Please use a PC Browser to access Register-Tadawul

A Fresh Look at Butterfield (NYSE:NTB) Valuation Following Key Executive Leadership Changes

Bank of N.T. Butterfield & Son Limited (The) NTB | 51.02 | -0.13% |

If you are holding or eyeing Bank of N.T. Butterfield & Son (NYSE:NTB), this week’s wave of executive changes is the kind of event that can shift your outlook. The bank just unveiled a refreshed leadership team, including a familiar face returning as Group CFO and an experienced hand stepping up as Group Chief Risk Officer. Management is highlighting disciplined risk management and the depth of its talent, which could matter a lot for investors thinking about long-term stability and strategy.

These appointments come after a year where NTB’s shares have climbed 26 percent. This momentum stands out compared to many peers. Over the last three months alone, the stock is up nearly 7 percent, even as annual revenue growth has been almost flat and net income slipped modestly. Investors seem to be rewarding management’s efforts, not just this week but throughout a multi-year stretch where NTB has prioritized steady returns and operational strength.

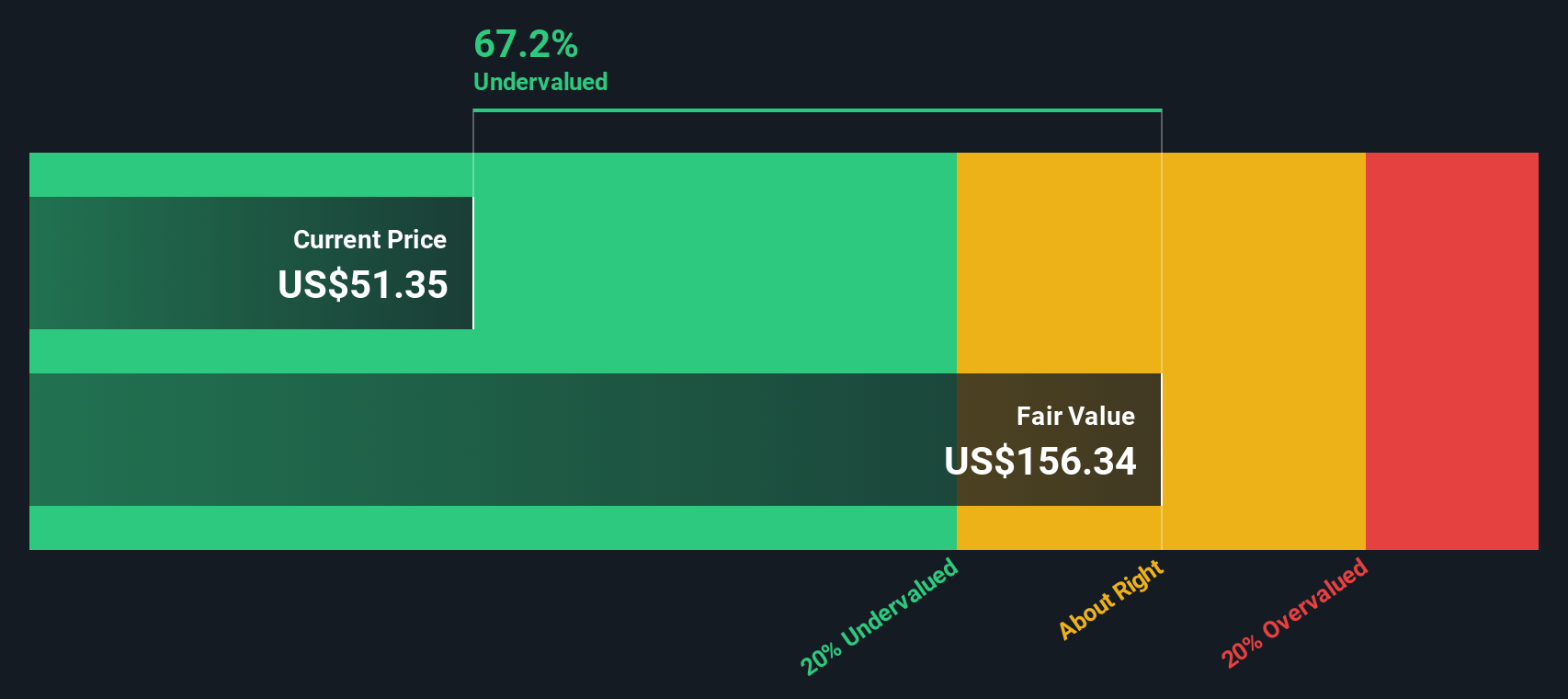

With leadership renewal and the stock’s recent run, the question now is whether Bank of N.T. Butterfield & Son is priced for further growth, or if the market is already capturing all upside. Let’s dig into the valuation case next.

Most Popular Narrative: 12.1% Undervalued

According to the most widely followed narrative, Bank of N.T. Butterfield & Son is considered undervalued by 12.1% relative to its estimated fair value. Analysts argue that the bank's future prospects, strategic initiatives, and operational strength support a higher valuation than its current market price.

Advanced digital transformation initiatives and continued investment in technology are expected to drive ongoing operational efficiencies, cost containment, and improved client service. These factors are projected to support better cost-to-income ratios and enhanced earnings over time.

Curious about what’s driving this bullish outlook? The entire model hinges on just a few pivotal assumptions, including profit expansion, shifting operating metrics, and a future valuation multiple that might surprise you. Want to see what’s really fueling the projected fair value? The answers behind these numbers could reshape your view of NTB’s potential.

Result: Fair Value of $51.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent pressure on deposit stability or a decline in net interest margins could quickly undermine the bank’s positive valuation case.

Find out about the key risks to this Bank of N.T. Butterfield & Son narrative.Another View: What Does the SWS DCF Model Say?

Looking from a different angle, our DCF model also suggests Bank of N.T. Butterfield & Son is trading below its fair value. This approach weighs future cash flows rather than relying solely on market multiples. Which method tells the truer story?

Build Your Own Bank of N.T. Butterfield & Son Narrative

If you see things differently or want to dive deeper into the numbers yourself, you can craft your own narrative for Bank of N.T. Butterfield & Son in just a few minutes. Do it your way.

A great starting point for your Bank of N.T. Butterfield & Son research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Angles?

Thousands of investors are already finding unique opportunities using the Simply Wall Street screener. Don’t wait; catch the next wave of potential winners for your own portfolio by acting now.

- Uncover reliable income streams by tapping into dividend stocks with yields > 3% offering yields above 3% and boosting stability when markets get choppy.

- Spot the future of artificial intelligence and turbocharge your watchlist by exploring AI penny stocks leading innovation in AI breakthroughs.

- Get ahead of the crowd with high-conviction value picks through our selection of undervalued stocks based on cash flows that could be trading far below what they’re really worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.