Please use a PC Browser to access Register-Tadawul

A Fresh Look at Insmed (INSM) Valuation Following Its Recent Momentum

Insmed Incorporated INSM | 200.67 | +1.90% |

Zooming out, Insmed's momentum has been building steadily, with its share price return rising over 56% in the last three months and its latest close at $152.8. While the one-year total shareholder return sits just above 1%, the longer-term three-year figure stands notably higher at over 5%. This signals growing confidence as optimism for future growth starts to outweigh recent uncertainty.

If you're interested in spotting more innovative biotech movers, take the next step and explore See the full list for free.

With shares near recent highs and growth expectations elevated, the key question now is whether Insmed is still undervalued or if the market has already priced in the company’s next phase. Could there be further upside for new buyers?

Most Popular Narrative: 7.1% Undervalued

Insmed's fair value, as seen through consensus analyst projections, stands higher than its last closing price. This gap is driven by expectations of outsized upcoming product launches and rapidly accelerating revenue.

The anticipated U.S. launch of brensocatib in bronchiectasis in the third quarter of 2025 is a major catalyst. It is expected to significantly increase revenue once it hits the market and starts generating sales late in Q3. The upcoming Phase II data for TPIP in PAH by mid-2025 and brensocatib in CRS without nasal polyps by the end of 2025 are key clinical milestones that could enhance future revenue streams if positive.

Want to know what powers this ambitious price target? The narrative hinges on bold growth forecasts and premium market multiples not often associated with biotechs at this stage. The hidden assumptions driving this valuation might surprise you. Click through to discover the numbers, timelines, and logic pushing Insmed’s projected fair value higher.

Result: Fair Value of $164.41 (UNDERVALUED)

However, there are still key risks ahead, including possible delays in FDA review and challenges with market access, which could slow down expected revenue growth.

Another View: Market Multiples Suggest a Premium Price

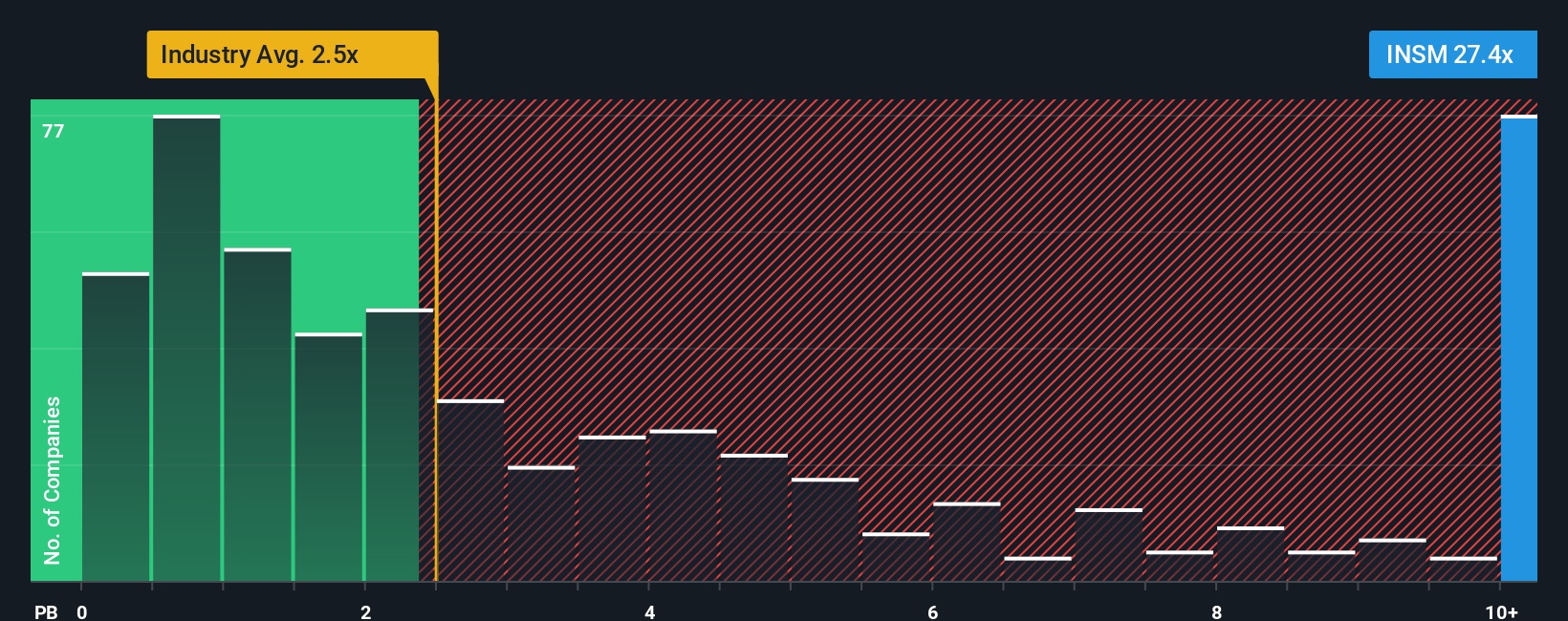

Taking a different approach, market multiples tell a more cautious story for Insmed. The company’s price-to-book ratio stands at 25.8x, which is far higher than both the US biotech sector average of 2.4x and the peer average of 7.4x. This indicates that shares are trading at a significant premium. As a result, valuation risk could increase if growth falters. Could market enthusiasm be running ahead of fundamentals?

Build Your Own Insmed Narrative

If you want to challenge these perspectives or dive into the numbers firsthand, shaping your own Insmed narrative takes just a few short minutes. Do it your way

A great starting point for your Insmed research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the crowd and supercharge your next move by checking out these unique opportunities. Don’t let others beat you to the smartest picks out there.

- Pinpoint the next wave of future-focused opportunities when you tap into these 24 AI penny stocks, setting the pace with groundbreaking advancements in artificial intelligence.

- Boost your portfolio potential and uncover income streams by securing a spot among these 19 dividend stocks with yields > 3% that consistently deliver robust yields above 3%.

- Seize early-stage growth before it hits the mainstream, targeting hidden winners with these 904 undervalued stocks based on cash flows based on strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.