Please use a PC Browser to access Register-Tadawul

A Fresh Look at GE HealthCare (GEHC) Valuation Following Nationwide Cardiac Imaging Expansion and New Product Launches

GE HealthCare Technologies Inc Ordinary Shares GEHC | 84.35 | -1.30% |

GE HealthCare Technologies (GEHC) just signed a distribution and services agreement with CardioNavix that could change the game for cardiac PET imaging across the United States. This move brings Flyrcado, GE’s new cardiac PET imaging agent, to more hospitals and outpatient practices. This development speaks directly to the company’s push into areas of higher diagnostic need. For investors, the partnership shows GE HealthCare’s commitment to making advanced diagnostic tools more accessible and aligns with the company’s long-term vision, drawing attention from anyone considering what’s next for GEHC stock.

Momentum has certainly been building for GE HealthCare lately. Beyond the CardioNavix news, the company has unveiled the Vivid Pioneer cardiovascular ultrasound system and rolled out a range of AI-enhanced cardiology solutions, all reinforcing its product leadership. Despite several launches and collaborations, GEHC’s shares remain down about 8% over the past year. However, the past month has seen an encouraging bounce of 9%. This mix of cautious investor sentiment and fresh commercial wins sets the backdrop for an intriguing valuation debate.

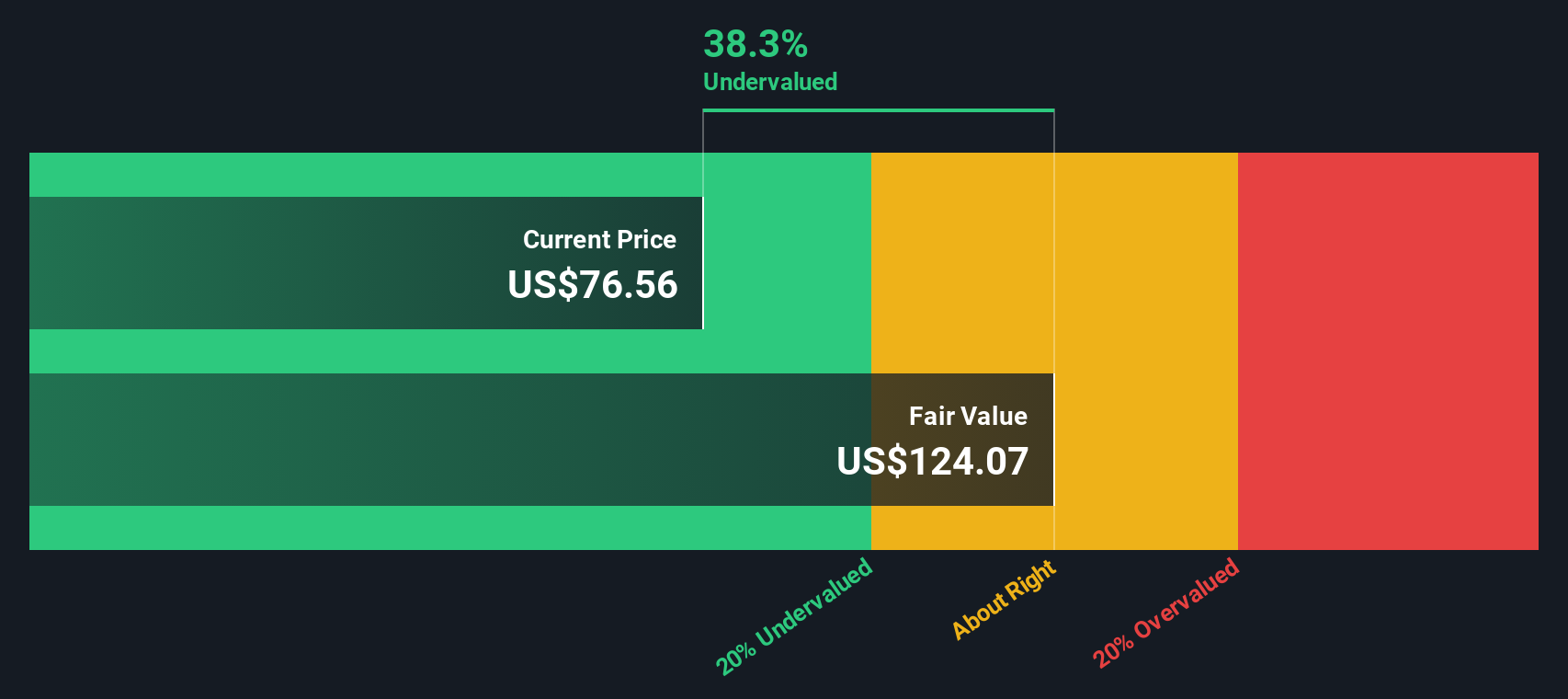

After a year marked by big product pushes but a lagging stock, is GE HealthCare Technologies a bargain with more upside, or has the market already factored in all that future growth?

Most Popular Narrative: 10.4% Undervalued

The most widely followed narrative contends that GE HealthCare Technologies is currently trading at a notable discount to its calculated fair value. According to the consensus, future growth drivers and ongoing business transformation are helping the company unlock upside potential that the market may not yet fully appreciate.

The pipeline of new high-impact products, such as Radiopharmaceuticals, Total Body PET, and Photon Counting CT, is anticipated to drive future revenue growth and potentially improve margins. The focus on expanding recurring revenue, particularly in areas like digital solutions and advanced visualization, is expected to contribute positively to revenue stability and net margins.

Want a glimpse inside the math powering this bullish valuation? The narrative relies on bold projections for sales, profits, and future multiples not often seen outside high-growth leaders. Curious what key assumptions are boosting the fair value above current levels? Find out which financial bets underpin this narrative’s optimism and what could be fueling a bigger run in GEHC stock.

Result: Fair Value of $87.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing tariff uncertainties and intensifying competition from industry rivals could put pressure on both margins and market share in the near term.

Find out about the key risks to this GE HealthCare Technologies narrative.Another View: SWS DCF Model Speaks

Looking at things from a different angle, our DCF model comes to a similar conclusion about GE HealthCare Technologies' valuation. This reinforces the idea that the shares could be trading below their real worth. But does this model see more upside that others might miss?

Build Your Own GE HealthCare Technologies Narrative

If you think there's another angle or want to see what your own analysis reveals, you can build your own view with just a few clicks. Do it your way.

A great starting point for your GE HealthCare Technologies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t limit your strategy to just one stock. Use the power of Simply Wall Street’s tools to uncover more stocks tailored to your goals. You could spot hidden opportunities before everyone else does.

- Capture growth by scanning for undervalued stocks with significant upside using our undervalued stocks based on cash flows.

- Unlock portfolio stability and steady income streams by targeting companies offering dividend stocks with yields > 3%.

- Pioneer the future by focusing on healthcare breakthroughs powered by artificial intelligence with our healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.