Please use a PC Browser to access Register-Tadawul

A Fresh Look at Tidewater (TDW) Valuation After Q2 Earnings Surprise and Analyst Upgrades

Tidewater Inc. TDW | 53.18 | +0.74% |

Most Popular Narrative: 6.6% Undervalued

According to the most widely followed analyst narrative, Tidewater is currently seen as undervalued compared to its estimated fair value, based on future growth and earnings projections.

Tight vessel supply due to minimal newbuild activity and expected attrition of older vessels is likely to constrain global OSV fleet growth through at least 2027. This may position Tidewater for higher utilization and improved day rates as offshore E&P and construction projects ramp up, serving as a catalyst for sustained revenue growth and margin expansion.

Curious what is fueling this "undervalued" thesis? Behind the headline is an aggressive blueprint that hinges on long-term revenue momentum, rising profit margins, and a future earnings multiple normally reserved for faster-growth industries. Want to know which key assumptions and projections set this price target apart? See how the narrative builds its fair value case on just a handful of surprisingly optimistic figures; the details may surprise you.

Result: Fair Value of $61.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent softness in offshore demand or setbacks in major acquisitions could disrupt Tidewater’s momentum and challenge the current bullish outlook.

Find out about the key risks to this Tidewater narrative.Another View: SWS DCF Model Puts the Spotlight on Potential Underpricing

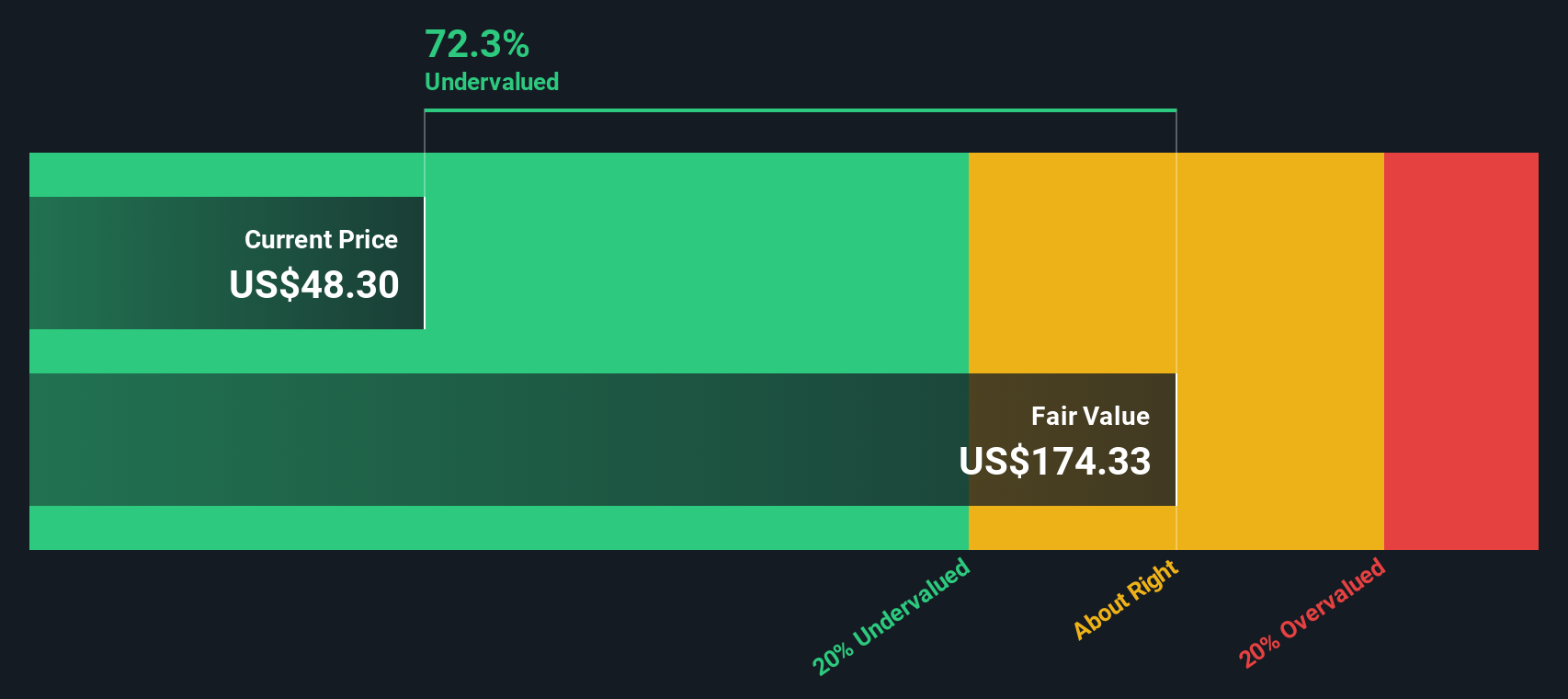

While analysts focus on future growth estimates and market sentiment, our DCF model presents a much more optimistic picture for Tidewater. This suggests that shares may be even more deeply undervalued than they appear. Could this model be identifying value that others overlook?

Build Your Own Tidewater Narrative

If you see things differently or want to dive into the numbers yourself, you can craft your own narrative for Tidewater in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Tidewater.

Looking for More Smart Investment Opportunities?

Why limit your strategy to one company? Give yourself an edge and uncover stocks with the most exciting financial potential before the crowd chases them higher.

- Zero in on hidden bargains by tracking undervalued prospects through our undervalued stocks based on cash flows. See which companies trade well below their intrinsic value and might fuel your next win.

- Spot future industry leaders by targeting AI-powered innovators with AI penny stocks. Stay ahead of the curve as artificial intelligence reshapes the market.

- Secure steady income streams and shield your portfolio from volatility by handpicking high-yield performers using the dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.