Please use a PC Browser to access Register-Tadawul

A Fresh Look at Vertex (VERX) Valuation After New AI Initiatives and E-Invoicing Expansion

Vertex VERX | 19.91 | +0.05% |

Vertex (VERX) is in the spotlight after showcasing its strategy to boost e-invoicing coverage and ramp up artificial intelligence capabilities, including the SmartCat platform and a recent AI startup acquisition. These moves are drawing fresh attention from investors.

Vertex’s focus on AI and global e-invoicing appears to have turned some heads; yet, the share price has barely budged this year, despite the recent strategic updates and conference buzz. Longer-term, total shareholder returns have been flat over the past year and most of the last five, signaling a company in search of fresh momentum but still on investors' radars as a potential turnaround story.

If Vertex’s strategic shift has you thinking bigger, this could be the moment to broaden your perspective and discover See the full list for free.

With shares still down nearly 40 percent over the past year and trading well below analyst price targets, the question remains: Is Vertex now an overlooked value play, or is the market already factoring in future growth?

Most Popular Narrative: 32.7% Undervalued

Analyst consensus positions Vertex’s fair value at $37.23, which stands well above the last close of $25.06. This has set up a debate around its growth forecasts and risk profile.

Significant near-term acceleration is expected as regulatory mandates for e-invoicing begin in major European economies like France and Germany in 2026 and 2027, forcing multinational enterprises to adopt advanced tax automation solutions. This dynamic is anticipated to drive robust new customer wins and recurring revenue expansion for Vertex.

Curious what powers that target price? The narrative draws on rapid industry changes, global mandates, and sizable shifts in recurring revenue. Want to see the projections behind the optimism? Explore how margin leaps and aggressive growth forecasts shape this valuation story.

Result: Fair Value of $37.23 (UNDERVALUED)

However, slowing enterprise cloud migrations or persistent economic uncertainty could easily derail Vertex’s turnaround. This could impact both new customer wins and revenue forecasts.

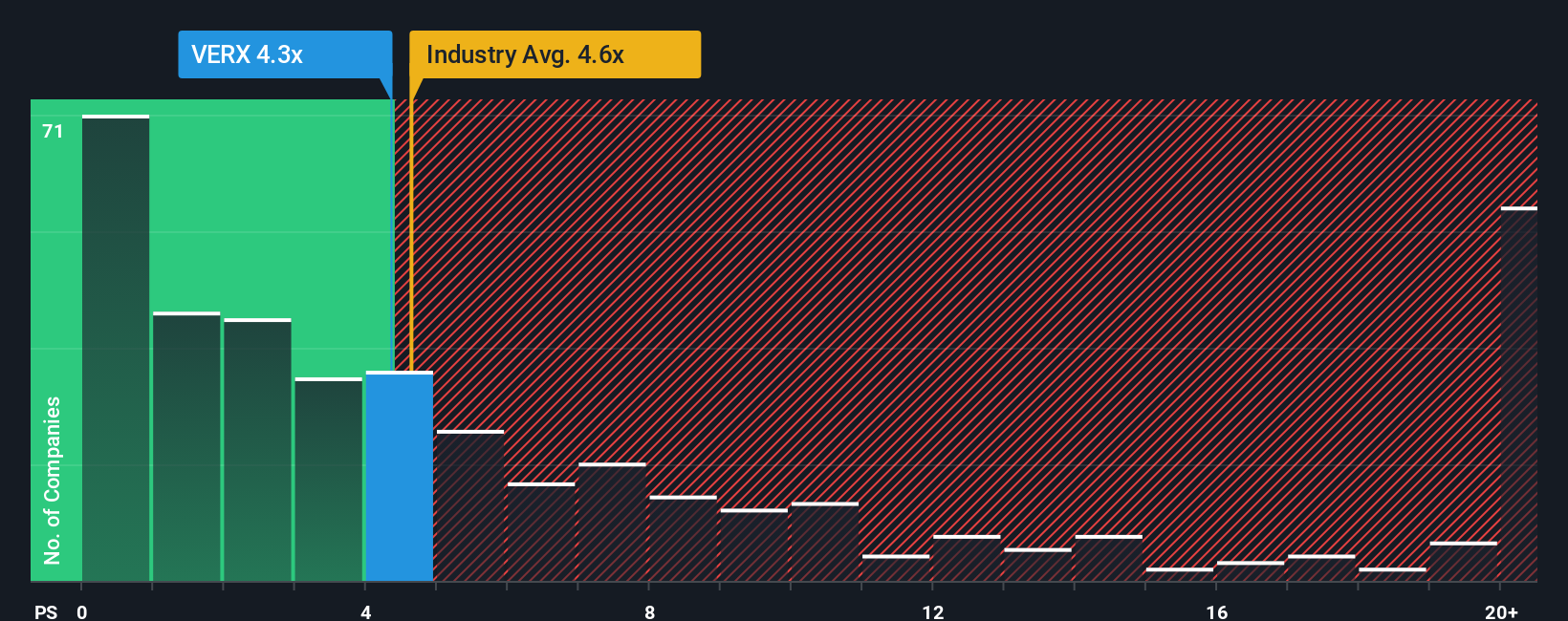

Another View: Industry Multiples Tell a Different Story

While Vertex looks undervalued through the analyst consensus and cash flow lens, its price-to-sales ratio of 5.6x is slightly higher than the US software industry average of 5.3x, though more attractive than the peer average of 6.5x. This suggests Vertex may not be as neglected by the market as it seems. The gap between the company’s ratio and the fair ratio of 4.9x could mark either a future risk or an opportunity, depending on market sentiment. Does the market favor growth optimism, or is there still valuation risk lurking?

Build Your Own Vertex Narrative

If these perspectives do not match your own, or you would rather dig into the details yourself, you can shape a personalized take in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Vertex.

Looking for More Investment Ideas?

Smart investors seize every edge. Go beyond Vertex and open the door to unique opportunities on Simply Wall Street. Don’t let the next big winner pass you by.

- Unlock hidden gems in tech by scanning these 24 AI penny stocks, already setting new standards in artificial intelligence and automation.

- Capture consistent cash flow and strengthen your portfolio with these 19 dividend stocks with yields > 3%, offering yields above 3 percent and reliable growth potential.

- Ride the frontier of innovation by targeting breakthroughs and early-mover advantage with these 26 quantum computing stocks leading the quantum computing revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.