Please use a PC Browser to access Register-Tadawul

A Fresh Look at MACOM Technology Solutions (MTSI) Valuation Following Its New Data Center Chipset Launch

MACOM Technology MTSI | 177.35 | -6.59% |

MACOM Technology Solutions Holdings (MTSI) just made headlines by launching a chipset aimed at overcoming one of the toughest challenges in modern data centers: extending PCIe and CXL connectivity over optical fiber to 100 meters, while consolidating multiple signals for greater efficiency. For tech investors, this gives fresh momentum to the story around disaggregated computing, where flexibility and high performance are key advantages. As the industry moves toward architectures that require massive, fast data transfer with low latency, MACOM’s new solution could put it at the forefront in an evolving market.

This announcement comes after a year in which MACOM’s stock has climbed 30%, carrying solid momentum and outpacing the broader technology sector. While the share price has been steady over the past month, supported by the company’s steady revenue growth and a series of product announcements, much of the long-term interest stems from strong multi-year returns and MACOM’s ability to emerge at key industry inflection points. With data centers and cloud providers focusing more on efficiency and scalability, MACOM’s continued innovation may be contributing to investor confidence and shifting risk perceptions.

After a year of outperformance and with a promising product launch underway, the question becomes: is there a real buying opportunity here, or are markets already factoring in the future growth MACOM could achieve?

Most Popular Narrative: 11.7% Undervalued

The most widely followed narrative currently values MACOM as notably undervalued, pointing to a gap between current market price and estimated fair value.

Ongoing investments in proprietary, high-value R&D and targeted M&A (with $735M in cash and a net cash position) enhance MACOM's ability to rapidly innovate for future optical, RF, and mixed-signal applications. This is expected to further accelerate EPS and free cash flow growth as emerging standards and systems ramp up in coming years.

What fuels this bold price target? The narrative relies on growth assumptions that significantly exceed today’s profit baseline, along with a re-rating typically seen with market leaders. Curious how these financial projections compare to typical sector norms, and which specific metrics influence the fair value? See what’s behind the optimistic view and discover if the market is truly missing the mark.

Result: Fair Value of $149.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, execution issues at the RTP fab or volatile data center markets could quickly shift MACOM's growth outlook and challenge the current sense of valuation optimism.

Find out about the key risks to this MACOM Technology Solutions Holdings narrative.Another View: Expensive on Key Ratio Compared to Peers

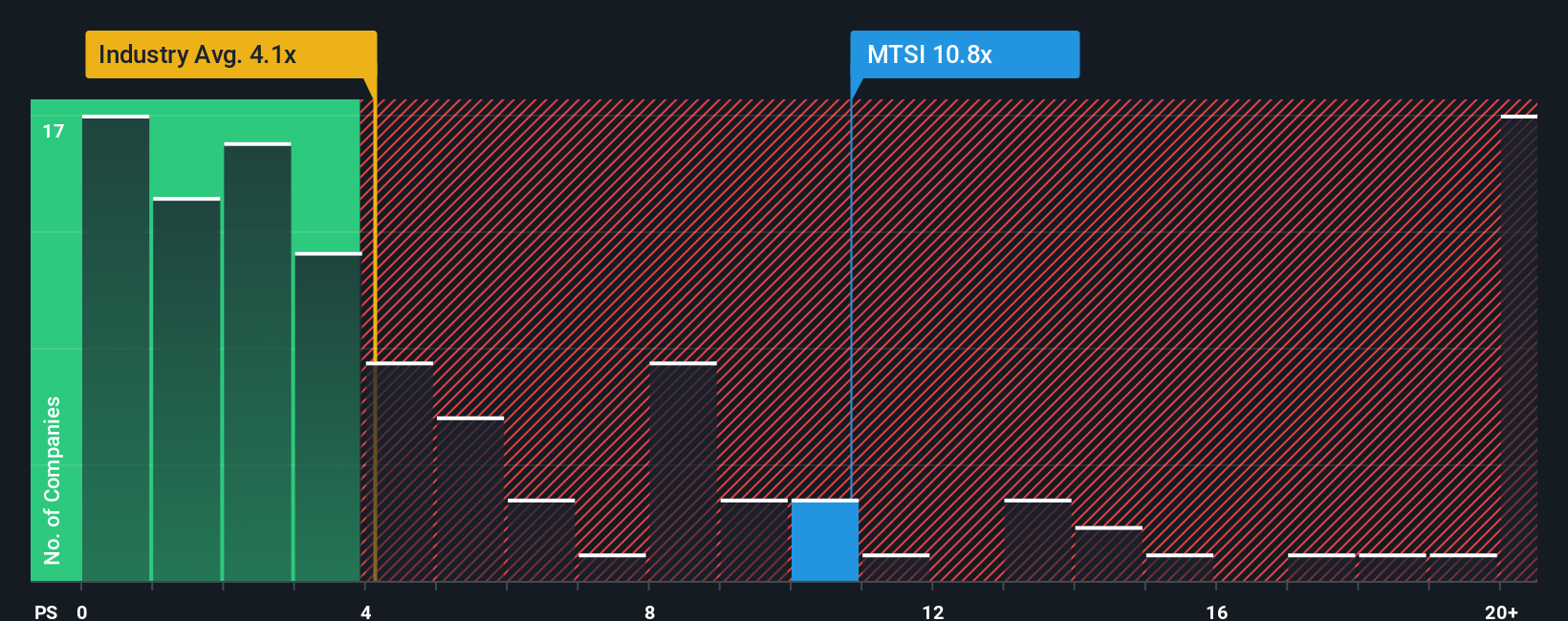

There is a contrasting perspective that uses a simple sales-based yardstick instead of growth projections. On this basis, MACOM currently looks expensive relative to the average for its U.S. semiconductor industry peers. Does this mean the optimistic scenario has gotten ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MACOM Technology Solutions Holdings Narrative

If you have a different perspective or want to dig deeper into the numbers yourself, you can build your own case and personal view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding MACOM Technology Solutions Holdings.

Looking for more investment ideas?

Staying ahead means acting on tomorrow’s trends before the crowd. Use these powerful tools to uncover standout opportunities and avoid missing the next market mover.

- Pinpoint overlooked value as you scan for stocks that may be trading below their true worth by leveraging undervalued stocks based on cash flows in your search.

- Get ahead of the curve by spotting companies advancing breakthroughs in artificial intelligence. Start with AI penny stocks to identify real AI momentum plays.

- Secure reliable returns by finding companies offering robust yields and consistent payments when you tap into dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.