Please use a PC Browser to access Register-Tadawul

A Fresh Look at Perrigo’s (PRGO) Value as Labor Strike Raises Operational Questions

Perrigo Co. Plc PRGO | 13.82 | +0.51% |

Perrigo (NYSE:PRGO) is back in the headlines, and this time it may have an impact that investors cannot ignore. A group of 190 Teamsters Local 210 members walked off the job at the company’s Bronx manufacturing facilities after Perrigo proposed to end both overtime pay protections and contributions to workers’ retirement plans. With the union contract expired and negotiations set to continue next week, the strike puts a spotlight on Perrigo’s labor relations just as operational stability is critical.

The news comes against the backdrop of a challenging period for Perrigo’s shares. Over the past year, the stock has slid 16%, with recent quarterly and monthly declines reinforcing a stubborn downward trend. This is despite annual revenue growth of nearly 2% and a major boost to net income in the latest reporting period, suggesting the market remains concerned about issues beyond the top line. The current strike, depending on how long it lasts, could become one of those key operational hurdles.

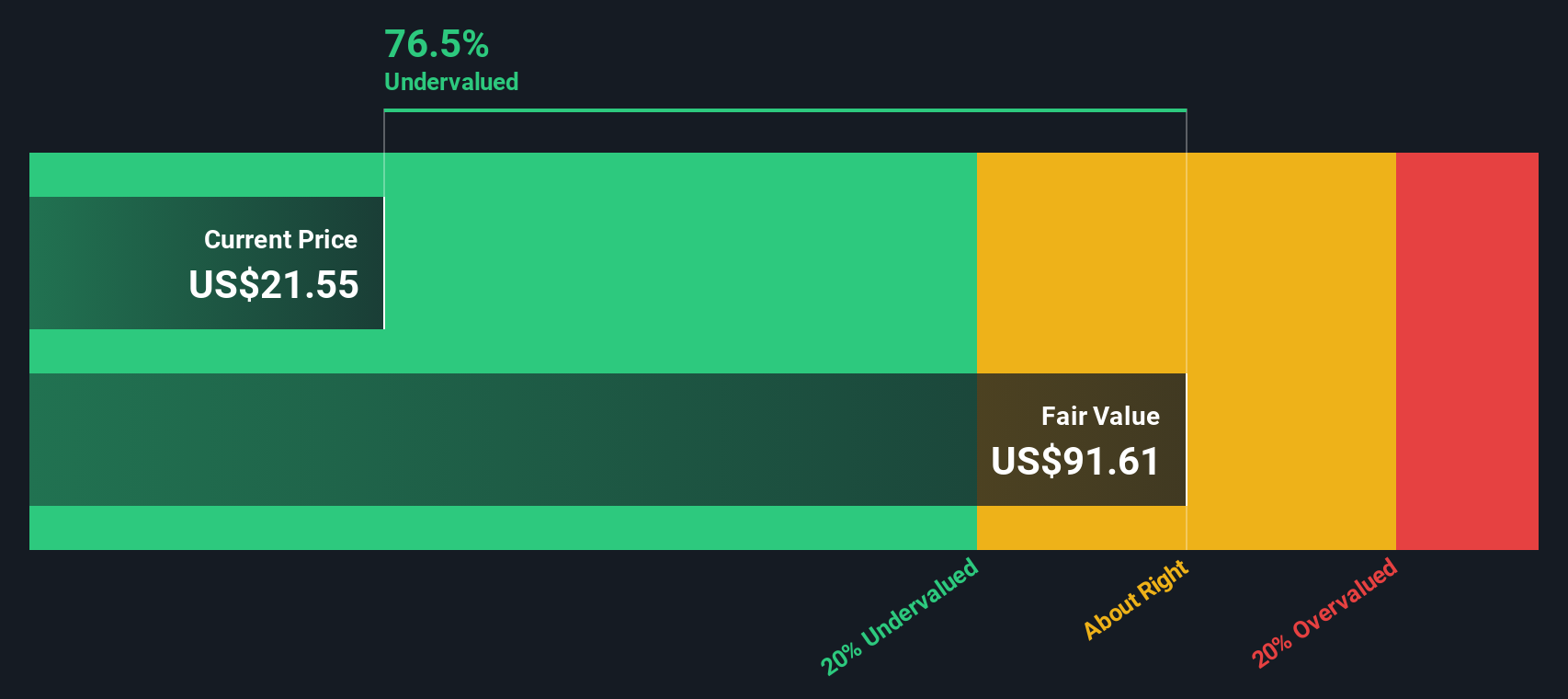

With the share price drifting lower and now facing a fresh labor disruption, investors may be considering whether Perrigo appears undervalued or whether the market is already factoring in more risk and subdued growth going forward.

Most Popular Narrative: 35% Undervalued

Perrigo is currently viewed as significantly undervalued, with the most widely followed narrative assigning it a fair value well above the present share price.

“Increasing consumer cost-consciousness is driving stronger adoption of store-brand (private label) OTC products, with Perrigo reporting accelerated unit and volume share gains. This structural shift is expanding Perrigo's addressable market and supports enduring top-line revenue growth. The aging global population and rising consumer interest in self-care and wellness continue to create longer-term demand tailwinds for Perrigo's OTC and nutrition products, providing stable, defensive revenue streams even in periods of macro uncertainty.”

Curious why analysts see so much hidden value in Perrigo? The growth story is built on bold expectations for profits, revenue, and margins. These numbers set this forecast apart. If you want to uncover which make-or-break targets and aggressive assumptions are fueling such a high fair value, this is the one narrative you cannot ignore.

Result: Fair Value of $34.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing weak demand and heightened competition in key OTC and infant formula markets could quickly diminish Perrigo's perceived value advantage.

Find out about the key risks to this Perrigo narrative.Another View: Our DCF Model

Challenging the optimistic narrative, our SWS DCF model also suggests Perrigo is undervalued based on future cash flows. This method factors in long-term fundamentals instead of just market multiples. Which approach truly captures reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Perrigo Narrative

If you have a different perspective or want to dig deeper into Perrigo’s numbers, it only takes a few minutes to shape your own narrative: Do it your way.

A great starting point for your Perrigo research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Exciting Opportunities?

Set your portfolio apart by acting on tomorrow’s trends today. See what you could be missing by tapping into innovative investment ideas ready for your attention now.

- Unlock rapid growth potential as you scan for penny stocks with strong financials to catch hidden gems before they make headlines and gain an inside edge.

- Power up your returns with automated picks by filtering for companies leading the Artificial Intelligence revolution through AI penny stocks and watch the leaders reshape entire industries.

- Generate consistent cash flow for your future by using dividend stocks with yields > 3% to find high-yielding stocks delivering steady income.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.