Please use a PC Browser to access Register-Tadawul

A Fresh Look at Toast (TOST) Valuation Following Analyst Upgrade and Growth Ambitions

Toast, Inc. TOST | 37.28 | +2.93% |

If you’ve been watching Toast (TOST) lately, the action around this stock is picking up and for good reason. The company just received a Zacks Rank upgrade to #2 (Buy), signaling fresh optimism from analysts about up-and-coming earnings growth. Combine that with Toast’s recent moves to spotlight its AI-driven innovations and international ambitions, and it makes sense that investors are giving this name a closer look.

This upgrade follows a period where Toast outperformed the market in its most recent session, gaining more than 2%. However, it still trailed sector gains for the past month. Looking back on the year, Toast’s share price has climbed nearly 48%, momentum that has largely been driven by upbeat earnings outlooks and new product developments such as its AI sous-chef and marketing tools. CEO Aman Narang has also emphasized expansion plans at industry conferences, underscoring management’s confidence in future growth.

With the upgraded rating and increased investor attention, the question now is clear: is there real value left for new buyers, or is the market already pricing in Toast’s next growth phase?

Most Popular Narrative: 18.6% Undervalued

Based on the most widely followed narrative, Toast is currently seen as undervalued with meaningful upside to its fair value. This perspective hinges on aggressive growth assumptions and ambitious profit margin improvements in the coming years.

The rapid adoption of integrated digital payment and ordering solutions, including mobile and contactless experiences, continues to expand Toast's addressable market. This positions the company to capture increased transaction volume and higher recurring fintech and software revenues as restaurants upgrade from legacy systems.

Want to uncover what’s really fueling Toast’s high valuation? There is a bold strategy around profit margins and revenue growth that could rewrite expectations. Intrigued by the numbers and the assumptions the analysts used? Find out what’s behind this valuation and see which projections could surprise you.

Result: Fair Value of $50.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising costs and intense competition could threaten Toast’s margins. If these challenges persist, they could create real hurdles to the bullish growth narrative.

Find out about the key risks to this Toast narrative.Another View: Is Toast Really That Cheap?

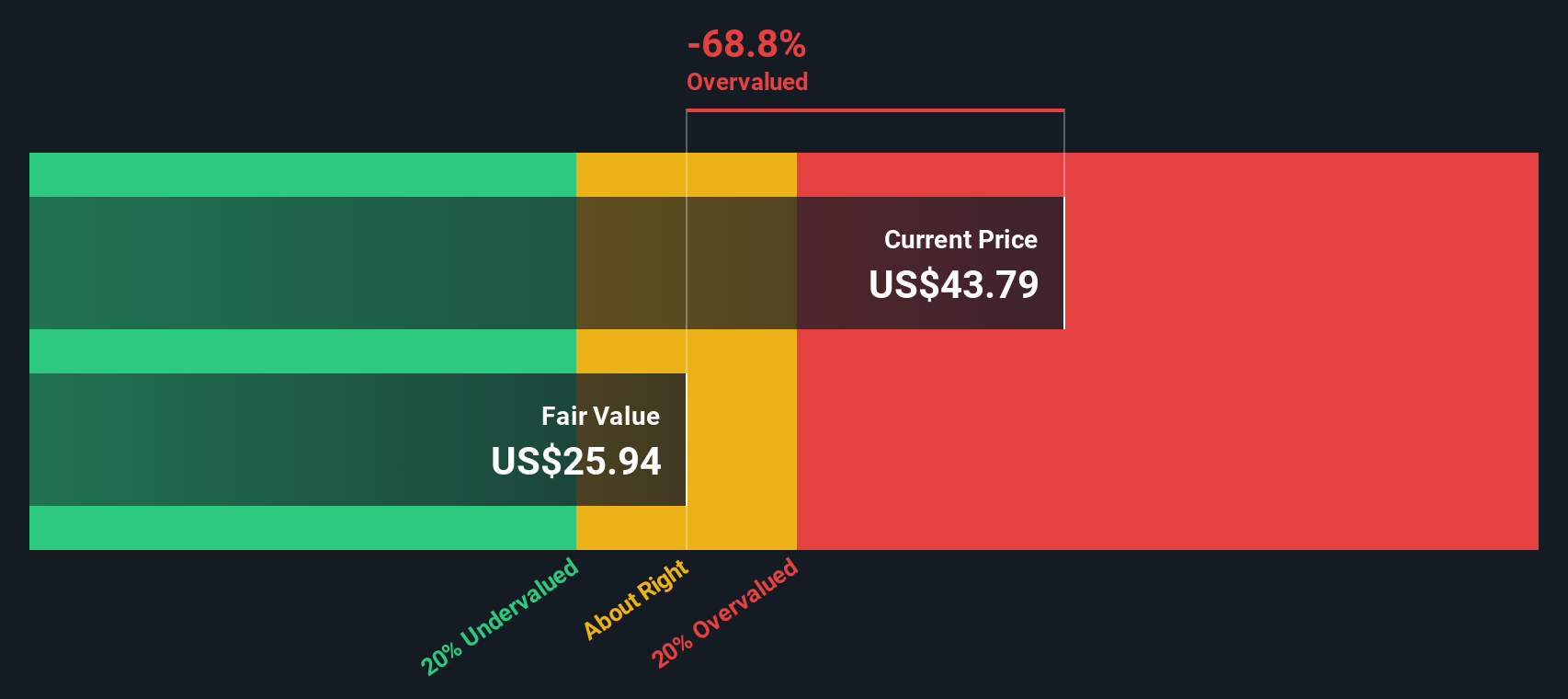

While analysts see upside based on optimistic growth and profit forecasts, a closer look using the SWS DCF model tells a different story. In this analysis, Toast is actually trading above what our model views as fair value. Which figure deserves your trust?

Build Your Own Toast Narrative

If you have your own perspective or want to dig deeper into the numbers, you can craft your personal narrative from scratch in just a few minutes. Do it your way

A great starting point for your Toast research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Stock Opportunities?

Why limit yourself to just one winning idea? Supercharge your search by using the Simply Wall Street Screener to uncover different angles for outperformance.

- Unlock the potential of rising technology by scanning for innovators in artificial intelligence and machine learning with AI penny stocks, a tool built to spotlight tomorrow’s leaders.

- Target strong income streams by searching among top-performing companies offering reliable payouts, all highlighted in our easy-access tool for dividend stocks with yields > 3%.

- Jump ahead of the crowd with unique insights into digital currency and blockchain trends using our tool featuring cryptocurrency and blockchain stocks, designed for the next phase of financial transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.