Please use a PC Browser to access Register-Tadawul

A Fresh Look at NETGEAR (NTGR) Valuation as TP-Link Faces Potential U.S. Restrictions and Competition Shifts

NETGEAR, Inc. NTGR | 24.57 | -3.23% |

NETGEAR (NTGR) shares jumped after reports surfaced that the Trump administration may label Chinese rival TP-Link Systems a national security threat. This move could sharply shift competition in the U.S. router sector.

Adding to a flurry of headlines, NETGEAR’s stock has shown real momentum lately, with a standout 22.8% share price return over the last month and a strong 68.7% total shareholder return in the past year. The buzz around possible U.S. restrictions on TP-Link seems to have accelerated bullish sentiment. This suggests that investors view the company’s recent security product launch and shifting competitive landscape as important growth drivers both now and into the future.

If you’re looking for more companies catching attention in tech and AI, see the full list for free: See the full list for free.

With NETGEAR’s share price soaring and bullish headlines everywhere, the key question is whether the stock’s current valuation truly reflects future potential or if investors are still being presented with a compelling buying opportunity.

Most Popular Narrative: 9.9% Overvalued

With NETGEAR trading at $35.18, the most popular narrative sees fair value sitting at $32. The current price sits above this calculated level, marking a possible disconnect between recent market enthusiasm and the narrative's earnings-driven outlook.

The company's ongoing operational optimization, including streamlined supply chain management, leaner inventory, in-sourcing of software development, and organizational restructuring, has already led to record gross margins. This provides a foundation for sustainable margin improvement, enhanced earnings quality, and improved operating leverage as growth resumes.

Curious which aggressive financial moves could reset the margin game for NETGEAR? This narrative hints at levers being pulled that might surprise even seasoned investors. The numbers powering this perspective are not what you'd expect from a company in transition. Find out what’s driving this confident valuation call.

Result: Fair Value of $32 (OVERVALUED)

However, intensifying price competition from low-cost rivals and persistent supply chain setbacks could challenge NETGEAR’s growth narrative in the near term.

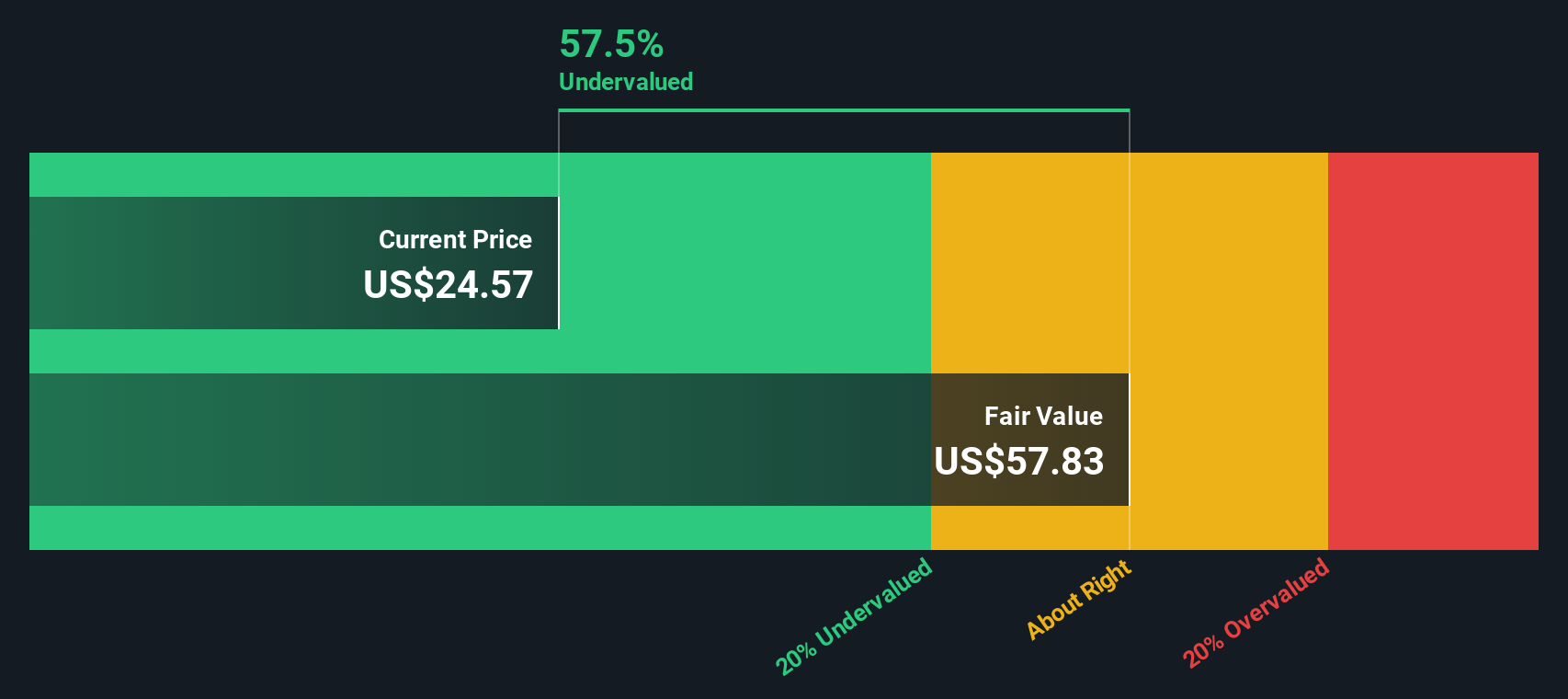

Another View: How the SWS DCF Model Stacks Up

While the most popular narrative finds NETGEAR overvalued at current prices, our SWS DCF model offers a very different take. It suggests shares are actually trading about 36% below fair value, which points to the possibility of significant upside if these underlying cash flow assumptions play out. So, which story should investors trust?

Build Your Own NETGEAR Narrative

If this perspective does not quite fit your view, or you prefer hands-on analysis, it is quick and easy to shape your own insights. Just a few minutes is all it takes. Do it your way

A great starting point for your NETGEAR research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always stay one step ahead by uncovering new opportunities beyond the obvious headlines. Make sure you are not left behind. See where else your capital could grow:

- Tap into huge future potential by checking out these 24 AI penny stocks, where emerging companies are transforming industries with real-world artificial intelligence breakthroughs.

- Secure your portfolio with steady income and reliable payouts by reviewing these 19 dividend stocks with yields > 3%, a handpicked selection of high-yield opportunities.

- Capitalize on tomorrow’s financial game changers by exploring these 79 cryptocurrency and blockchain stocks taking leadership in blockchain technology and the evolving cryptocurrency landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.