Please use a PC Browser to access Register-Tadawul

A Fresh Look at Formula One Group (FWON.K) Valuation Following Strong Long-Term Gains

Formula One Group (FWON.K) shares have edged lower over the past week, slipping 4%. Investors are curious about the stock's current valuation after a 23% gain over the past year, as the company continues to report steady revenue and net income growth.

Momentum for Formula One Group has cooled a bit, with share price giving back 4% over the past week despite strong longer-term gains. Even so, the company’s steady revenue and profit growth continues to drive overall confidence, underscored by a robust 23% total shareholder return in the last year and an impressive 175% total return over five years.

If you’re curious about where opportunity is building next, it could be the perfect moment to broaden your investing search and discover fast growing stocks with high insider ownership

The question now is whether Formula One Group’s momentum means there is still value to be found for new investors, or if the recent gains suggest that future growth has already been factored into the share price.

Most Popular Narrative: 14.6% Undervalued

Formula One Group’s widely followed narrative puts its fair value well above the recent closing price, suggesting the market is still catching up to the company’s long-term growth story.

Expansion into high-growth markets such as the U.S., with record-setting race attendance, media viewership, and a robust event calendar including new race additions like Madrid and continued sell-outs in Las Vegas, will increase hosting fees, media rights values, and local commercial partnerships. This is expected to provide long-term revenue diversification and growth.

Curious how optimistic forecasts shape this bold price target? The secret: analysts are betting on powerful recurring growth, ramping margins, and major international momentum. Which milestone numbers give this narrative its punch? Peek inside and see what projections are revving up Formula One Group’s valuation engine.

Result: Fair Value of $115.87 (UNDERVALUED)

However, short-term gains from one-time events and rising operational costs could challenge the optimistic outlook and test the sustainability of Formula One Group's growth narrative.

Another View: Multiples Raise Caution

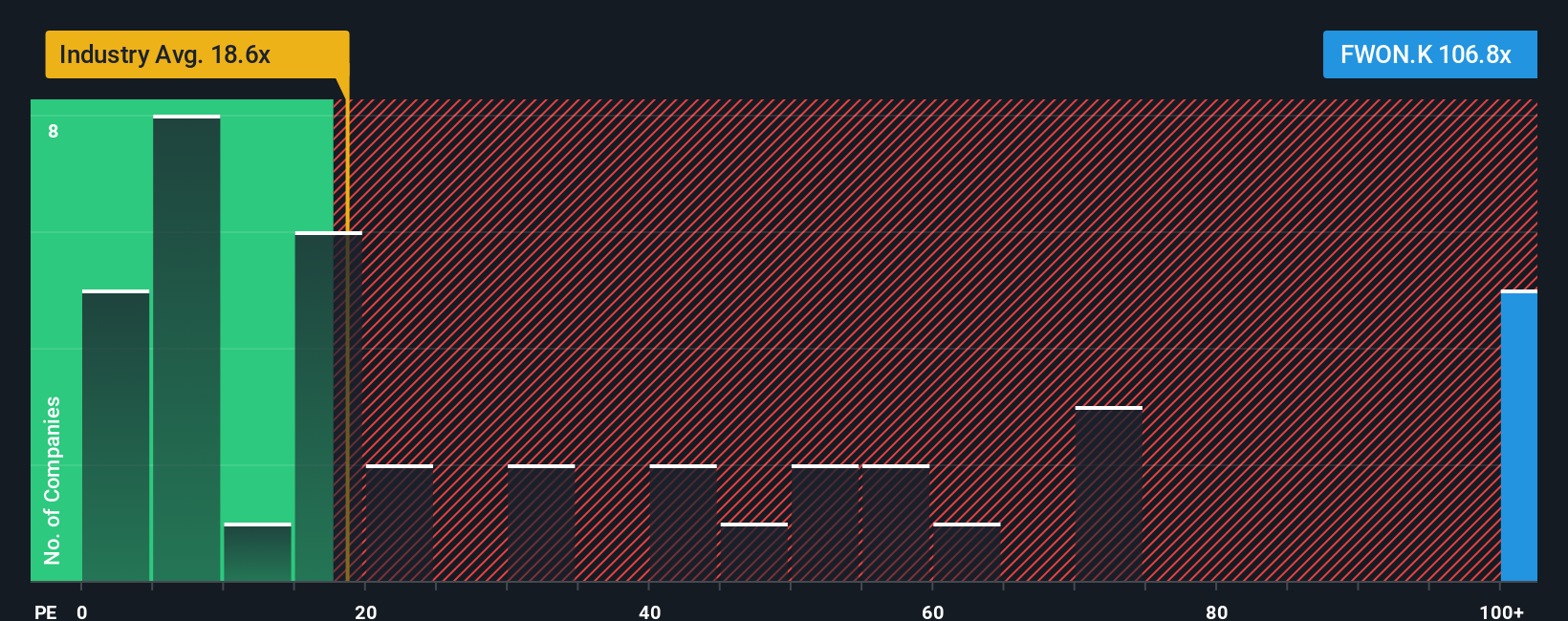

While some forecasts call Formula One Group undervalued, current market pricing tells another story. The stock trades at a price-to-earnings ratio of 90.6 times, which is much higher than the peer average of 51.8 times, the US Entertainment industry at 24.7 times, and even the fair ratio of 28.3 times. This steep premium raises questions about whether recent optimism has run too far, and if the market might eventually adjust closer to more typical levels.

Build Your Own Formula One Group Narrative

If you see things differently, or like to explore the numbers for yourself, you can easily craft your own take in just a few minutes. Do it your way

A great starting point for your Formula One Group research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. Fuel your portfolio with new possibilities using the Simply Wall Street Screener and stay ahead of the crowd.

- Capitalize on emerging industries by checking out these 24 AI penny stocks harnessing artificial intelligence for the next era of innovation and market growth.

- Strengthen your income potential by searching for smart yield opportunities among these 18 dividend stocks with yields > 3% that stand out for stable performance and attractive returns.

- Step into the future of finance with these 79 cryptocurrency and blockchain stocks making strides in blockchain advancements, digital payments, and transforming the financial landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.