Please use a PC Browser to access Register-Tadawul

A Fresh Look at First Bancorp (FBNC) Valuation Following Regional Bank Credit Concerns

First Bancorp FBNC | 53.36 53.36 | -0.02% 0.00% Pre |

First Bancorp (FBNC) shares faced pressure after fresh disclosures from Zions Bancorp and Western Alliance Bancorp shed light on mounting loan quality concerns among regional banks, stirring broader investor anxiety about possible credit risks.

Although First Bancorp has encountered short-term volatility, its 30-day share price return stands at -10.21% following the negative headlines in regional banking. The longer-term story remains robust, with a 1-year total shareholder return of 11.4% and an impressive 119% over five years. Despite recent profit-taking and sector jitters, the stock’s momentum over the past year suggests that investors still see compelling long-term value, even as perceptions of risk fluctuate in the wake of fresh industry disclosures.

If recent sector headlines have you curious about what else is stirring beyond regional banks, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With First Bancorp trading nearly 19% below analyst price targets and showing robust long-term growth metrics, the question remains: is the current weakness a buying opportunity, or is the market already pricing in future gains?

Price-to-Earnings of 20.4x: Is it justified?

First Bancorp shares currently trade at a price-to-earnings (P/E) ratio of 20.4x, which stands out as significantly higher than both its industry and peer averages. Despite recent volatility, this premium multiple signals that the market has priced in strong expectations for future earnings growth.

The P/E ratio measures how much investors are willing to pay for each dollar of earnings. For banks like First Bancorp, it offers a snapshot of sentiment around profitability and growth prospects relative to competitors.

At 20.4x, First Bancorp is markedly more expensive than the US Banks industry average of 11.2x and the peer average of 13.9x. This suggests investors expect the company to deliver results well above the sector, or that they are paying a premium for greater perceived stability or growth. Compared to an estimated fair P/E ratio of 15.1x, the current valuation could be stretched, leaving room for potential adjustment if expectations do not materialize.

Result: Price-to-Earnings of 20.4x (OVERVALUED)

However, persistent concerns over regional bank loan quality and the potential for earnings disappointments could quickly shift investor sentiment away from First Bancorp.

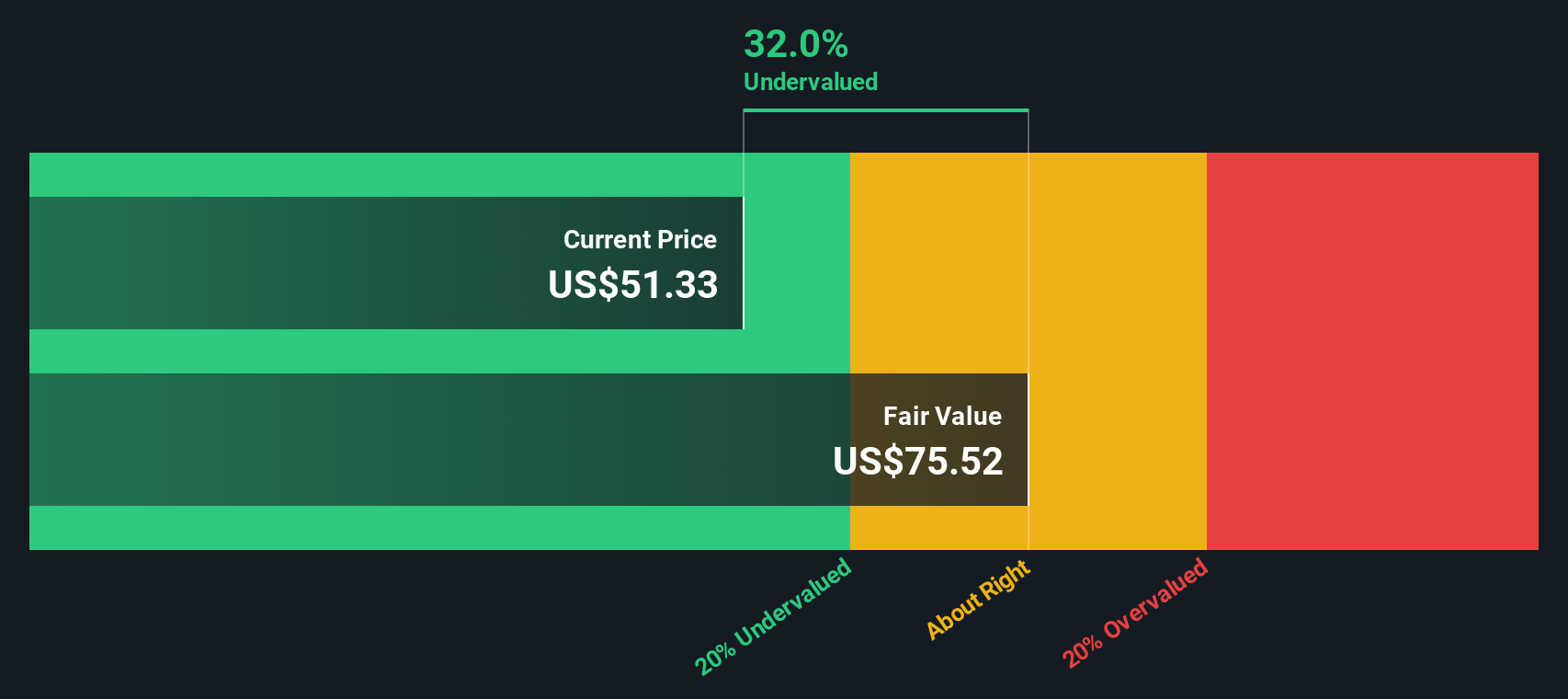

Another View: SWS DCF Model Suggests Undervaluation

While the price-to-earnings ratio paints a picture of overvaluation, our DCF model tells a different story. According to the SWS DCF model, First Bancorp’s current price is nearly 38% below its estimated fair value, which may indicate significant upside. Could traditional ratios be overlooking the stock’s intrinsic worth?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out First Bancorp for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own First Bancorp Narrative

If you like to challenge the consensus or want to dig into the numbers on your own, it’s quick and easy to build your own perspective on First Bancorp. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding First Bancorp.

Looking for more investment ideas?

Smart investors stay a step ahead by acting on real opportunities. Don’t miss out—there are outstanding stocks beyond regional banks waiting for your attention.

- Capture growth potential in next-generation medicine by tapping into these 33 healthcare AI stocks, which is shaping tomorrow’s healthcare breakthroughs.

- Unlock strong income streams with these 18 dividend stocks with yields > 3%, offering robust yields and proven dividend histories.

- Position yourself early in cutting-edge technology with these 24 AI penny stocks, paving the way for tomorrow’s market disruptors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.