Please use a PC Browser to access Register-Tadawul

A Fresh Look at USA Compression Partners (USAC) Valuation After Recent Performance Highlights

USA Compression Partners LP USAC | 24.26 24.26 | -1.38% 0.00% Pre |

USA Compression Partners (USAC) has been on investors’ radar after its most recent performance updates attracted attention. With a steady annual revenue growth and positive returns over the past year, the stock’s recent movements raise some valid questions for those watching the energy sector closely.

USA Compression Partners’ share price has held steady recently, but what stands out is its consistent total shareholder return: 11.6% over the past year and a remarkable 269% over five years. This points to a stock that has quietly rewarded patient investors even as short-term price momentum has been muted.

If you’re interested in broadening your search beyond the energy space, now is a perfect time to discover fast growing stocks with high insider ownership.

But with shares trading at a notable discount to analyst price targets and strong financial growth figures, the big question is whether there is a genuine undervaluation here or if the market has already accounted for future gains.

Most Popular Narrative: 11% Undervalued

With USA Compression Partners last closing at $23.58, this widely followed narrative sets its fair value at $26.50, which points to clear upside potential in analysts’ eyes as the market’s price lags behind growth projections and contract momentum.

Robust growth in natural gas demand fueled by AI, cloud computing, and massive new data center investments is driving a sustained need for reliable, high-horsepower compression solutions. This positions USAC for ongoing contract wins and steady revenue growth.

Want to know the quantitative engine powering this price target? Behind the scenes, big assumptions around contract renewals, margin breakthroughs, and faster earnings growth are at play. Discover the bold forecasts investors are betting on, and find out what makes this estimate so surprising.

Result: Fair Value of $26.50 (UNDERVALUED)

However, concentrated reliance on a few key customers or rising costs could challenge revenue stability and test the optimistic growth narrative for USAC.

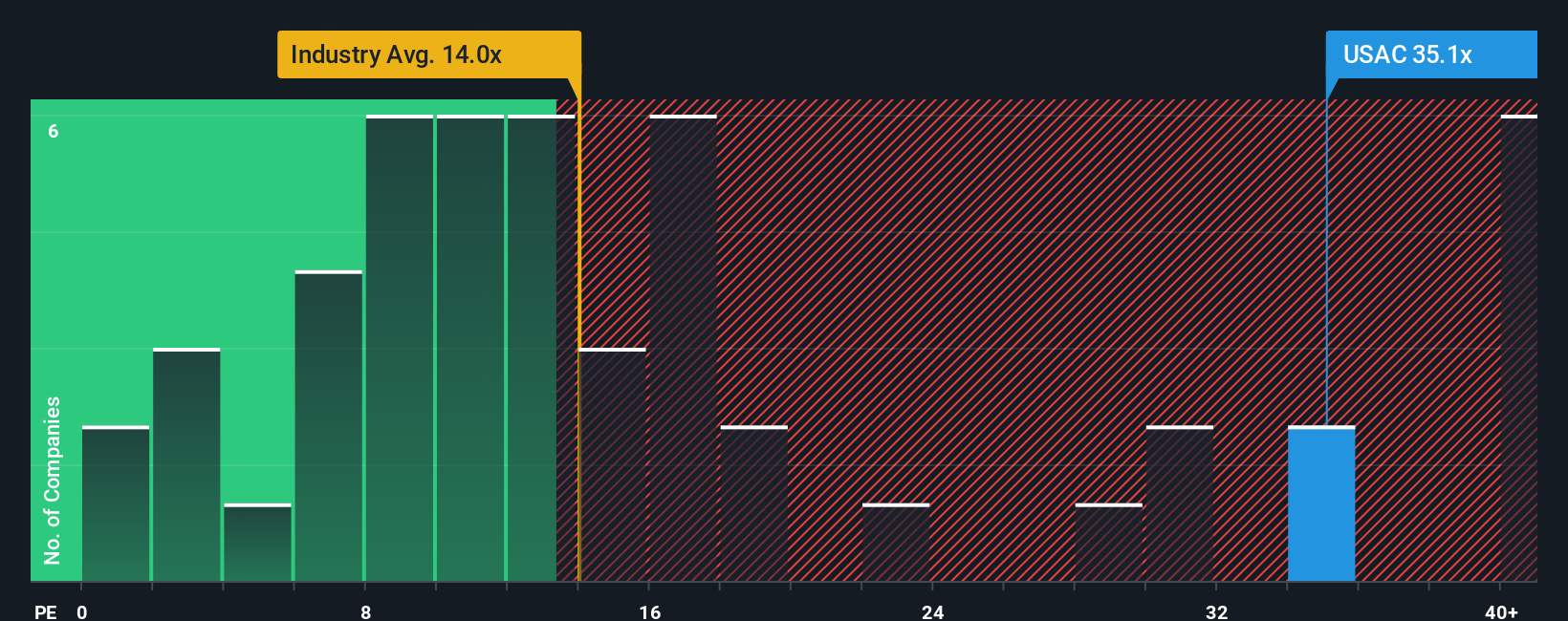

Another View: Multiples Tell a Different Story

Looking from the angle of price-to-earnings, USA Compression Partners trades at 36.7x earnings, which is lower than the peer group’s average of 39.3x. However, it is much higher than the broader US energy services industry at 15.1x. The fair ratio is 19.9x, suggesting the stock may be richly valued compared to where the market could eventually settle. This raises the question: is the high multiple a reward for quality or a warning sign for investors?

Build Your Own USA Compression Partners Narrative

If you’re inclined to dig deeper or construct your own story from the numbers, all it takes is a few minutes. Do it your way with Do it your way.

A great starting point for your USA Compression Partners research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Carve out your next opportunity by tapping into smartly curated stock lists. Take action now so you don't miss the emerging trends and standout performers changing the investment landscape.

- Grow your wealth with stable income producers by zeroing in on these 19 dividend stocks with yields > 3% offering yields over 3% for dependable returns.

- Catalyze fresh opportunities in tech by following these 24 AI penny stocks, which are at the forefront of artificial intelligence innovation and rapid business growth.

- Unlock value plays before the crowd with these 900 undervalued stocks based on cash flows, powered by in-depth cash flow analysis and featured at attractive prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.