Please use a PC Browser to access Register-Tadawul

A Fresh Look at GXO Logistics (GXO) Valuation After New Distribution Center and Efficiency Gains

GXO Logistics, Inc. Common Stock GXO | 53.14 | -1.23% |

If you’ve been keeping an eye on GXO Logistics (GXO) lately, you probably noticed a bit of a stir sparked by the company’s latest move: launching a state-of-the-art automated distribution center in Dorsten, Germany, as part of its ongoing partnership with Levi Strauss & Co. This isn’t just another facility opening; it signals a real step forward in GXO’s European expansion plans and underlines their push for tailored, automated logistics solutions. At a time when some investors might be wary due to softening economic news in the U.S., GXO’s operational momentum seems to be offering a contrasting story.

Looking back over the past year, GXO’s stock performance has been relatively flat, eking out just around 1% in total return. Yet, the recent quarter showed a pickup, with shares climbing nearly 19%, pointing to renewed momentum after a tough month and summer stretch. Alongside the Dorsten facility news, it’s also worth noting that GXO’s return on capital employed has been improving steadily, even as the company expands its asset base. This is a promising signal for those tracking efficiency and growth.

After all the market ups and downs of the year, the question now is whether the latest updates mean GXO Logistics is trading at a discount, or if the current price already reflects its next phase of growth.

Most Popular Narrative: 15.5% Undervalued

The narrative for GXO Logistics suggests that the company is trading below its estimated fair value, implying upside potential for investors. This view is grounded in forecasts of robust earnings growth, improved efficiency, and strategic expansion within the logistics sector.

Enhanced deployment of automation, AI, and proprietary software (with recent launches like GXO IQ) is rapidly improving warehouse productivity, reducing labor costs, and increasing operational efficiency. This is beginning to drive margin expansion and should positively impact net earnings and EBITDA margins.

What is fueling this optimism? Analysts are betting big on a logistics transformation, with future growth calculations hinging on ambitious projections for revenue, earnings, and strategic tech integration. Want to see which single factor, if proven right, could send this valuation soaring? The full narrative breaks down the pivotal assumptions anchoring that double-digit discount to fair value.

Result: Fair Value of $60.41 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, leadership transitions and potential integration challenges with Wincanton could disrupt expected margin gains and cast doubt on GXO's long-term momentum.

Find out about the key risks to this GXO Logistics narrative.Another View: Looking Through a Different Lens

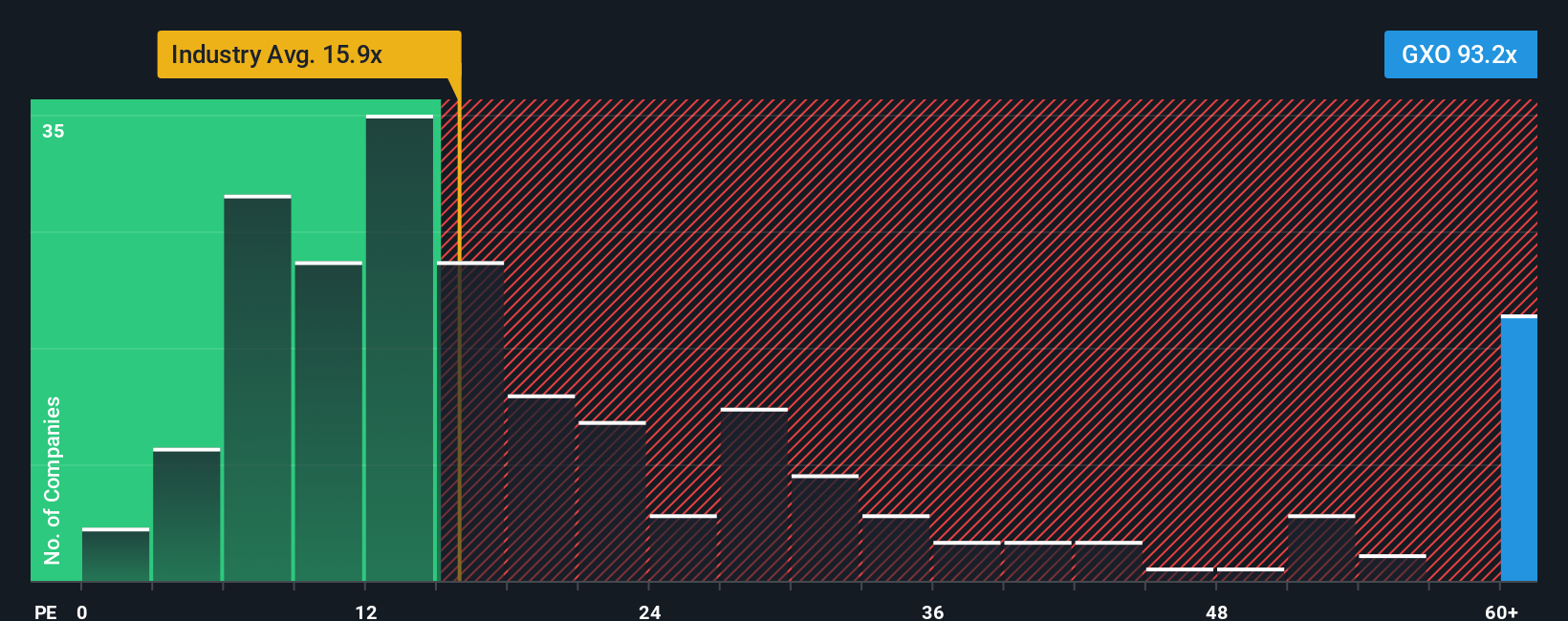

While analysts project upside based on earnings forecasts, a look at valuation compared to the broader industry’s price-to-earnings ratio paints a tougher picture. This suggests the market may be pricing in more future growth than competitors. Could the market be overlooking something, or is caution warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GXO Logistics Narrative

If you’d rather dig into the numbers firsthand or want to shape your own perspective, you can easily build a custom take in just a few minutes. Do it your way.

A great starting point for your GXO Logistics research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Don’t let opportunity pass you by. Turn your research into action and unlock new ideas with tailored screeners built for forward-thinking investors like you.

- Spot rare value gems by tapping into our undervalued stocks based on cash flows and see which companies might be priced well below their true worth.

- Boost your potential for steady returns by checking out dividend stocks with yields > 3% to discover businesses consistently rewarding shareholders with yields above 3%.

- Seize tomorrow’s disruptive trends with AI penny stocks to meet the innovators shaping the future of artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.