Please use a PC Browser to access Register-Tadawul

A Fresh Look at Procaps Group (OTCPK:PROC.F) Valuation After Recent Share Price Surge

Procaps Group (OTCPK:PROC.F) recently jumped onto the radar of many investors after a sudden and sizable move in its stock over the past month. While there was no single event or announcement driving the change, such unexpected price action is often enough to make market watchers pause and wonder whether something new is brewing beneath the surface or if shifting investor sentiment is at play.

Looking at the bigger picture, this recent surge comes after a challenging year for Procaps Group. Despite posting a sharp gain of over 50% in the past month, the stock remains down nearly 30% compared to a year ago and has seen major declines over longer periods. The latest movement might suggest renewed investor interest or a reassessment of the company’s risks, especially as positive momentum appears to be building again after months of poor performance.

With that in mind, is this sharp rebound a genuine buying opportunity, or is the market already pricing in hopes for a turnaround at Procaps Group?

Price-to-Book Ratio: Is it justified?

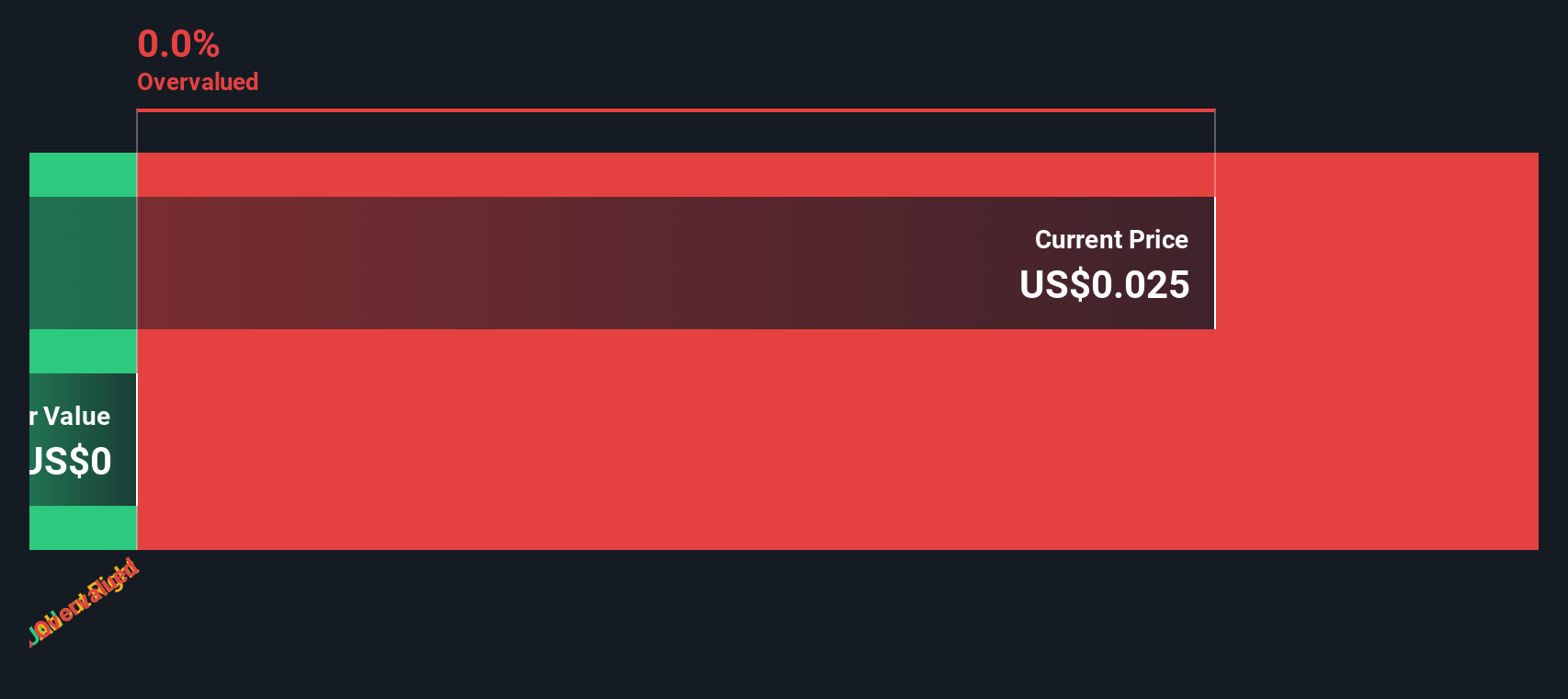

Procaps Group's valuation cannot be determined using the price-to-book ratio, as there is insufficient data to compare this multiple with industry averages or peers.

The price-to-book ratio measures a company's market price relative to its book value and is a common tool for assessing whether a stock is trading at an attractive valuation compared to its net assets. In sectors like pharmaceuticals, this ratio helps investors weigh current market expectations against the value of what the business actually owns.

Without adequate disclosure of financial figures, investors cannot evaluate whether the current market price accurately reflects underlying fundamentals or relative value within the sector. As a result, it is not possible to determine if Procaps Group is undervalued, overvalued, or fairly valued using this method.

Result: Fair Value of $-- (--)

See our latest analysis for Procaps Group.However, a persistent lack of financial transparency and ongoing negative long-term returns could undermine confidence in Procaps Group's recent recovery.

Find out about the key risks to this Procaps Group narrative.Another View: Discounted Cash Flow Perspective

Stepping away from market multiples, our DCF model also cannot provide clarity due to a lack of reported financials for Procaps Group. This leaves investors wondering if there could be value hidden beneath the surface that current methods just cannot reveal.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Procaps Group Narrative

If you have a different perspective or want to dive deeper into the numbers, you can easily build your own take in just a few minutes by using Do it your way.

A great starting point for your Procaps Group research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t miss your chance to find unique opportunities. The Simply Wall Street Screener lets you tap into different trends and spot tomorrow’s winners before the crowd.

- Uncover hidden gems among value plays by starting your search with undervalued stocks based on cash flows. This can help reveal stocks that may be trading below their true worth.

- Capitalize on the booming demand for smart healthcare by checking out healthcare AI stocks to identify companies combining medical expertise with artificial intelligence breakthroughs.

- Catch the next surge in rapidly evolving crypto-related businesses by exploring cryptocurrency and blockchain stocks, where blockchain innovation and digital finance are reshaping entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.