Please use a PC Browser to access Register-Tadawul

A Fresh Look at Corcept Therapeutics (CORT) Valuation Following New Care Partnerships and Pipeline Expansion

Corcept Therapeutics CORT | 81.12 | -7.08% |

Corcept Therapeutics (CORT) recently partnered with Curant Health’s Curant Rare division to support patients with personalized care and improved access to therapy. The company is also advancing relacorilant in an effort to diversify its product lineup.

Corcept Therapeutics’ latest collaboration and push to expand its pipeline came alongside a brief jump in the share price, reflecting optimistic sentiment around its growth prospects. While momentum has cooled somewhat, the stock’s 1-year total shareholder return of 0.94% suggests steady progress rather than a breakout. Investors are watching for signs of stronger long-term traction as product diversification efforts unfold.

If you’re curious about where else innovation and breakthroughs are driving the future of medicine, this is the perfect time to discover See the full list for free.

After a year of steady but unspectacular returns, the question now is whether Corcept Therapeutics is trading at a bargain given its pipeline momentum, or if expectations for future growth have already been priced in.

Most Popular Narrative: 34.5% Undervalued

Corcept Therapeutics' last close price of $88.15 stands considerably below the narrative's calculated fair value of $134.5. This sets up a debate about whether analysts are forecasting ambitious growth or the market is underappreciating the company's prospects.

The publication of the CATALYST study and the resulting increased awareness and screening for hypercortisolism among physicians are expanding the potential addressable patient pool. This is expected to drive significant acceleration in revenue growth over the next several years.

Curious about the radical projections behind this valuation? The narrative models blockbuster revenue acceleration and bold profit expansion driven by new drugs and a fast-growing pipeline. Want to see which precise financial milestones analysts think Corcept will hit, and the critical profit multiple they've used to justify this price target? Unlock the full story to reveal the numbers behind the optimism.

Result: Fair Value of $134.5 (UNDERVALUED)

However, ongoing patent litigation and heavy reliance on Korlym could still derail these expectations. This may also put pressure on both revenue and profit margins in the future.

Another View: What Do Market Ratios Say?

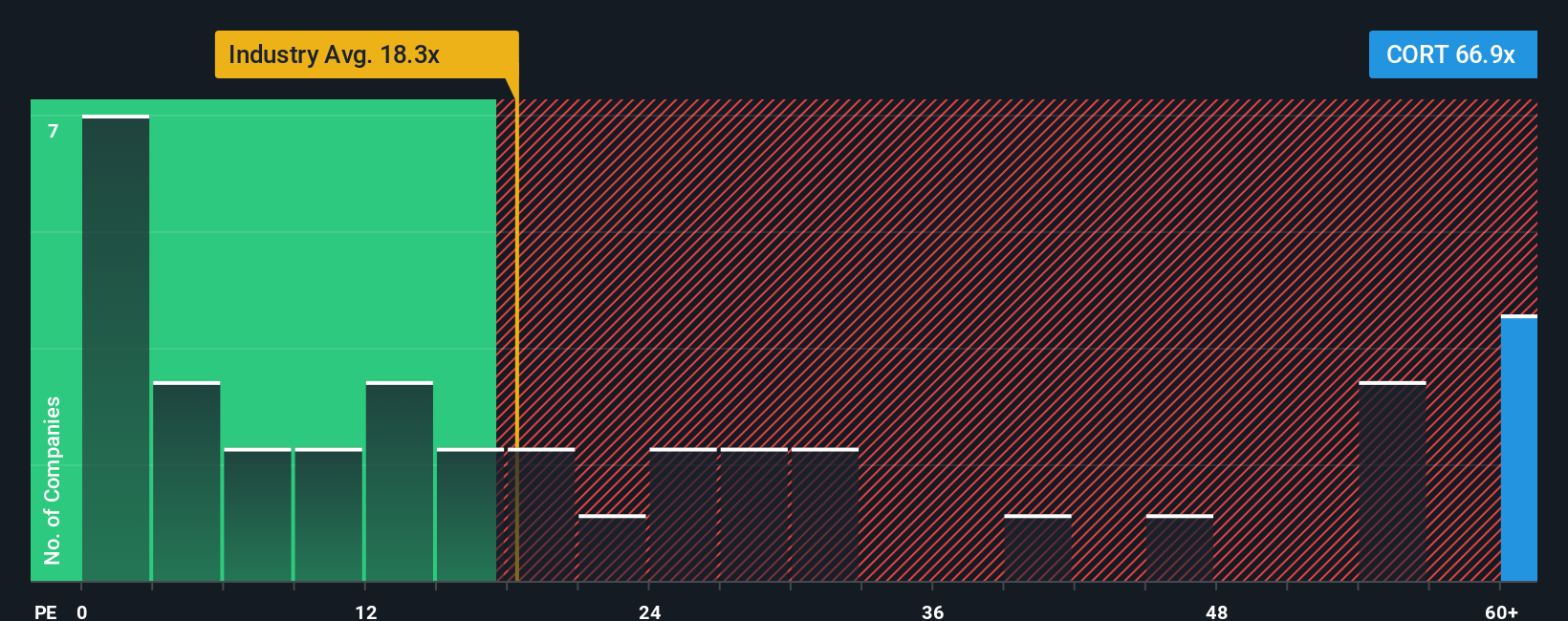

While analysts project a bright future, market valuation tells another story. Corcept Therapeutics trades at a price-to-earnings ratio of 70.4x. This is much higher than the US Pharmaceuticals average of 20x, its peer average of 27.1x, and even its fair ratio of 60x. This premium suggests expectations are sky-high, but also exposes the stock to valuation risk if earnings lag. Will real results eventually catch up with the optimism baked into this price?

Build Your Own Corcept Therapeutics Narrative

If the current outlook doesn’t fully match your perspective, you can always dig into the figures yourself and build a narrative around what you discover. It only takes a few minutes to get started. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Corcept Therapeutics.

Looking for More Investment Ideas?

Searching for your next potential winner? Smart investors always keep an eye on fresh opportunities, and you could be missing out if you only focus on a single stock.

- Uncover real value for your portfolio by scanning these 901 undervalued stocks based on cash flows, where strong fundamentals meet attractive pricing.

- Capture the momentum in artificial intelligence by checking out these 24 AI penny stocks, which are making waves in automation, analytics, and next-gen platforms.

- Boost your passive income strategy by reviewing these 19 dividend stocks with yields > 3%, which consistently delivers yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.