Please use a PC Browser to access Register-Tadawul

A Fresh Look at Toast (TOST) Valuation After Strong Recurring Revenue Growth and Analyst Support

Toast, Inc. TOST | 35.28 | -1.92% |

If you’ve been following Toast (TOST), this week’s headlines might have caught your eye. The company just posted another sharp jump in annual recurring revenue, underlined by continued support from prominent analysts. That combination of real business momentum and external confidence is the kind of double benefit investors look for when evaluating whether a stock is at a new inflection point or if it’s simply hitting its stride after a period of steady build-up.

Toast’s performance hasn’t gone unnoticed in the broader market this year. The stock is up more than 52% over the past 12 months, while momentum has eased off lately with a roughly 10% dip in the past month. This recent pullback comes after quarters of growth and optimistic forecasts about Toast’s revenue trajectory. Despite a stiffening pace of customer acquisition costs, the company’s long-term growth track and customer loyalty continue to support the story of a business still gaining ground within its niche.

After this mix of earnings-driven strength and a share price reset, is Toast offering investors an attractive entry point or is the market already accounting for every bit of future upside?

Most Popular Narrative: 21% Undervalued

The most widely followed narrative suggests Toast is currently undervalued, trading well below its calculated fair value. This optimism comes despite a recent moderation in revenue growth forecasts and recent share price volatility.

Long-term challenges with labor shortages and wage pressures in hospitality drive restaurants to seek automation and operational efficiency, increasing demand for Toast's AI-driven tools (such as ToastIQ and Sous Chef) and productivity-enhancing hardware (Toast Go 3). This is expected to support sustained revenue growth and improve net margins. Expansion into new market segments (enterprise chains, food and beverage retail, and international markets like Australia) is anticipated to create diversified and fast-growing high-ARPU customer streams, which will drive top-line growth and help improve earnings resilience.

Curious about the quantifiable growth story powering this 21% undervaluation? The fair value here is calculated using bold projections on revenue, earnings, and margins, which reveals a surprisingly optimistic view of Toast’s expansion and profit future. Just what numbers are behind this bullish outlook? Find out which assumptions set this valuation apart.

Result: Fair Value of $50.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent hardware challenges or aggressive competition from established rivals could quickly pressure Toast’s margins and test the strength of its bullish narrative.

Find out about the key risks to this Toast narrative.Another View: Market Comparisons Tell a Different Story

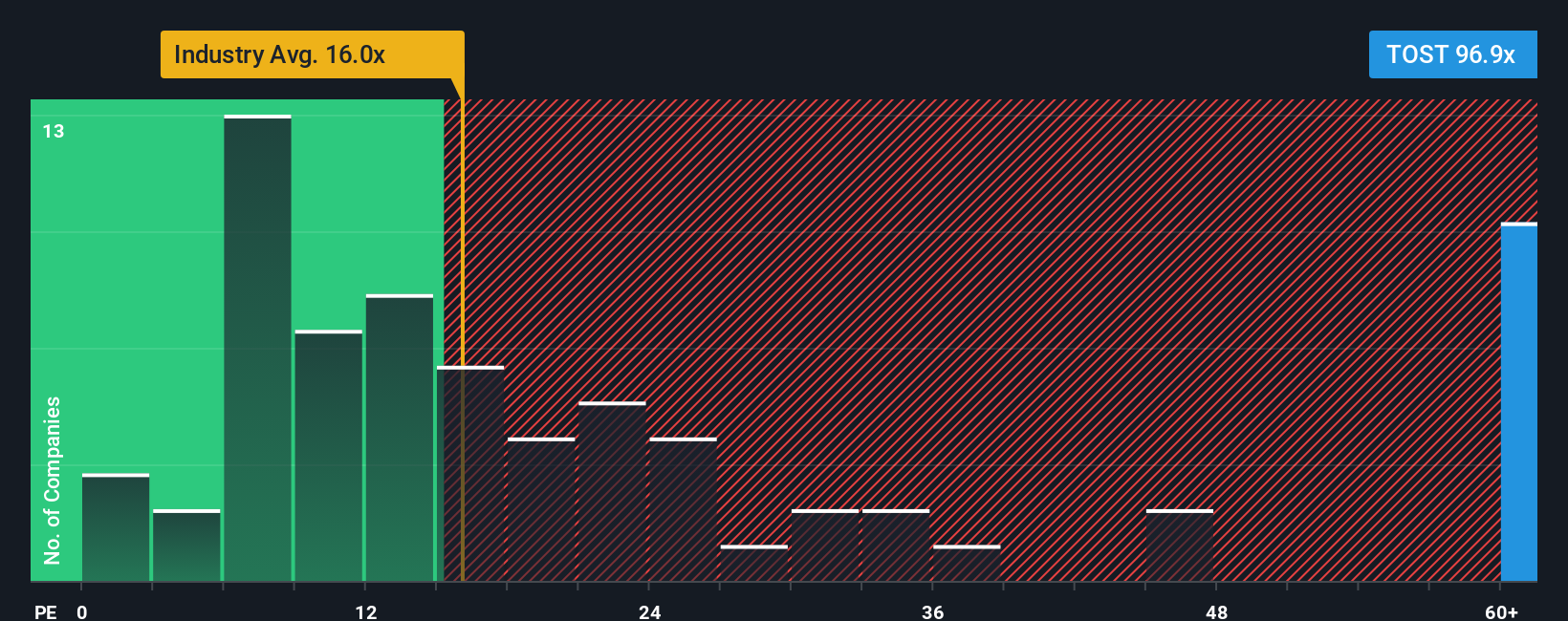

While analyst forecasts point to Toast being undervalued, a comparison to the sector’s earnings multiples paints it as expensive relative to industry norms. Could market optimism be inflating expectations, or simply running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Toast Narrative

Of course, if you see the numbers differently or want to dig into Toast’s story with your own research, you can put together your perspective in just a few minutes using our tools. Do it your way.

A great starting point for your Toast research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Opportunities?

Don’t leave your portfolio limited to just one story. Tap into high-potential sectors and companies rising fast by checking out these targeted ideas below. People who act today may benefit from these opportunities.

- Amplify your returns by jumping into markets where companies are truly trading below their worth through undervalued stocks based on cash flows.

- Stay ahead of the innovation curve by researching the most promising breakthroughs in healthcare technology, starting with healthcare AI stocks.

- Capitalize on next-wave tech trends and spot quantum breakthroughs before they go mainstream with quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.