Please use a PC Browser to access Register-Tadawul

A Fresh Look at Artisan Partners Asset Management's Valuation After Reporting $178.1 Billion in Assets Under Management

Artisan Partners Asset Management, Inc. Class A APAM | 41.49 41.49 | +0.05% 0.00% Pre |

Artisan Partners Asset Management (APAM) just announced its preliminary assets under management reached $178.1 billion at the end of August 2025. This figure is likely on the minds of investors watching the stock. This update is more than just a number, as it reflects both the company’s expanding scale and the reach of its many investment strategies. For shareholders, it also signals how the firm is positioning itself in a crowded market that values both size and specialization.

Looking at where the stock stands, APAM has climbed 23% over the past year, building on its momentum with a near 10% return in the past 3 months. Despite a dip in the past month, the three- and five-year gains of over 80% and 77% demonstrate longer-term growth that outpaces many financial sector peers. Recent months have also seen revenue and net income grow by about 6%, suggesting underlying business health even as market sentiment shifts with updates like this latest AUM figure.

After all of this movement, the question for investors is simple: is there a real buying opportunity here, or is the market already pricing in Artisan’s continued growth?

Most Popular Narrative: Fairly Valued

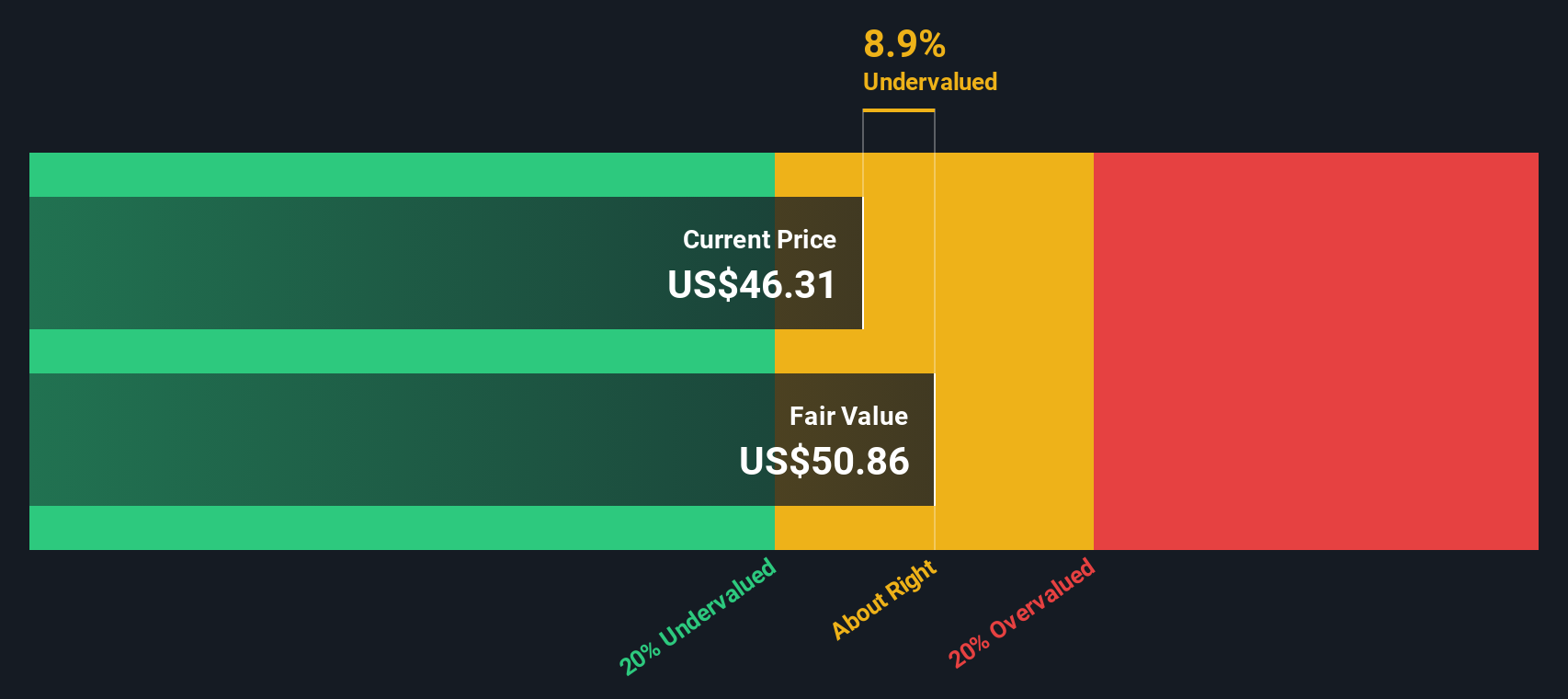

The current consensus among analysts suggests that Artisan Partners Asset Management stock is fairly valued, with the share price sitting almost exactly at projected fair value based on future earnings and profit expectations.

The analysts have a consensus price target of $46.125 for Artisan Partners Asset Management based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $51.0, and the most bearish reporting a price target of just $41.5.

Want to know the financial recipe that pins Artisan’s stock at this current level? The key figure is a delicate dance between projected profit margins, an industry-defying earnings multiple, and a new revenue trajectory. What hidden assumptions led analysts to declare the stock fairly priced? Are you missing out on the details that could shape your next move? Explore the full narrative for the numbers that set this valuation.

Result: Fair Value of $46.13 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, sustained outperformance by key strategies or unexpected asset growth could quickly challenge the current view and lead to higher valuations.

Find out about the key risks to this Artisan Partners Asset Management narrative.Another View: Discounted Cash Flow Puts a Twist on the Story

While analyst forecasts and industry comparisons suggest Artisan Partners Asset Management is at fair value, our SWS DCF model views the stock as undervalued based on projected future cash flows. Which method will turn out closer to the truth?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Artisan Partners Asset Management Narrative

If you want to dig deeper or think your perspective offers more, you can review the data and shape your own view in just a few minutes. Do it your way

A great starting point for your Artisan Partners Asset Management research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Open the door to new opportunities and power up your portfolio with investments beyond the obvious. Don’t let the next big winner slip past you. These handpicked strategies could put you ahead of the crowd.

- Tap into market potential and scan for undervalued stocks based on cash flows before others spot these opportunities in undervalued gems that may be poised for a strong rebound.

- Accelerate your exposure to tomorrow’s breakthroughs by uncovering AI penny stocks that are taking the lead in artificial intelligence innovation and shaping industries worldwide.

- Secure your cash flow by pinpointing dividend stocks with yields > 3% offering impressive yields and historically resilient performance through changing markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.