A Glimpse Into The Expert Outlook On eBay Through 21 Analysts

eBay Inc. EBAY | 0.00 |

In the last three months, 21 analysts have published ratings on eBay (NASDAQ:EBAY), offering a diverse range of perspectives from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 5 | 14 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 2 | 5 | 11 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

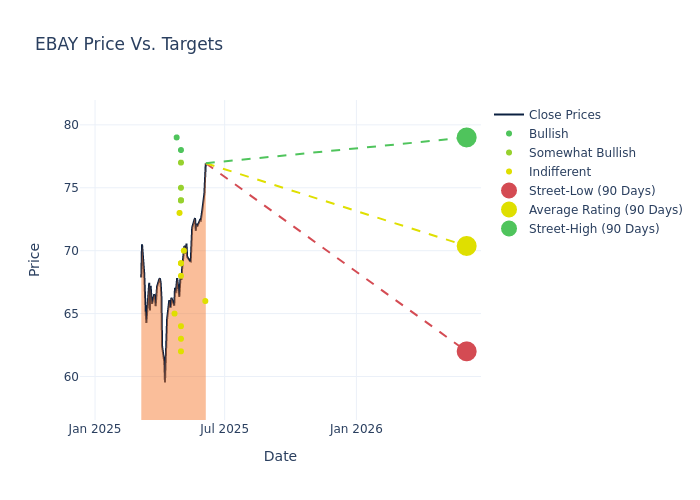

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $68.24, along with a high estimate of $79.00 and a low estimate of $54.00. Marking an increase of 3.39%, the current average surpasses the previous average price target of $66.00.

Analyzing Analyst Ratings: A Detailed Breakdown

The perception of eBay by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Doug Anmuth | JP Morgan | Raises | Neutral | $66.00 | $60.00 |

| Shyam Patil | Susquehanna | Raises | Neutral | $70.00 | $65.00 |

| Nathan Feather | Morgan Stanley | Raises | Overweight | $74.00 | $70.00 |

| Deepak Mathivanan | Cantor Fitzgerald | Raises | Neutral | $69.00 | $65.00 |

| Doug Anmuth | JP Morgan | Raises | Neutral | $60.00 | $54.00 |

| John Blackledge | TD Securities | Raises | Hold | $64.00 | $62.00 |

| Mark Kelley | Stifel | Raises | Hold | $62.00 | $61.00 |

| Youssef Squali | Truist Securities | Raises | Hold | $68.00 | $62.00 |

| Ross Sandler | Barclays | Raises | Overweight | $77.00 | $72.00 |

| Ken Gawrelski | Wells Fargo | Raises | Equal-Weight | $63.00 | $62.00 |

| Thomas Champion | Piper Sandler | Raises | Overweight | $74.00 | $70.00 |

| Mark Mahaney | Evercore ISI Group | Raises | In-Line | $69.00 | $63.00 |

| Colin Sebastian | Baird | Raises | Outperform | $75.00 | $68.00 |

| Bernie McTernan | Needham | Raises | Buy | $78.00 | $72.00 |

| Kunal Madhukar | UBS | Raises | Neutral | $73.00 | $72.00 |

| Ygal Arounian | Citigroup | Lowers | Buy | $79.00 | $80.00 |

| Mark Kelley | Stifel | Lowers | Hold | $61.00 | $63.00 |

| Nikhil Devnani | Bernstein | Lowers | Market Perform | $65.00 | $70.00 |

| Nathan Feather | Morgan Stanley | Lowers | Overweight | $70.00 | $71.00 |

| Doug Anmuth | JP Morgan | Lowers | Neutral | $54.00 | $60.00 |

| Ken Gawrelski | Wells Fargo | Lowers | Equal-Weight | $62.00 | $64.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to eBay. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of eBay compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of eBay's stock. This examination reveals shifts in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into eBay's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on eBay analyst ratings.

Delving into eBay's Background

EBay operates one of the largest e-commerce marketplaces in the world, with $75 billion in 2024 gross merchandise volume rendering the firm a top 10 global e-commerce company. It generates revenue from listing fees, advertising, revenue-sharing arrangements with service providers, and managed payments, with its platform connecting more than 130 million buyers and roughly 20 million sellers across almost 190 global markets at the end of 2024. EBay generates just north of 50% of its GMV in international markets, with a large presence in the UK, Germany, and Australia.

eBay: Financial Performance Dissected

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Positive Revenue Trend: Examining eBay's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 1.13% as of 31 March, 2025, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Net Margin: eBay's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 19.46%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): eBay's ROE stands out, surpassing industry averages. With an impressive ROE of 9.95%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 2.63%, the company showcases effective utilization of assets.

Debt Management: With a high debt-to-equity ratio of 1.45, eBay faces challenges in effectively managing its debt levels, indicating potential financial strain.

The Basics of Analyst Ratings

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Recommend

- Simply Wall St 23/11 12:48

'Tax and customs police raid two Amazon sites in Italy in China smuggling probe, sources say' - Reuters

Benzinga News 24/11 12:21MEDIA-Amazon's data center tally tops 900 facilities - Bloomberg News

Reuters 24/11 11:20Amazon Orders Staff To Ditch Rival AI Coding Tools As It Pushes Kiro To Close Gap With OpenAI, Google

Benzinga News Today 07:01Kohl's Raises FY2025 Adj EPS Guidance from $0.50-$0.80 to $1.25-$1.45 vs $0.71 Est; Projects Net Sales To Fall In the Range Of (3.5%)-(4%)

Benzinga News Today 12:11French prosecutor opens probe on Ebay over suspicion of sale of illicit goods

Reuters Today 11:57Alibaba's Cloud, E-Commerce Engines Hit Full Throttle In Q2

Benzinga News Today 12:27'French prosecutor opens probe on Ebay over suspicion of sale of illicit goods' - Reuters

Benzinga News Today 13:22