Please use a PC Browser to access Register-Tadawul

A Fresh Look at German American Bancorp (GABC) Valuation Following Sector Optimism and Fed Signals

German American Bancorp, Inc. GABC | 44.10 | -0.61% |

German American Bancorp (GABC) shares saw upward momentum as investor confidence returned to regional banks after several major institutions beat third-quarter earnings estimates. Comments from Fed Chair Jerome Powell also supported the rally, as he signaled a potential end to quantitative tightening.

The past year has seen German American Bancorp weather volatility. The recent rally hints that investor sentiment is warming up as sector optimism grows. Despite a modest year-to-date share price return, the stock boasts a solid 45.8% five-year total shareholder return, which suggests patient investors have been rewarded as confidence returns to regional banks.

If you're interested in what else is picking up steam in the market, this is the perfect opportunity to discover fast growing stocks with high insider ownership

With shares bouncing back and current analyst price targets suggesting upside, is German American Bancorp still trading at a discount, or is the market already factoring in all future growth potential?

Price-to-Earnings of 16.9x: Is it justified?

German American Bancorp’s shares currently trade at a price-to-earnings (P/E) ratio of 16.9x, which is notably higher than the sector’s average and above both peer and fair value benchmarks. Compared to its last close price of $38.93, the stock appears expensive by this metric.

The P/E ratio measures how much investors are paying for every dollar of company earnings. For banks like GABC, this ratio provides a quick snapshot of investor expectations relative to profitability.

GABC’s P/E of 16.9x stands out against the US Banks industry average of just 11.7x and the peer group at 12.6x. In addition, the estimated fair P/E is 14.2x, indicating the market is assigning a premium to GABC, perhaps based on future growth expectations or perceived quality.

If the market were to re-rate the stock toward the fair ratio, there could be notable valuation shifts ahead. Explore the SWS fair ratio for German American Bancorp

Result: Price-to-Earnings of 16.9x (OVERVALUED)

However, lingering economic uncertainty and any setback in revenue or net income growth could quickly reverse the recent momentum seen in German American Bancorp's shares.

Another View: DCF Model Paints a Different Picture

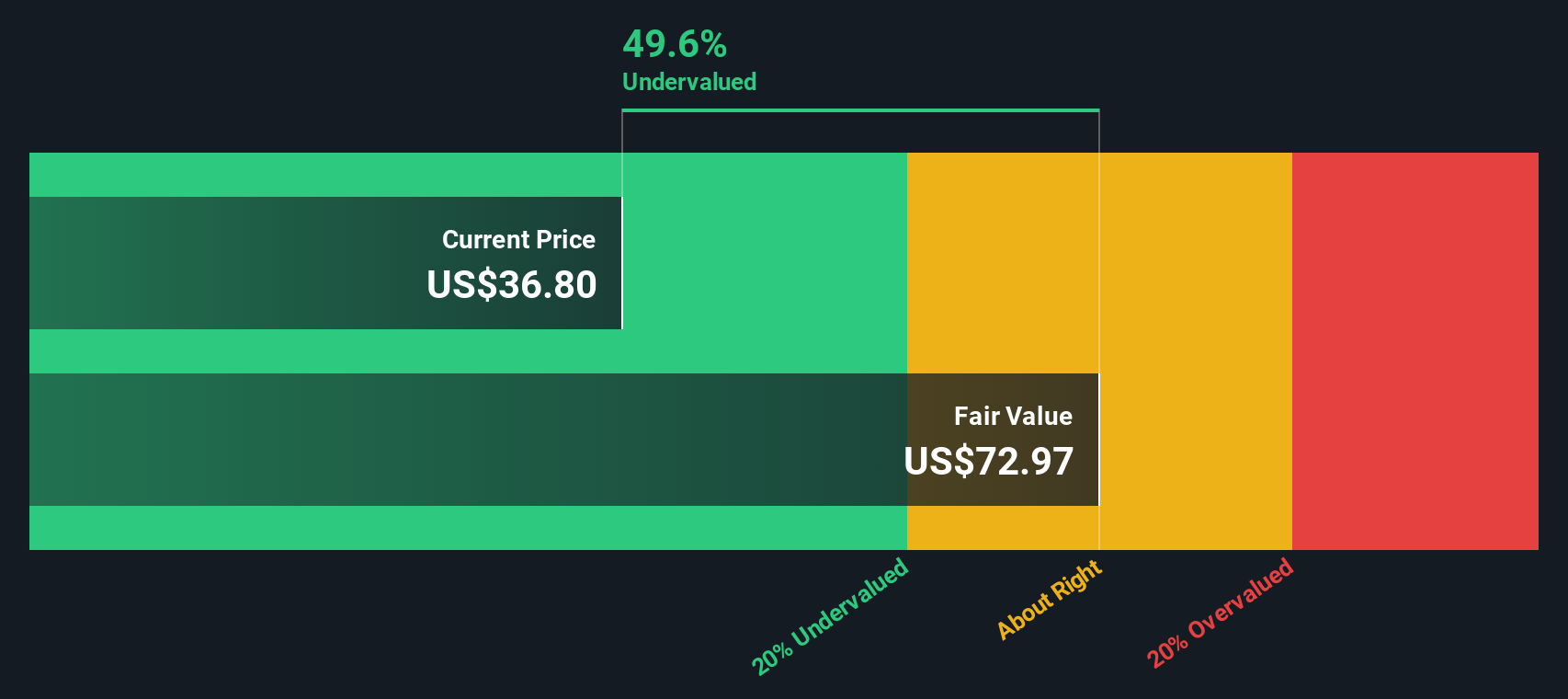

While the P/E ratio suggests German American Bancorp looks expensive compared to peers, our SWS DCF model takes a longer-term cash flow approach. On this basis, GABC appears significantly undervalued, with the share price trading about 45% below our fair value estimate of $70.85.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out German American Bancorp for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own German American Bancorp Narrative

If you see the numbers differently or want to run your own analysis, you can easily build a custom narrative from the data in just minutes, Do it your way

A great starting point for your German American Bancorp research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don't wait for the crowd to spot great opportunities. Take the lead and find compelling stocks that could power up your portfolio right now:

- Benefit from steady income when you unlock these 18 dividend stocks with yields > 3%, which consistently outperform and offer yields above 3% for stronger cash flow.

- Stay ahead of tech trends and chase growth by accessing these 24 AI penny stocks, which are driving the latest advancements in artificial intelligence and automation.

- Boost your portfolio's potential by targeting these 871 undervalued stocks based on cash flows trading at attractive prices based on real cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.