Please use a PC Browser to access Register-Tadawul

A Fresh Look at Global Medical REIT (GMRE) Valuation Following Reverse Stock Split Announcement

Global Medical REIT, Inc. GMRE | 36.63 | -0.22% |

Global Medical REIT (GMRE) just announced a reverse stock split that will convert every five existing shares into one new share and adjust the par value of its common stock. This move is designed to streamline the share structure and is prompting fresh interest from investors curious about what it could mean for GMRE’s future trading dynamics.

After a relatively quiet year, Global Medical REIT’s reverse split has put the spotlight back on its stock. While the 1-year total shareholder return is down 24%, this move signals a management push to reshape perceptions and possibly momentum. Over the longer term, GMRE’s results have swung between double-digit gains and steep pullbacks, which hints at both growth ambitions and lingering uncertainty.

If this shift has you wondering about what else is taking shape in the healthcare sector, you might want to check out See the full list for free..

With the stock trading well below analyst price targets even after recent declines, the real question is whether Global Medical REIT is now undervalued or if the market is accurately reflecting future growth prospects.

Most Popular Narrative: 26.9% Undervalued

Global Medical REIT’s most widely followed narrative points to a fair value well above its last close. This increases attention on its future potential and recent management decisions.

The ongoing and expected acquisition of outpatient medical properties at significant discounts to replacement cost, with in-place rents estimated more than 30% below market, positions the company for outsized rent growth as leases reset to market rates over time. This directly supports top-line revenue and future earnings growth.

Curious how this projection holds up? The key assumptions could reshape how you view GMRE’s potential in the healthcare REIT landscape. What bold financial moves and unconventional market shifts are lurking beneath the surface? Click to reveal the full set of catalysts and forecasts behind this valuation call.

Result: Fair Value of $44.84 (UNDERVALUED)

However, persistent refinancing risks and declining occupancy rates could undermine the optimistic outlook and challenge GMRE's ability to deliver on growth expectations.

Another View: Market Pricing Sends a Different Signal

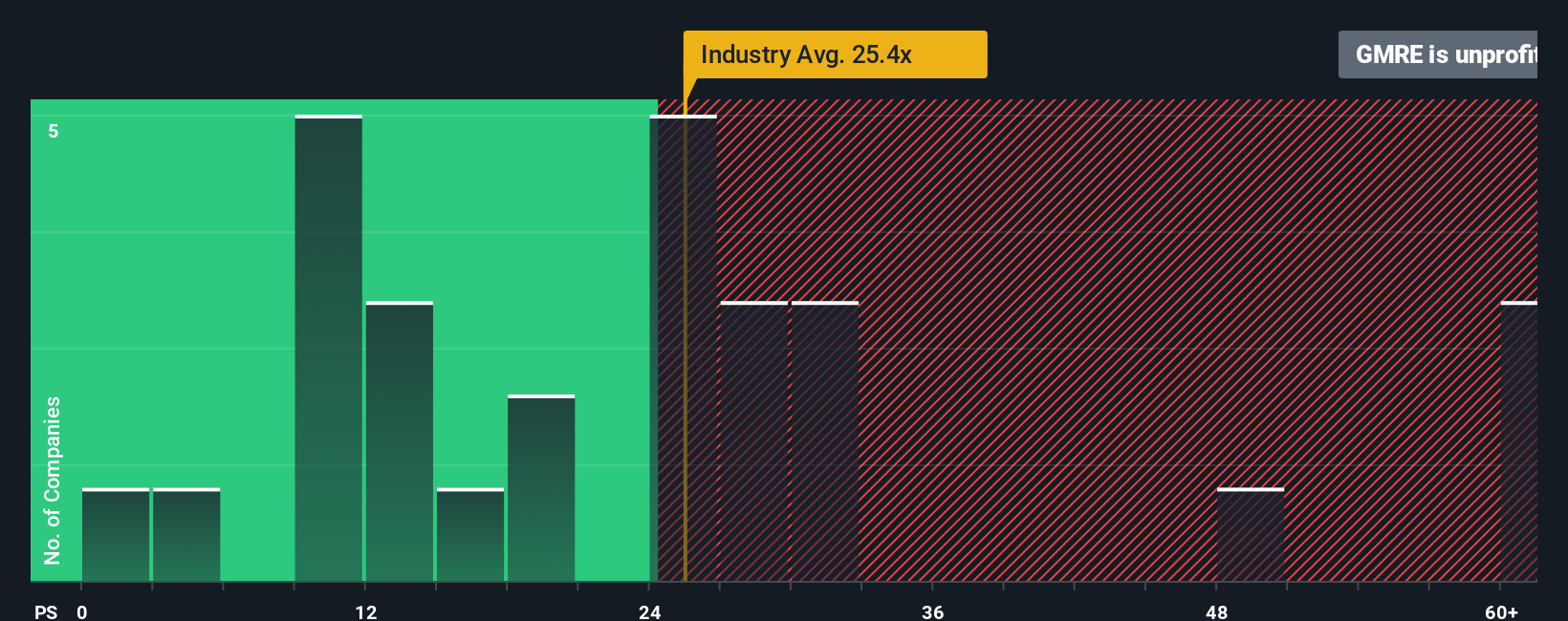

Taking a closer look at GMRE’s valuation using its price-to-earnings ratio, the story shifts. The company trades at 98.2 times earnings, far above both peers (23.3x) and the global industry average (24.3x), as well as the fair ratio of 34.3x. This steep premium suggests the market may be pricing in higher risks or possibly inflated expectations. Is the optimism justified, or does it open the door to volatility ahead?

Build Your Own Global Medical REIT Narrative

If you prefer hands-on analysis or have your own perspective, you can dive into the figures and shape your own story in just a few minutes. Do it your way.

A great starting point for your Global Medical REIT research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors do not wait on the sidelines. Uncover stocks with hidden upsides and explore tomorrow's biggest trends with screener tools designed for real results.

- Capture untapped value by checking out these 909 undervalued stocks based on cash flows that analysts believe are overlooked based on their robust cash flows and profit potential.

- Accelerate your search for income by selecting these 19 dividend stocks with yields > 3% featuring reliable yields higher than 3% for compounding your returns.

- Stay ahead in tech innovation by tapping into these 24 AI penny stocks fueling breakthroughs in artificial intelligence across industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.