Please use a PC Browser to access Register-Tadawul

A Fresh Look at Waters (WAT) Valuation After Xevo CDMS Launch in Genetic Medicine and Biotherapeutics

Waters Corporation WAT | 385.33 385.33 | -1.75% 0.00% Pre |

Waters (WAT) just launched its Xevo CDMS system, a tool that enables direct measurement of large biomolecules and viral vector capsids. This innovation is positioned to capture interest as genetic medicine and biotherapeutics continue to gain momentum.

Waters’ launch of the Xevo CDMS comes as investors look for renewed signs of growth, especially after a lackluster stretch in the share price. Despite a recent strong run, including a 10% one-month and 16% 90-day share price return, the stock’s total return over the past year remains down by 4%. Still, with a cumulative 51% total shareholder return over five years, long-term momentum hasn’t vanished.

If the pace of innovation at Waters has you thinking about what else is possible in healthcare and biotech, explore fresh opportunities with the See the full list for free.

With Waters delivering its most significant product launch in years, the key question for investors is whether recent gains leave the stock undervalued or if the promise of future innovation is already priced in.

Most Popular Narrative: 4.7% Undervalued

The most followed narrative places Waters' fair value at $351.07, about 4.7% above its last close of $334.59. Investors are watching closely as the narrative weighs the company’s innovation, projected earnings gains, and sector trends to set these expectations.

The planned combination with BD's Biosciences and Diagnostic Solutions business is expected to accelerate entry into biologics, precision medicine, and cell/gene therapy markets. These are segments with expanding analytical needs, unlocking new addressable markets and providing a multi-year revenue synergy opportunity, directly impacting future revenues and EPS growth.

What’s fueling this valuation? Powerful moves into new markets, bold assumptions about margin expansion, and a playbook built around transformative partnerships. Curious which financial levers drive the target price? Uncover the story and see if you agree with what’s behind the calculation.

Result: Fair Value of $351.07 (UNDERVALUED)

However, delays in integrating BD's business or continued weakness in pharma R&D spending could quickly challenge bullish expectations for Waters’ earnings trajectory.

Another View: Multiples Point to Caution

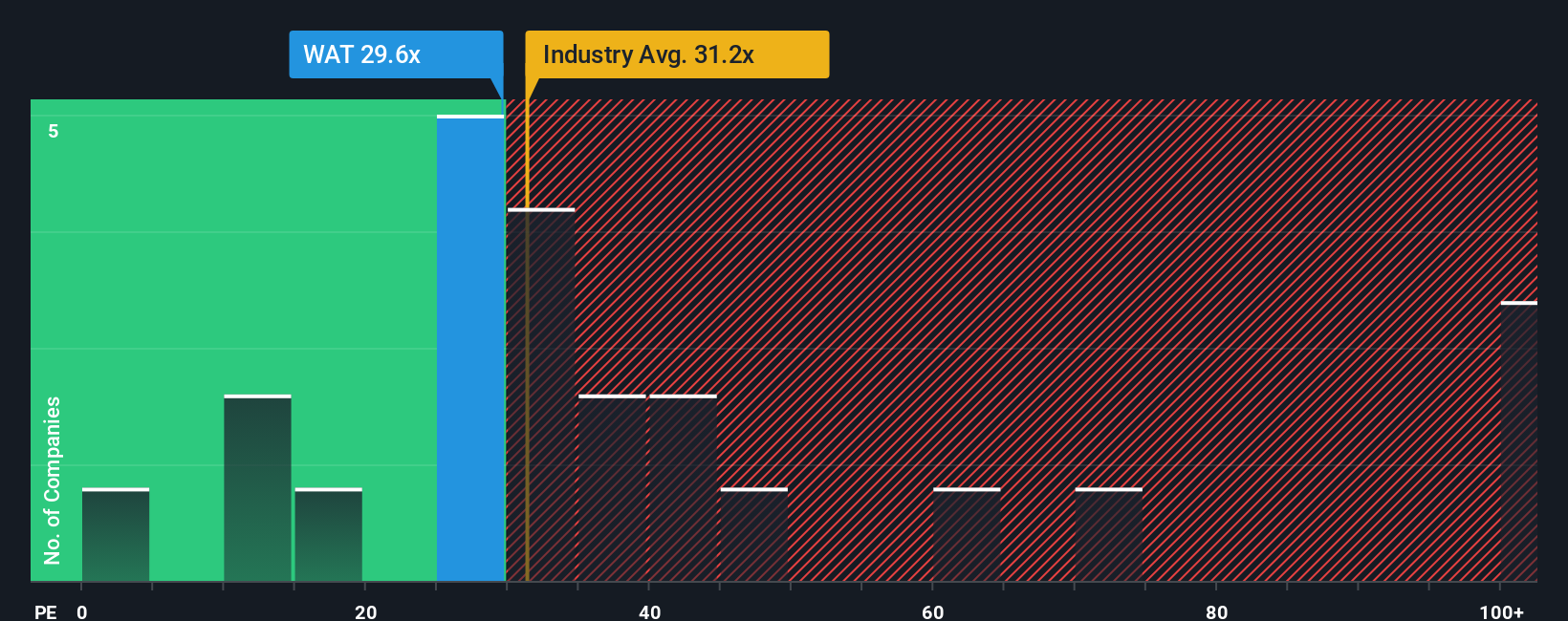

Looking at Waters from a price-to-earnings perspective reveals a mixed story. Its P/E ratio sits at 30.1x, which is higher than both peers (25.8x) and the fair ratio (22.3x) our models suggest the market might eventually prefer. This gap signals greater valuation risk if sentiment changes. Does the premium reflect lasting quality or set investors up for disappointment?

Build Your Own Waters Narrative

If you see things differently or want to form your own perspective, our tools let you craft a custom Waters narrative in just minutes. Do it your way

A great starting point for your Waters research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don't settle for the usual choices when you could access tomorrow's market leaders today. Expand your horizons and stay ahead by checking out these handpicked opportunities:

- Tap into market momentum by reviewing these 878 undervalued stocks based on cash flows, where strong fundamentals meet attractive entry points.

- Spot breakthrough innovations by following these 24 AI penny stocks, which harness artificial intelligence to reshape entire industries.

- Boost your portfolio’s income stream as you browse these 18 dividend stocks with yields > 3%, filled with stocks offering reliable yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.