Please use a PC Browser to access Register-Tadawul

A Fresh Look at Hewlett Packard Enterprise (HPE) Valuation Following Strong Q3 Results and Juniper Networks Acquisition

Hewlett Packard Enterprise Co. HPE | 23.87 | -2.73% |

Hewlett Packard Enterprise (HPE) just delivered a fiscal Q3 update that is sure to turn a few heads. The company’s big move, closing the Juniper Networks acquisition, has not just beefed up its networking segment; it has also shaken up its overall growth story. By reporting results that exceeded market expectations, HPE is making a statement about its commitment to carving out a bigger piece of the AI and hybrid cloud landscape, with autonomous networking now taking center stage.

This news comes at a time when HPE’s momentum is clearly gathering pace. The stock is up 5% in the past week and has delivered a 48% gain over the past year, with a three-year return more than doubling investors’ capital. While recent earnings and acquisitions have attracted attention, investors are also weighing up continued buyback activity, fresh debt offerings, and persistent earnings guidance as part of the broader picture. It is a reminder that HPE is putting its balance sheet to work for growth while trying to stay agile in a rapidly changing tech environment.

After this jump, the real question is whether HPE’s share price reflects all the future upside from its integration with Juniper and new AI capabilities, or if further opportunity still exists below the surface.

Most Popular Narrative: 3.1% Undervalued

According to the most widely followed narrative, Hewlett Packard Enterprise is currently trading at a modest discount to its estimated fair value. This narrative is built on projected future earnings growth, margin expansion, and the strategic upside from recent acquisitions.

"Strategic acquisitions and expansion in high-growth technologies, including the integration of Juniper, launches of next-gen Gen12 servers, and AI-driven management platforms, are enhancing HPE's competitive positioning in edge, networking, and AI. These factors are laying the groundwork for continued share gains and outsized revenue growth relative to traditional industry averages."

What is the real engine driving this valuation call? Analysts are betting on a transformation fueled by bold forecasts for revenue, profit margins, and AI-fueled growth. Which key metrics did they bake into their models to land here? The exact assumptions and rates might surprise you, and the numbers behind this valuation tell a story you will want to follow.

Result: Fair Value of $25.51 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent reliance on hardware and integration risks from the Juniper deal could challenge HPE's projected margin expansion and future earnings narrative.

Find out about the key risks to this Hewlett Packard Enterprise narrative.Another View: Market-Based Valuation Raises Questions

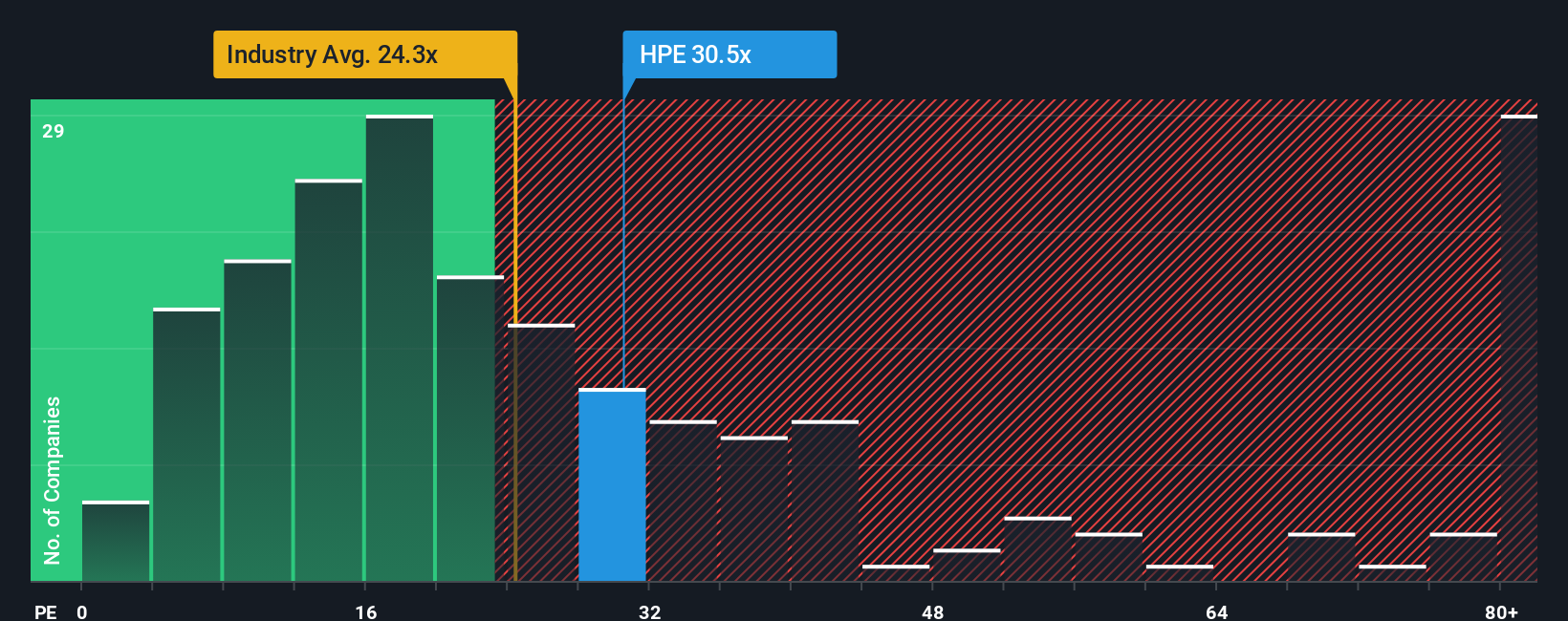

Looking at HPE through the market’s lens, the company appears expensive compared to global sector averages. This price-based method challenges earlier undervalued calls and suggests buyers already pay up for future growth. Which story rings truer for you?

Build Your Own Hewlett Packard Enterprise Narrative

While these insights highlight key debates, you are invited to dive into the numbers and craft your own story. Building a custom view of HPE’s future growth only takes a few minutes. Do it your way

A great starting point for your Hewlett Packard Enterprise research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

Ready for Your Next Smart Investment?

Jump ahead of the crowd by using expert-curated screeners that make spotting tomorrow’s opportunities easy. If you are serious about leveling up your strategy, these picks belong on your radar.

- Discover rare value opportunities with solid fundamentals by checking out stocks that are currently undervalued stocks based on cash flows.

- Take advantage of rapid shifts in the healthcare sector by seeking out innovators disrupting medicine with healthcare AI stocks.

- Benefit from the AI momentum by targeting promising up-and-comers with AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.