Please use a PC Browser to access Register-Tadawul

A Fresh Look at Dayforce (DAY) Valuation After Its Recent Stock Rally

Dayforce, Inc. DAY | 69.86 69.86 | Delist 0.00% Post |

Most Popular Narrative: 1.2% Undervalued

The most widely followed narrative currently values Dayforce as slightly undervalued, suggesting the fair value per share is modestly higher than the current market price.

Strong and sustained bookings growth (over 40% year-over-year for three consecutive quarters) reflects accelerating enterprise demand for unified, cloud-based HCM platforms. This demand is driven by business digital transformation and complexity in HR systems consolidation, which creates high recurring revenue visibility and positions Dayforce to potentially outperform on top-line growth in future periods.

Curious what’s fueling Dayforce’s valuation edge? There is a specific blend of relentless recurring revenue, ambitious future profit multiples, and rapid adoption stories behind the scenes. If you want to uncover which bold forecasts are included in this near-fair-value call, you’ll need to dive into the deep-dive numbers driving the analyst outlook.

Result: Fair Value of $70.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, intensifying competition and a potential overreliance on core HCM products could quickly challenge Dayforce’s growth and put pressure on earnings visibility.

Find out about the key risks to this Dayforce narrative.Another View: Pricing Through a Different Lens

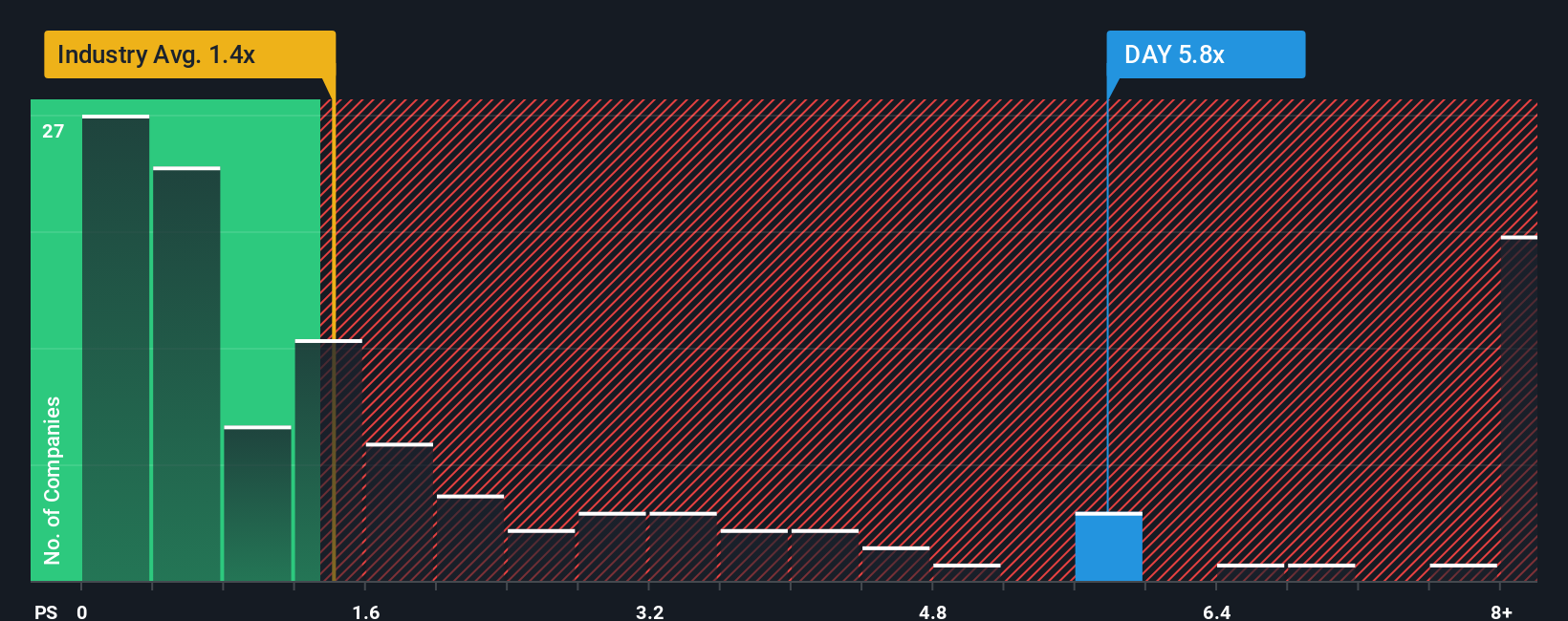

While the main view points to Dayforce as slightly undervalued, a look at typical valuation comparisons tells a different story. In this comparison, Dayforce appears more expensive than similar companies in its industry. Could this premium be justified, or does it signal overheating?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dayforce Narrative

You might not see things the same way as the crowd, and there’s always room to shape your own outlook using the tools at hand. If you want to dig in and map out your perspective, you can start in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Dayforce.

Looking for More Investment Ideas?

Don’t wait for the next headline to shape your investing journey. Step ahead by using powerful tools that spotlight stocks with serious upside and unique advantages before the crowd catches on.

- Uncover overlooked growth opportunities by zeroing in on penny stocks with strong financials set to break out with strong financials and bold momentum.

- Tap into the future of medicine and capitalize on companies transforming healthcare innovation through healthcare AI stocks, where artificial intelligence is already changing patient outcomes and industry dynamics.

- Strengthen your portfolio with steady income by finding dividend stocks with yields > 3% that offer robust yields above 3% and reward investors with reliable cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.