Please use a PC Browser to access Register-Tadawul

A Fresh Look at Ingram Micro Holding’s (INGM) Valuation Following Shelf Registration for Potential $535 Million Stock Offering

Ingram Micro Holding Corporation INGM | 21.66 | +1.17% |

Ingram Micro Holding (INGM) has announced a shelf registration filing that permits the offering of up to $535.8 million in common stock. This positions the company to potentially raise significant capital in the future.

After an initial pick-up earlier this year, Ingram Micro Holding’s momentum has cooled, with a 7.16% 1-month share price return in the red and its 1-year total shareholder return sitting at -10.99%. While the shelf registration hints at future moves to strengthen the balance sheet, recent stock action suggests investors are weighing potential dilution and reassessing growth prospects in the near term.

If you’re interested in uncovering what else is catching investor attention beyond the news, now’s the perfect time to explore fast growing stocks with high insider ownership.

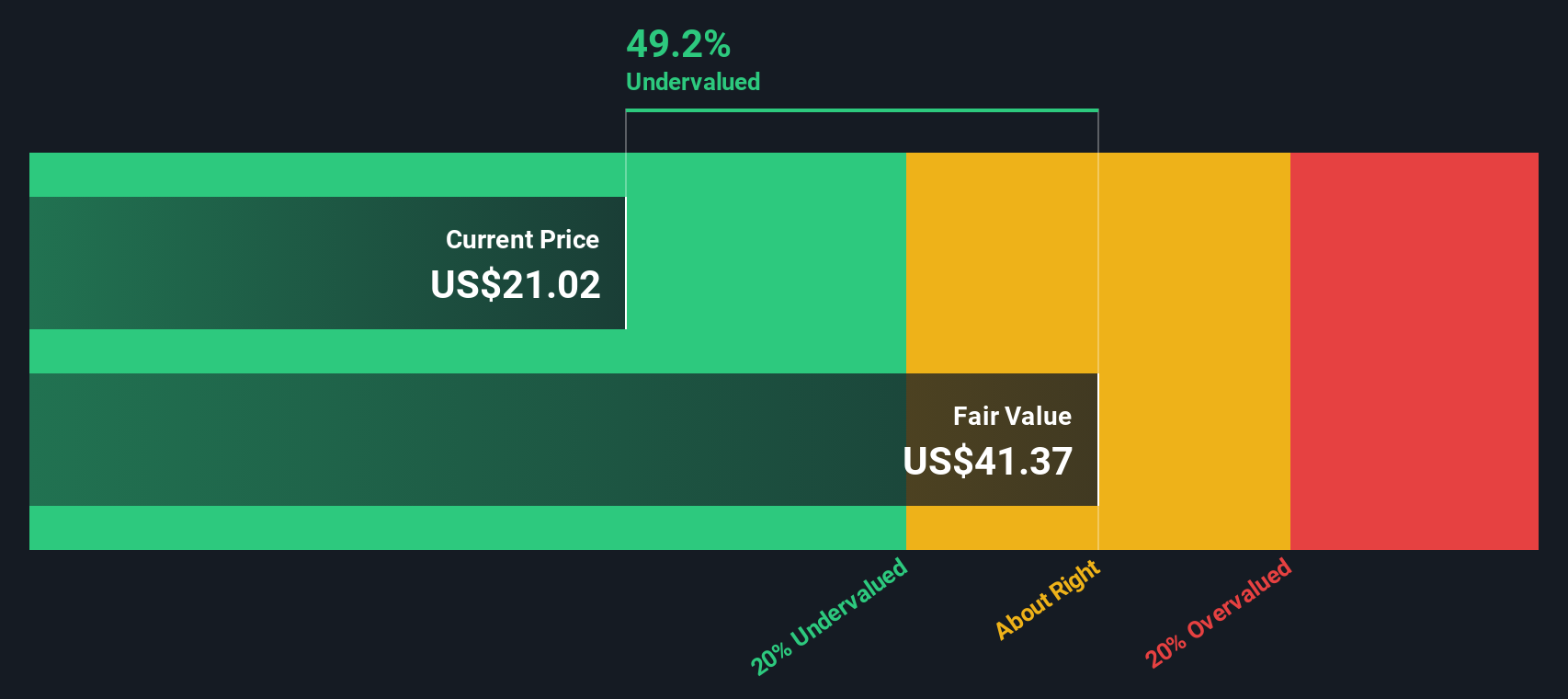

With the stock trading nearly 27% below analyst targets and an intrinsic discount of over 45%, the big question for investors is whether there is real value on offer or if the market is already pricing in its future growth.

Price-to-Earnings of 16.2x: Is it justified?

Ingram Micro Holding’s shares trade at a price-to-earnings (P/E) ratio of 16.2x, standing out as an apparent bargain compared to both industry peers and the broader electronic sector.

The price-to-earnings ratio gives investors a sense of how much they are paying for each dollar of current earnings, providing a snapshot of perceived value versus future potential. For a technology distributor like Ingram Micro, this metric can signal whether the market is discounting its growth prospects or valuing it more like a stable, mature business.

This sub-20 multiple looks conservative compared to the US Electronic industry average of 23.7x. This suggests the market has lower future expectations for INGM than its rivals. When contrasted with the estimated fair P/E ratio of 32.7x, the stock also appears materially undervalued, supporting the case that sentiment could shift if performance trends improve. The market could re-rate this stock upwards toward that fair ratio if growth assumptions play out.

Result: Price-to-Earnings of 16.2x (UNDERVALUED)

However, macroeconomic uncertainty and the potential for ongoing earnings volatility could still challenge the undervaluation thesis in the coming quarters.

Another View: What Does Our DCF Model Say?

Looking through the lens of the SWS DCF model, Ingram Micro Holding appears significantly undervalued. The current share price of $19.96 sits well below the estimated fair value of $36.59, which implies a steep discount. But could this gap suggest a hidden opportunity, or is the market seeing risks that forecasts do not capture?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ingram Micro Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 901 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ingram Micro Holding Narrative

If our take doesn’t align with your own analysis, you can always dive into the numbers and craft a personal perspective using our narrative tools in under three minutes, or simply Do it your way.

A great starting point for your Ingram Micro Holding research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Move beyond the headlines and stay ahead by tapping into fresh opportunities across new sectors using tailored stock screeners. Don’t let tomorrow’s big winners slip past you today.

- Seize the chance for consistent passive income with high-yield picks in these 16 dividend stocks with yields > 3%.

- Spot major trends and position yourself early by checking out the latest movers among these 26 quantum computing stocks.

- Catch undervalued gems trading below their true worth by exploring these 901 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.