Please use a PC Browser to access Register-Tadawul

A Fresh Look at Floor & Decor (FND) Valuation Following Q2 Growth Surprise and Earnings Rebound

Floor & Decor Holdings, Inc. Class A FND | 61.73 | +0.93% |

Floor & Decor Holdings (FND) just released its second quarter results, and there are a few points that should catch investors’ attention right away. The company’s revenue and gross margin exceeded expectations, and management highlighted an uptick in comparable store sales for the first time since late 2022.

Floor & Decor Holdings’ 1-day share price return of 1.8% hints at renewed optimism around the company, but zooming out shows there is still ground to recover, with a year-to-date share price decline of 25.7% and a one-year total shareholder return of -29%. Still, the latest results and positive comp sales may encourage investors who think the recent dip could mark a turning point for the stock's longer-term momentum.

If you’re curious about what other companies are building momentum or catching investors’ eyes, now is the perfect time to discover fast growing stocks with high insider ownership.

The big question for investors now is whether Floor & Decor’s recent rebound signals the stock is undervalued, or if all the good news has already been priced in. Is there really a buying opportunity here, or are markets simply anticipating stronger growth ahead?

Most Popular Narrative: 11.9% Undervalued

The prevailing narrative sees Floor & Decor Holdings as trading notably below its calculated fair value, with a fair value estimate of $82.23 compared to the recent closing price of $72.48. This creates a story where the company's future depends on strong expansion and favorable industry trends.

Floor & Decor's ongoing aggressive store expansion strategy, opening 20 new warehouse-format stores this year and at least 20 planned for next year, with the infrastructure to accelerate openings further as housing market conditions improve, positions the company to capture outsized revenue growth and future operating leverage as end-market demand returns.

Want to know how much growth the narrative expects from all these new stores? Find out which ambitious profit and revenue projections power such a high valuation. Dive in to see why analysts believe this expansion story could rewrite expectations for the stock.

Result: Fair Value of $82.23 (UNDERVALUED)

However, continued weakness in existing home sales and slower than expected new store performance could easily challenge the bullish outlook for Floor & Decor Holdings.

Another View: Valuation by Market Multiples

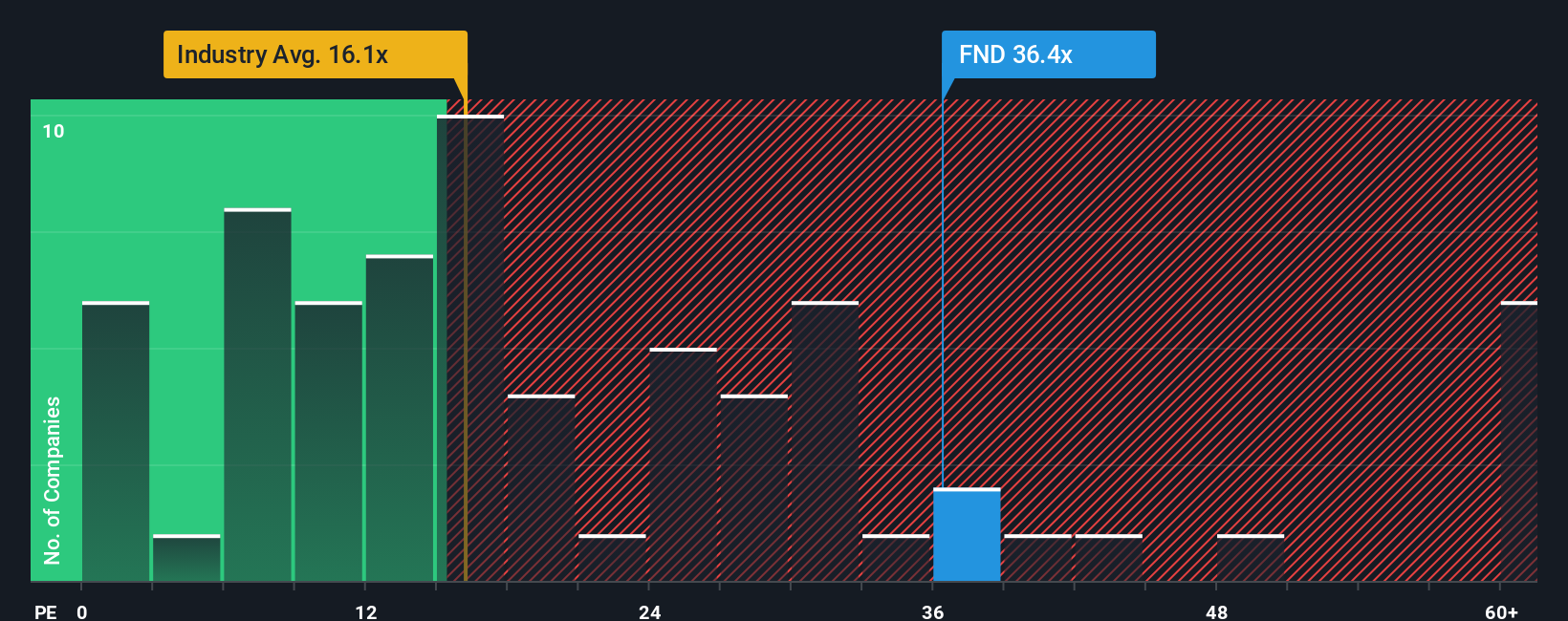

Taking a fresh angle, let's look at Floor & Decor’s price-to-earnings ratio. Currently at 37x, it stands more than double the US Specialty Retail industry average of 16.5x and far above its peer average of 15.4x. The fair ratio, based on market regression, sits at 18.4x. That places Floor & Decor at a notable premium, raising real questions about valuation risk and whether the market is betting on big future growth or ignoring clear signals.

Build Your Own Floor & Decor Holdings Narrative

If you see things differently or would rather dig into the facts yourself, you can craft a personal investment narrative in just a few minutes, your way. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Floor & Decor Holdings.

Looking for more investment ideas?

Smart investors always look ahead, so don't let incredible opportunities slip past you. Use these tailored tools to uncover standout companies primed for growth and innovation.

- Tap into tomorrow’s tech leaders by scanning these 27 AI penny stocks as they ride the artificial intelligence wave.

- Earn consistent income with these 17 dividend stocks with yields > 3% offering attractive yields above 3% for income-focused portfolios.

- Uncover hidden value by targeting these 877 undervalued stocks based on cash flows that are poised for outsized returns based on their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.