Please use a PC Browser to access Register-Tadawul

A Fresh Look at Niagen Bioscience (NAGE) Valuation After Nationwide iCRYO Distribution Expansion

Niagen Bioscience Inc. Ordinary Shares NAGE | 6.50 | -0.31% |

Niagen Bioscience (NAGE) has expanded its reach by partnering with iCRYO, placing its Niagen Plus line and related pharmaceutical-grade offerings in over 900 clinics, including more than 50 newly added locations nationwide. This step highlights increasing demand within the health and wellness space.

Niagen Bioscience’s latest push into hundreds more wellness clinics has sparked renewed interest in the stock. However, share price returns have been relatively muted so far this year. Despite some short-term volatility, long-term total shareholder return remains modest but positive. This suggests the market is watching closely for evidence of sustained growth momentum.

If this expansion in wellness channels has you wondering what else is emerging in the space, it could be a great time to check out See the full list for free.

With new growth drivers and steady revenue gains, investors might wonder whether Niagen Bioscience is flying under the radar or if the current price already factors in all the future upside. Is there still room for a buying opportunity?

Most Popular Narrative: 56.8% Undervalued

The most widely followed narrative places Niagen Bioscience’s fair value far above its latest closing price. This highlights a significant perceived discount that is fueling fresh debate on the company’s long-term potential.

Expansion into pharmaceutical-grade Niagen and increased e-commerce performance could drive revenue growth through direct-to-consumer channels and enhanced demand. Increased R&D investments and legal settlements might strengthen the balance sheet and lead to potential high-margin pharmaceutical developments.

Curious why some see huge upside here? The fair value hinges on rapid revenue and margin growth, plus high expectations for future profitability. If you want to see what is powering this bullish outlook, you need to look inside the narrative’s projections. It holds the numbers most investors never see.

Result: Fair Value of $16.04 (UNDERVALUED)

However, supply chain challenges and intense competition in the NAD booster market remain potential catalysts that could quickly alter the current outlook.

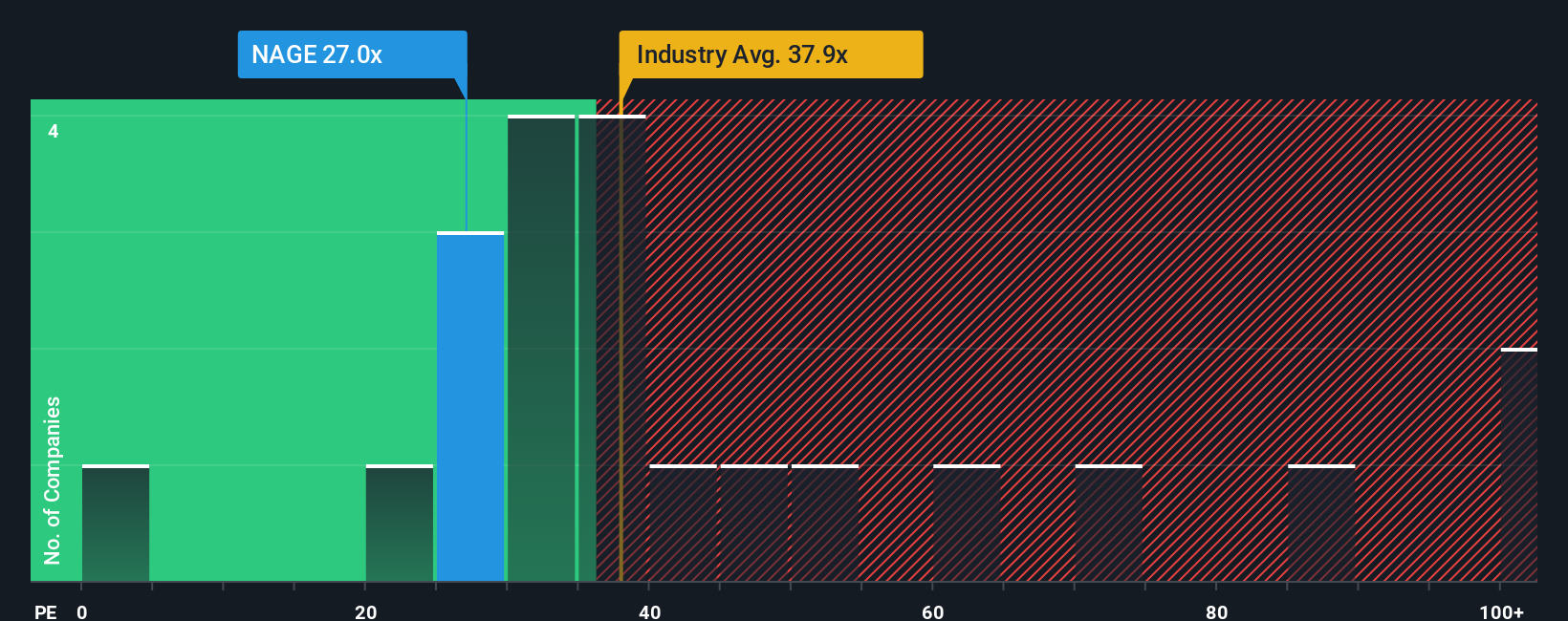

Another View: Multiples Tell a Different Story

While many investors focus on Niagen Bioscience’s growth potential, looking at its price-to-earnings ratio adds a new layer. Currently, shares trade at 33.3 times earnings, just above the US Life Sciences industry average of 32.2x and notably higher than the fair ratio of 28.8x suggested by market regression analysis.

This gap suggests some optimism is already built into the current price. Could the market be expecting even faster improvements, or is there a risk of overpaying if growth slows? The numbers give investors plenty to consider.

Build Your Own Niagen Bioscience Narrative

Keep in mind, if you have your own perspective or want to dive deeper yourself, you can build your own analysis in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Niagen Bioscience.

Looking for more investment ideas?

Smart investors keep their eyes on tomorrow’s opportunities. Seize your edge by checking these handpicked stock themes that others might overlook, because in markets, the next move matters most.

- Amplify your potential for explosive returns by tapping into these 3561 penny stocks with strong financials, which are shaking up their industries with strong financial foundations.

- Capture the next wave of innovation by following these 24 AI penny stocks, where emerging leaders are transforming artificial intelligence into real shareholder value.

- Secure hidden value others may miss by targeting these 901 undervalued stocks based on cash flows, highlighting stocks with powerful cash flows that could be tomorrow’s winners.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.