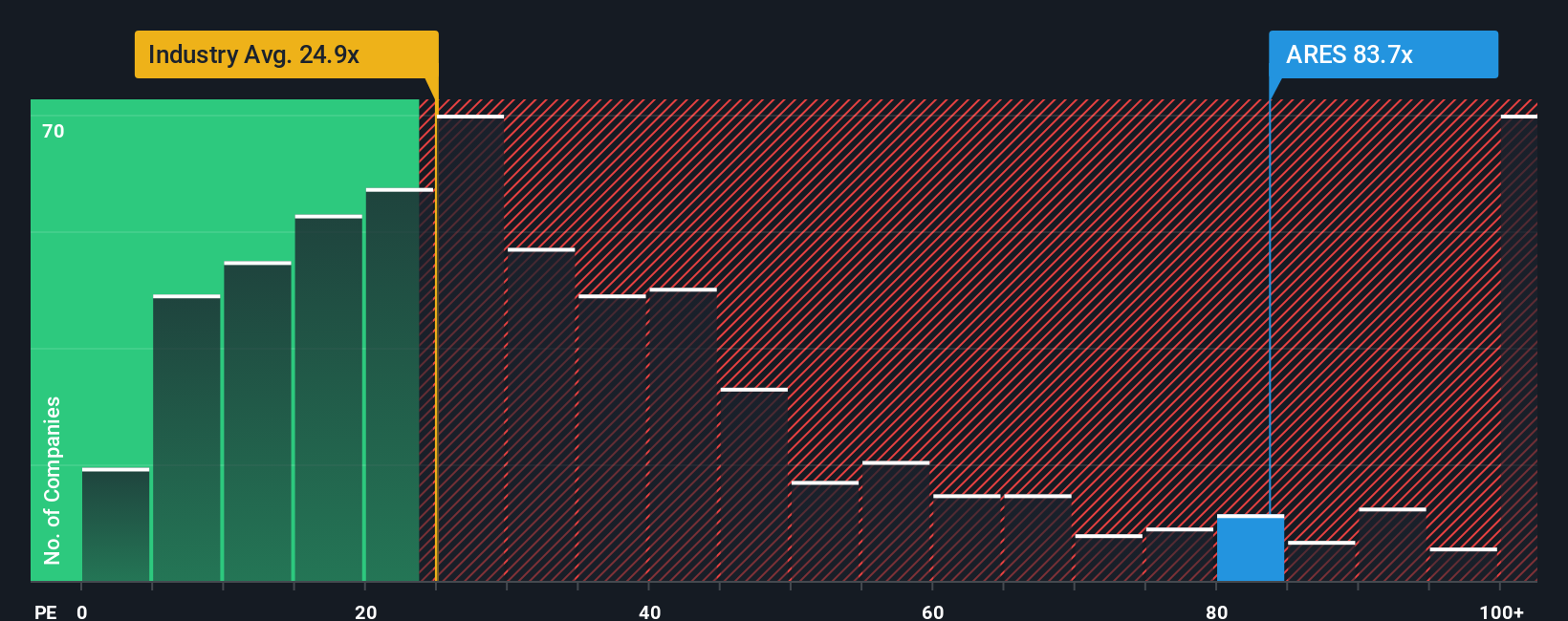

While analyst projections suggest Ares Management is undervalued, a closer look at company earnings compared to industry norms paints a different picture. The company appears expensive by this measure, which may indicate cautious optimism in the market. Could these high expectations prove difficult to meet?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ares Management Narrative

If you see the data differently or want to dig deeper into the numbers yourself, it only takes a few minutes to craft your own perspective and analysis. Do it your way

A great starting point for your Ares Management research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors stay ahead by finding promising opportunities beyond the obvious. Broaden your portfolio and take action on trends that others may overlook before they make headlines.

- Tap into the growth of artificial intelligence by tracking tomorrow’s innovators through our list of AI penny stocks.

- Grow your income with steady cash flows by focusing on companies offering dividend stocks with yields > 3%.

- Position yourself for potential upside by zeroing in on shares trading below their intrinsic value with the power of our undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.