Please use a PC Browser to access Register-Tadawul

A Fresh Look at Omnicell (OMCL) Valuation as Investors React to Recent Trading Momentum

Omnicell, Inc. OMCL | 43.86 | +1.32% |

Omnicell’s share price has rebounded 10% over the past 90 days after a challenging start to the year, though its one-year total shareholder return remains firmly negative at -21%. While recent trading momentum hints at improving sentiment, the stock is still working to regain its former strength after a broader multi-year slide.

If the shifts around Omnicell’s outlook have you interested in what else is unfolding in the sector, it’s worth exploring compelling opportunities with our healthcare stocks discovery tool: See the full list for free.

With Omnicell rebounding from recent lows and still trading well below analyst targets, the question for investors now is whether the market is overlooking its turnaround potential or if all future growth has already been accounted for.

Most Popular Narrative: 29% Undervalued

Omnicell’s most widely followed narrative pins fair value at $44, a solid premium over the recent closing price of $31.10. This difference has become a focal point for investors seeking a rebound story.

“The continued rollout and adoption of the cloud-native OmniSphere platform across Omnicell's customer base will simplify enterprise-wide medication management, make adding new features and integrating advanced analytics much easier, and accelerate the company's transition to higher-margin, recurring SaaS-based revenues, supporting improved revenue predictability and net margins.”

What’s the math behind this price gap? The narrative leans on double-digit profit growth, fatter margins and a tech-style earnings multiple that defies sector norms. Feeling skeptical or inspired? Crack open the numbers behind Omnicell’s potential rerating.

Result: Fair Value of $44 (UNDERVALUED)

However, persistent tariff-related costs and intense competition could dampen Omnicell’s margin expansion and limit the pace of its earnings rebound.

Another View: High Market Multiple, High Expectations

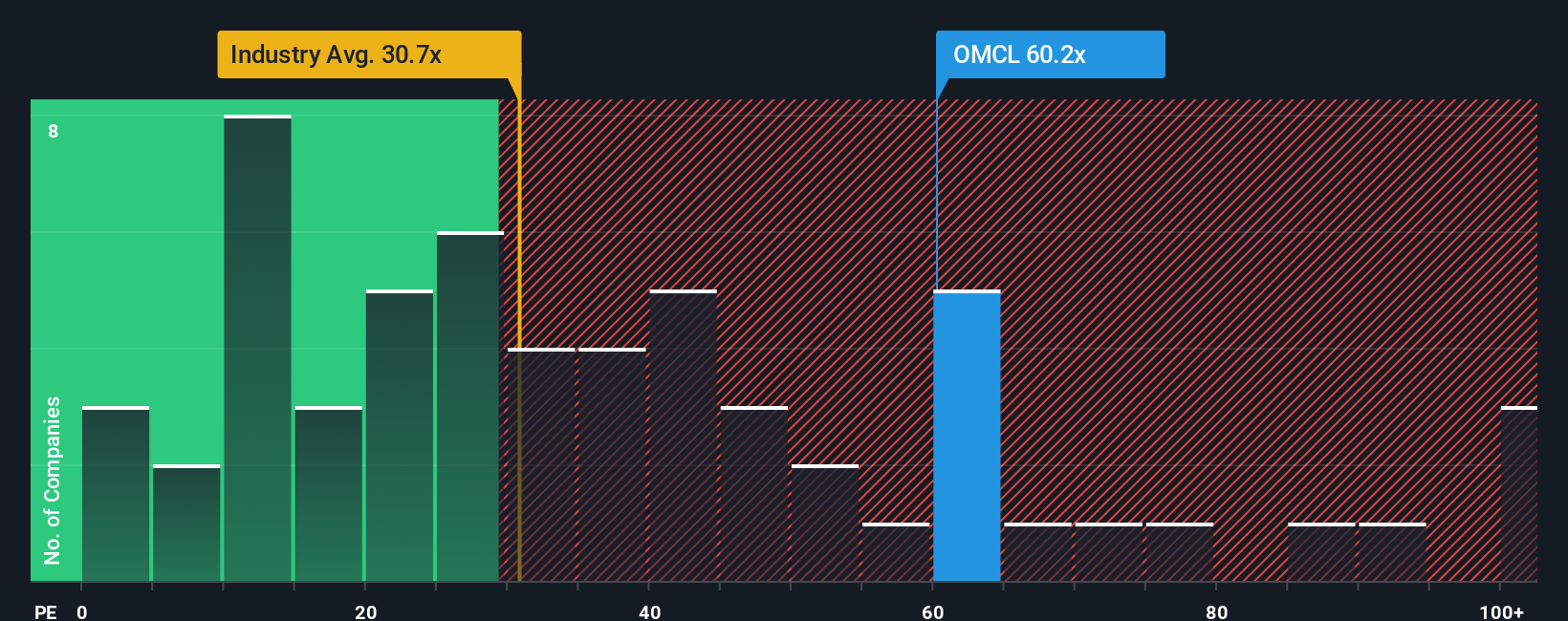

Stepping away from analyst targets, Omnicell’s shares currently trade at a price-to-earnings multiple of 61.9x, which is much higher than both the US Medical Equipment industry average (30.3x) and the average among peers (27.5x). The market’s ratio also sits well above the estimated fair ratio of 23.3x. Such a big gap suggests investors expect significant growth. However, it could also mean heightened risk if performance falls short. Could these elevated expectations set Omnicell up for a rerating, or is the market simply too optimistic?

Build Your Own Omnicell Narrative

If you see things differently or want to dig through the details yourself, crafting your own perspective is quick and straightforward. This process often takes under three minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Omnicell.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Expand your horizons and get ahead of the crowd with these handpicked screens, each designed to surface high-potential stocks and unique strategies you won’t want to overlook.

- Unlock value by targeting companies trading below what their cash flows suggest, using these 877 undervalued stocks based on cash flows to spot emerging bargains before the market catches on.

- Jump into tomorrow’s hottest technologies and back innovation leaders by tracking these 27 AI penny stocks making waves in artificial intelligence.

- Secure consistent income streams by searching for strong yields and steady payouts with these 17 dividend stocks with yields > 3% delivering reliable dividend opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.