Please use a PC Browser to access Register-Tadawul

A Fresh Look at Healthcare Services Group (HCSG) Valuation After Strong 2024 Shareholder Returns

Healthcare Services Group, Inc. HCSG | 19.37 19.37 | -0.21% 0.00% Pre |

Healthcare Services Group (HCSG) stock has been on the move recently, drawing attention from investors curious about what is driving the shift. With steady revenue and net income growth, many are re-examining its long-term potential.

Momentum appears to be building for Healthcare Services Group, as the stock’s share price has climbed 62.39% year-to-date and delivered a robust 73.93% total shareholder return over the past twelve months. After steady revenue growth and several operational milestones, investors are viewing the company’s recovery with renewed optimism, particularly in light of its strong rebounds after earlier setbacks.

If you’re interested in discovering other fast-growing leaders in the sector, now’s a great opportunity to explore the See the full list for free.

But with the stock’s remarkable rebound, the key question for investors remains: is Healthcare Services Group still undervalued, or has the recent surge already priced in the company’s future growth potential?

Most Popular Narrative: 12.8% Undervalued

The most widely followed narrative currently estimates Healthcare Services Group's fair value well above the last close price, highlighting optimism about future earnings and business momentum. The analysis weighs a broad set of strategic and industry factors to build its case.

The company is positioned to benefit from a multi-decade increase in demand for long-term and post-acute care services as the demographic shift of the aging U.S. population accelerates. This supports continued sequential revenue growth and a larger addressable market. With rising healthcare expenditures and an expanding focus on facility stewardship and compliance, the need for outsourced housekeeping and dietary services is increasing. This gives HCSG more opportunities for new contracts and higher retention, translating into sustained top-line revenue growth.

Curious about what drives that optimistic price target? The secret lies in bold forecasts for revenue growth, margin expansion, and changing industry economics. Want to know the exact assumptions and numbers powering this bullish narrative? Unlock the full breakdown and see what the analysts are banking on for Healthcare Services Group's future.

Result: Fair Value of $21.33 (UNDERVALUED)

However, ongoing client concentration and labor cost pressures could quickly spark volatility and threaten Healthcare Services Group’s growth trajectory if conditions deteriorate.

Another View: Market Ratios Tell a Different Story

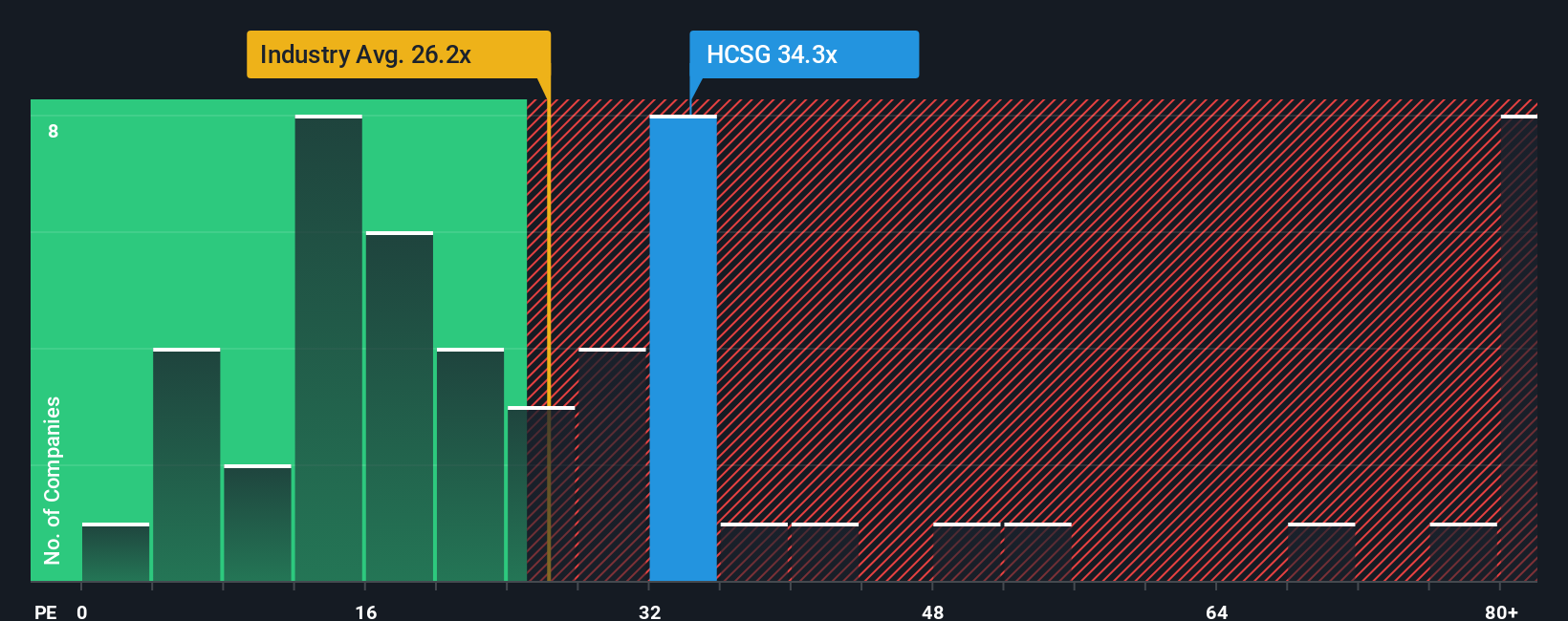

Switching gears from fair value, market price-to-earnings suggests a different angle. Healthcare Services Group trades at 33.9x earnings, which is more expensive than the US Commercial Services industry average of 26.8x and just above the fair ratio of 32.3x. This could imply limited upside unless the company delivers on growth.

Build Your Own Healthcare Services Group Narrative

If you’re interested in seeing things from a different perspective or want to dig into the numbers yourself, you can easily put together your own viewpoint in just a few minutes. Do it your way

A great starting point for your Healthcare Services Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Smart Investing Ideas?

Don’t let the next surge in high-potential stocks pass you by. Tap into tailored opportunities and give yourself a real edge in tomorrow’s market.

- Capitalize on rapid fintech evolution by checking out these 80 cryptocurrency and blockchain stocks for companies shaping blockchain, digital payments, and secure decentralized systems.

- Boost your portfolio’s earning power by targeting these 17 dividend stocks with yields > 3% with yields over 3 percent and proven records of shareholder rewards.

- Get ahead of emerging trends by focusing on these 27 AI penny stocks at the forefront of artificial intelligence innovation and tomorrow’s technology breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.